一、前言

A股涨跌受消息面影响巨大,国家货币政策和财政政策的颁布、宏观数据的发布、世界主要经济体市场动向等都会对A股当日涨跌造成直接影响。但是,消息面内容很难通过量化方式提前预知,隔夜消息一般会在开盘时反映,研究开盘后股市走势可以避免消息面影响。

本文研究开盘后日内走势,采用最基本的动量交易思想,探索有效的高频因子。

二、策略思路

研究时间:2017-01-01至2019-09-04

数据获取:

1. 当日开盘数据,本文设置为5分钟

2. 过去几日的涨跌幅,用以判断过去涨跌对当前走势的影响,本文只做了简单分析,未发现明显规律

3. 开盘5分钟后的一段时间股价走势

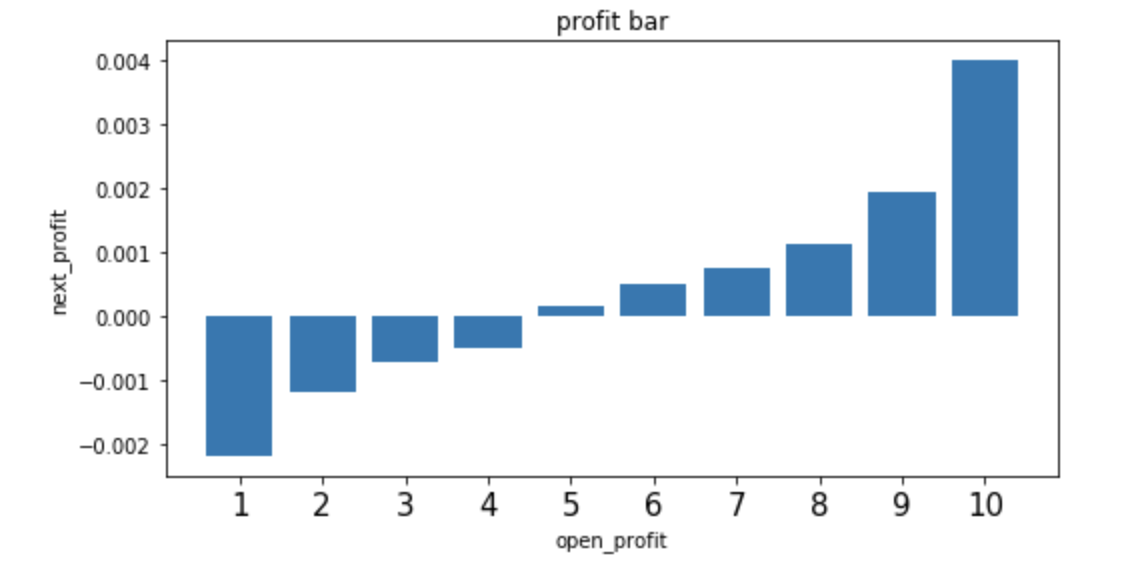

采用分位数分组的方式按开盘价分组,观察不同分组的后续收益情况。统计发现,开盘涨幅较大的股票后续继续上涨的概率更大,存在明显的动量现象。

三、结果

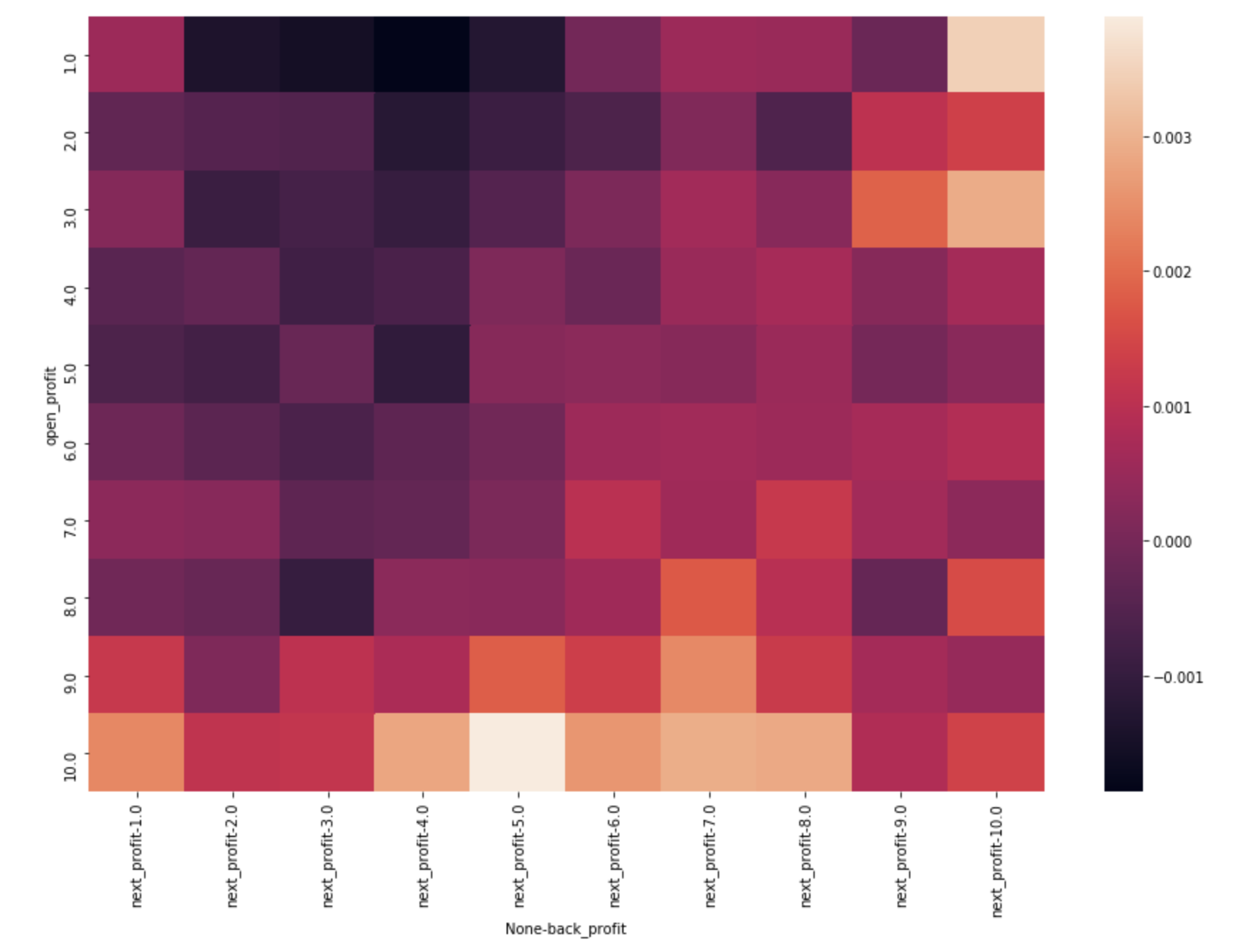

开盘价和过去涨跌热图

