'''

没有绘制蜡烛图部分,可以叠加绘制,蜡烛图部分以及分栏画法参考

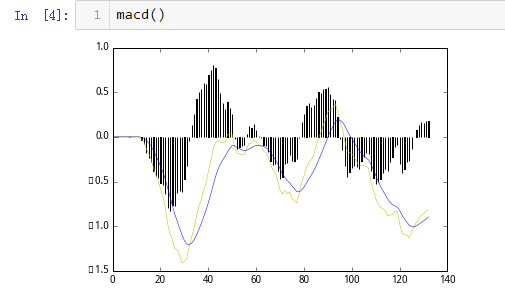

MACD线也即是在使用MACD指标时在图表上看到的MACD柱状线,常用于分析股票的买入、卖出时机。当MACD线(macd柱)位于0坐标上沿,

即由负变正时为买入时机;当MACD线(macd柱)位于0坐标下沿,即由正变负时为卖出时机。DIF黄色,DEA蓝色。

author:aaron_clark_aic 23/07/2018

'''

'''

EMA_today=α Price_today ( 1 - α ) EMA_yesterday

α=2/(N 1)

算法需要特别注意边界的转折处,前n的计算和n 1完全不同

author:aaron-clark-aic 23/07/2018

'''

'''

DIFF线 (Difference)收盘价短期、长期指数平滑移动平均线间的差

author:aaron_clark_aic 23/07/2018

'''

'''

DEA线 (Difference Exponential *erage)DIFF线的M日指数平滑移动平均线

author:aaron_clark_aic 23/07/2018

'''

.股票跌成狗,代码慌得一批~ .有问题可以留言,回不回复看心(大)情(盘)

update: aaron-clark-aic 27/02/2018 关于EMA计算的补充说明

import talibimport datetimeimport jqdataimport numpy as npimport matplotlib.pyplot as pltimport matplotlib.finance as mpf

'''默认股票代码格式(000915)转换为聚宽代码格式(000915.XSHG)author:aaron-clark-aic 18/07/2018'''def standardStocks(stocks):_stocks = list(get_all_securities('stock').index)_standardStocks = []for i in stocks:_standardStocks =_standardStocks+[code for code in _stocks if code.upper().startswith(i)]return _standardStocks'''EMA_today=α * Price_today + ( 1 - α ) * EMA_yesterdayα=2/(N+1)算法需要特别注意边界的转折处,前n的计算和n+1完全不同author:aaron-clark-aic 23/07/2018'''def ema(c_list,n=12):y_list=[]_n = 1 for c in c_list: if c == c_list[0]:y = celif _n<n:y= c*2/(_n+1) + (1- 2/(_n+1))*y_list[-1] else:y=c*2/(n+1)+(1-2/(n+1))*y_list[-1]y_list.append(y)_n = _n+1 return y_list'''DIFF线 (Difference)收盘价短期、长期指数平滑移动平均线间的差author:aaron_clark_aic 23/07/2018'''def diff(c_list,short=12,long=26):_diff = list(map(lambda x:x[0]-x[1],zip(ema(c_list,short),ema(c_list,long))))return _diff'''DEA线 (Difference Exponential *erage)DIFF线的M日指数平滑移动平均线author:aaron_clark_aic 23/07/2018'''def dea(c_list,m=9):return ema(diff(c_list),n=m)'''MACD线 DIFF线与DEA线的差,柱状线author:aaron_clark_aic 23/07/2018'''def bar(c_list):_bar = list(map(lambda x:2*(x[0]-x[1]),zip(diff(c_list),dea(c_list))))return _bar'''没有绘制蜡烛图部分,可以叠加绘制MACD线也即是在使用MACD指标时在图表上看到的MACD柱状线,常用于分析股票的买入、卖出时机。当MACD线(macd柱)位于0坐标上沿,即由负变正时为买入时机;当MACD线(macd柱)位于0坐标下沿,即由正变负时为卖出时机。DIF黄色,DEA蓝色。author:aaron_clark_aic 23/07/2018'''def macd(security=standardStocks(['000915']),start_date=(datetime.date.today()-datetime.timedelta(days=200)),end_date=datetime.date.today()):_data = get_price(security = security,start_date=start_date,end_date=end_date,fields=['close'])_close = np.hstack(_data['close'].values)_diff = diff(_close)_dea = dea(_close)_bar = bar(_close)plt.plot(range(len(_diff)),_diff,"y",lw=0.5)plt.plot(range(len(_dea)),_dea,"b",lw=0.5)plt.bar(range(len(_bar)),_bar,0.1)plt.show()

macd()