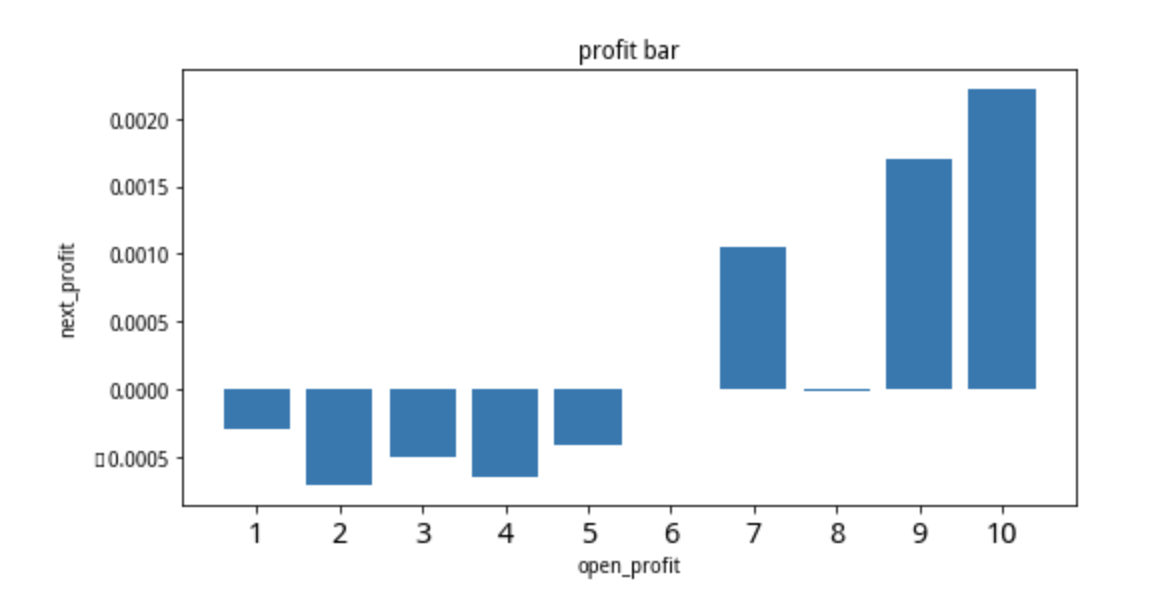

开盘价分组收益情况

存在明显的单调性

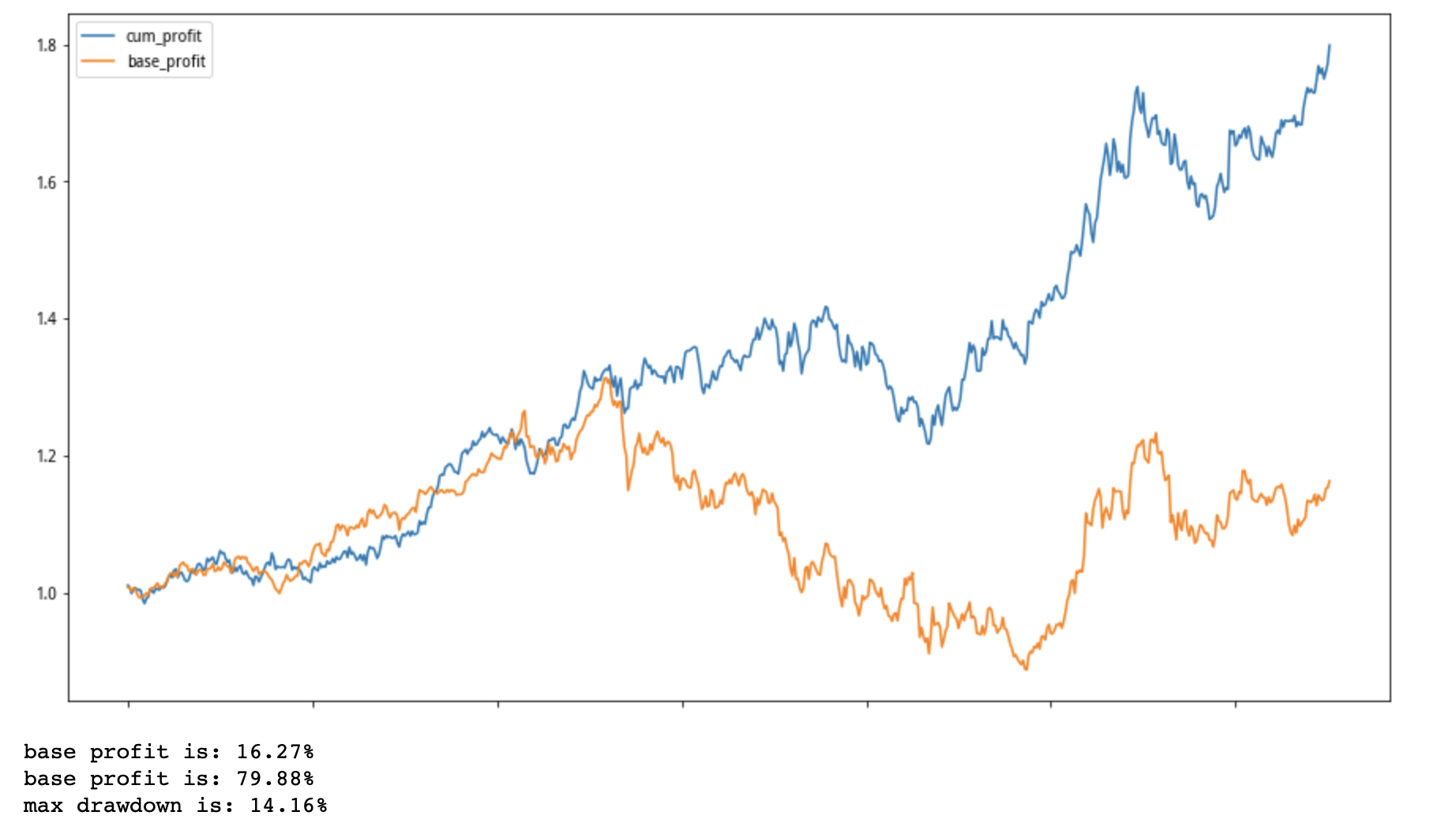

3.收益率

基准收益:16%

策略收益:80%

最大回撤:14%

从收益曲线可以看出,基本的涨跌走势和大盘一致,但仅此一个因子存在明显超额收益。

四、更多尝试

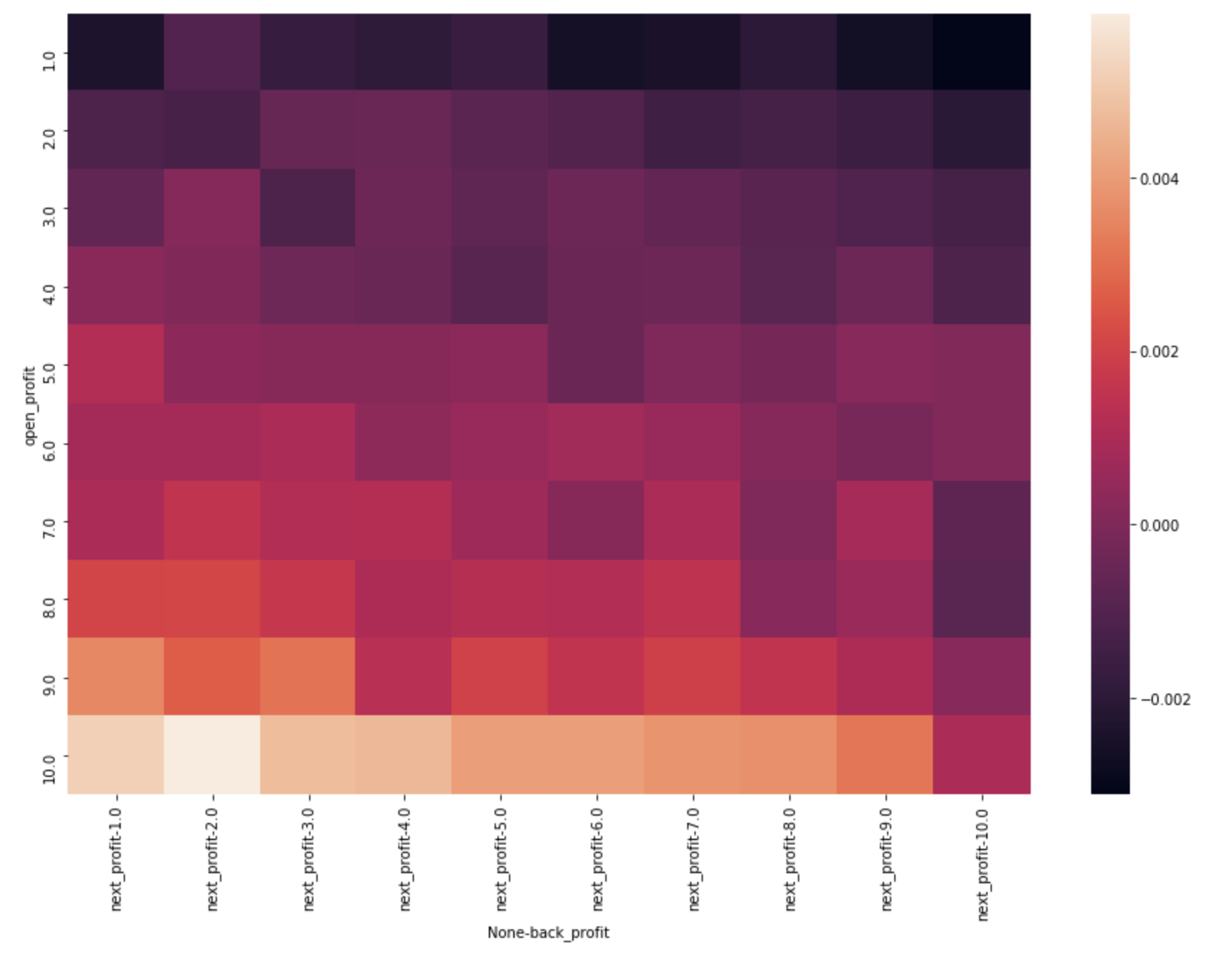

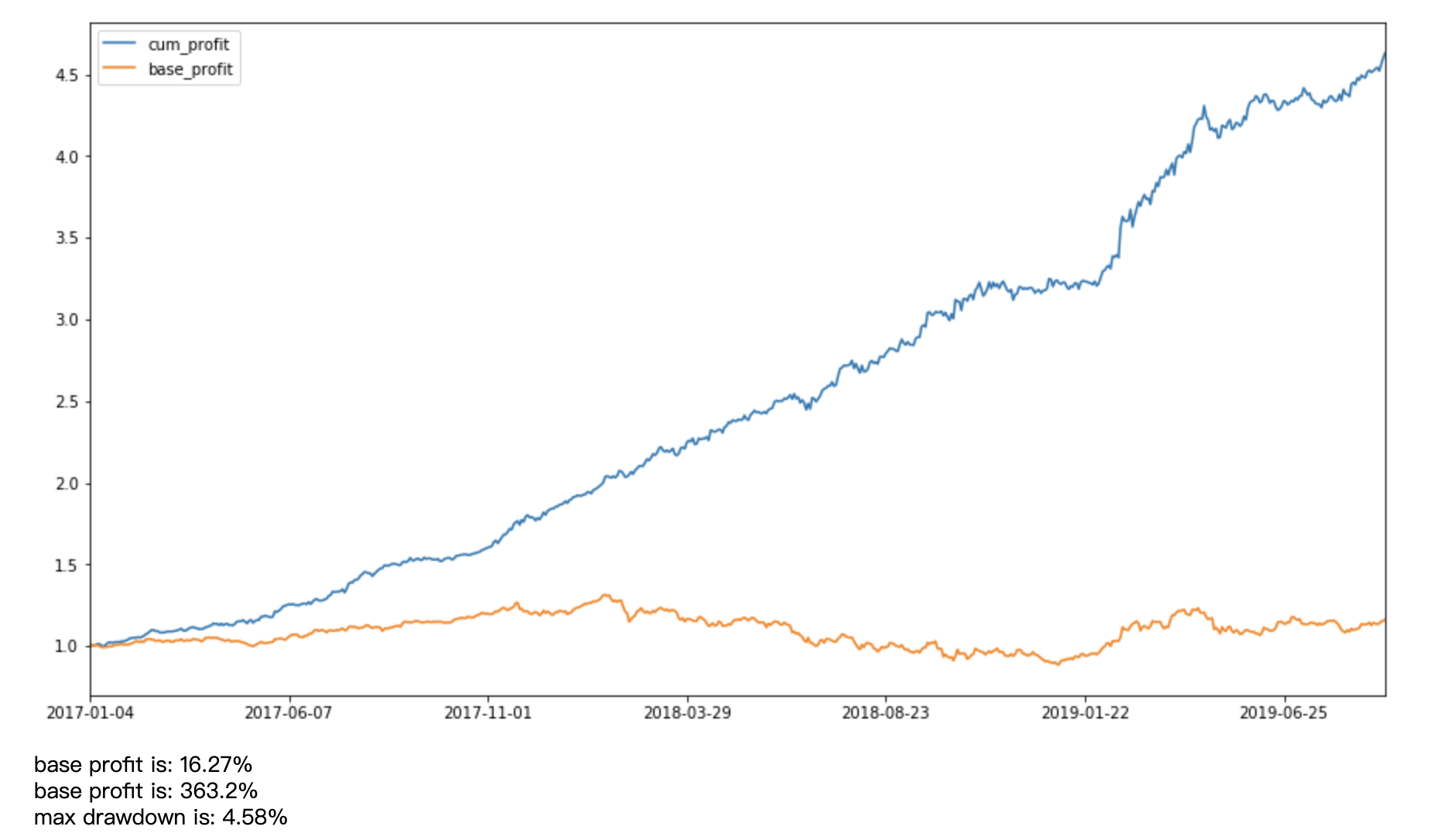

用上午最后五分钟的动量判断下午走势,效果更佳。

结果如下:

热图

单调性

收益率

基准收益:16%

策略收益:363%

最大回撤:4.6%

结果来看,无论是收益率还是回撤表现都非常优秀。

import pandas as pd

import numpy as np

from jqdata import *

import datetime

import warnings

import pickle

import matplotlib.pyplot as plt

import seaborn as sns

warnings.filterwarnings('ignore')

start_date = '2017-01-01'

end_date = '2019-09-05'

train_percent = 0.5

sel_percent = [0.8,0.98]

cut_layer = 10

stocks = get_index_stocks('000300.XSHG')

def get_tradeday_list(start, end, frequency=None, count=None):

'''

获取日期列表

input:

start:str or datetime,起始时间,与count二选一

end:str or datetime,终止时间

frequency:

str: day,month,quarter,halfyear,默认为day

int:间隔天数

count:int,与start二选一,默认使用start

'''

if isinstance(frequency, int):

all_trade_days = get_trade_days(start, end)

trade_days = all_trade_days[::frequency]

days = [datetime.datetime.strftime(i, '%Y-%m-%d') for i in trade_days]

return days

if count != None:

df = get_price('000001.XSHG', end_date=end, count=count)

else:

df = get_price('000001.XSHG', start_date=start, end_date=end)

if frequency == None or frequency == 'day':

days = df.index

else:

df['year-month'] = [str(i)[0:7] for i in df.index]

if frequency == 'month':

days = df.drop_duplicates('year-month').index

elif frequency == 'quarter':

df['month'] = [str(i)[5:7] for i in df.index]

df = df[(df['month'] == '01') | (df['month'] == '04') | (df['month'] == '07') | (df['month'] == '10')]

days = df.drop_duplicates('year-month').index

elif frequency == 'halfyear':

df['month'] = [str(i)[5:7] for i in df.index]

df = df[(df['month'] == '01') | (df['month'] == '06')]

days = df.drop_duplicates('year-month').index

trade_days = [datetime.datetime.strftime(i, '%Y-%m-%d') for i in days]

return trade_days

def find_max_drawdown(returns):

#returns 为cumprod收益

# 定义最大回撤的变量

result = 0

# 记录最高的回报率点

historical_return = 0

# 遍历所有日期

for i in range(len(returns)):

# 最高回报率记录

historical_return = max(historical_return, returns[i])

# 最大回撤记录

drawdown = 1 - (returns[i]) / (historical_return)

# 记录最大回撤

result = max(drawdown, result)

# 返回最大回撤值

return result

date_list = get_tradeday_list(start=start_date,end=end_date)

def get_profit_minutes_period(stocks,date,n=5,next_n=120):

'''

计算date前一天最后一段时间的动量收益

注意:获取的数据是输入时间前一天的数据

input:

stocks:输入股票列表

date:时间,数据为前一天

n:开盘收益计算时间长度

next_n:开盘后收益计算长度

'''

print(date)

price = get_price(stocks,end_date=date,frequency='1m',count=n+next_n,fields=['close'])['close']

l = len(price.shape)

if l > 1:

profit_open = price.pct_change(n-1)

profit_open = profit_open.iloc[n]

profit_next = price.pct_change(next_n)

profit_next = profit_next.iloc[-1]

profit = pd.concat([profit_open,profit_next],axis=1)

profit.columns = ['open_profit','next_profit']

else:

profit_open = price.pct_change(n)

profit_open = profit_open.iloc[n]

profit_open = pd.DataFrame([profit_open],index=[stocks])

profit_next = price.pct_change(next_n - 1)

profit_next = profit_next.iloc[-1]

profit_next = pd.DataFrame([profit_next],index=[stocks])

profit = pd.concat([profit_open,profit_next],axis=1)

profit.columns = ['open_profit','next_profit']

return profit

def get_open_profit_minutes_period(stocks,date,n=5,next_n=120):

'''

计算date前一天开盘的动量收益

注意:获取的数据是输入时间前一天的数据

input:

stocks:输入股票列表

date:时间,数据为前一天

n:开盘收益计算时间长度

next_n:开盘后收益计算长度

'''

price = get_price(stocks,end_date=date,frequency='1m',count=240,fields=['close'])['close']

l = len(price.shape)

if l > 1:

profit_open = price.pct_change(n)

profit_open = profit_open.iloc[n]

profit_next = price.pct_change(next_n)

profit_next = profit_next.iloc[n+next_n+1]

profit = pd.concat([profit_open,profit_next],axis=1)

profit.columns = ['open_profit','next_profit']

else:

profit_open = price.pct_change(n)

profit_open = profit_open.iloc[n]

profit_next = price.pct_change(next_n)

profit_next = profit_next.iloc[n+next_n+1]

profit_open = pd.DataFrame([profit_open],index=[stocks])

profit_next = pd.DataFrame([profit_next],index=[stocks])

profit = pd.concat([profit_open,profit_next],axis=1)

profit.columns = ['open_profit','next_profit']

return profit

def get_day_profit_backward(stocks,end_date,start_date=None,count=3):

'''

向前计算收益率,得到的收益率是输入时间end_date向前计算,不包括当天

input:

stocks:list or Series,股票代码

start_date:开始时间

end_date:结束时间

count:与start_date二选一,向前取值个数

pre_num:int,向后计算的天数

output:

profit:dataframe,index为日期,columns为股票代码,values为收益率

'''

if count == -1:

price = get_price(stocks,start_date,end_date,fields=['close'])['close']

else:

price = get_price(stocks,end_date=end_date,count=count+1,fields=['close'])['close']

profit = price.pct_change(count-1)

profit = profit.iloc[-2]

if isinstance(profit,pd.Series):

profit = profit.to_frame()

else:

profit = pd.DataFrame([profit],index=[stocks])

profit.columns = ['back_profit']

return profit

def get_open_and_backward_profit(stocks,date_list,n=5,next_n=60,count=3):

'''

注意:时间对齐

'''

l = len(date_list)

dic = {}

for d in range(l - 1):

date = date_list[d+1]

open_profit = get_open_profit_minutes_period(stocks,date,n,next_n)

date = date_list[d]

backward_profit = get_day_profit_backward(stocks,date,count)

profit = pd.merge(open_profit,backward_profit,left_index=True,right_index=True,how='inner')

dic[date] = profit

return dic

'''

dic_res_5_60_3 = get_open_and_backward_profit(stocks,date_list,n=5,next_n=60,count=3)

with open('open_and_backward_profit.pkl','wb') as pk_file:

pickle.dump(dic_res_5_60_3,pk_file)

'''

"\ndic_res_5_60_3 = get_open_and_backward_profit(stocks,date_list,n=5,next_n=60,count=3)\nwith open('open_and_backward_profit.pkl','wb') as pk_file:\n pickle.dump(dic_res_5_60_3,pk_file)\n"

dic_res_5_60_3_hs300 = get_open_and_backward_profit(stocks,date_list,n=5,next_n=120,count=3)

with open('movement_5_120_3_open.pkl','wb') as pk_file:

pickle.dump(dic_res_5_60_3_hs300,pk_file)

len(dic_res_5_60_3_hs300)

653

with open('movement_5_120_3_open.pkl','rb') as pk_file:

dic_res = pickle.load(pk_file)

def combine_data(dic_res,sel_percent):

'''

字典数据按时间轴合并

'''

keys = list(dic_res.keys())

data_list = []

for key in keys:

data = dic_res[key]

data_list.append(data)

all_data = pd.concat(data_list)

print(len(all_data))

test_data = all_data.dropna()

new_col = ['back_profit','open_profit','next_profit']

all_data = all_data[new_col]

all_data.index = np.arange(len(all_data))

#删除开盘停牌股票

sel_data = all_data[all_data['open_profit'] == 0].index

all_data = all_data.drop(sel_data,axis=0)

length = len(all_data)

'''

#获取训练数据和测试数据

cut_point = int(train_percent * length)

print(cut_point)

train_data = all_data[:cut_point]

test_data = all_data[cut_point:]

'''

#剪切中间部分

start_point = int(sel_percent[0] * length)

end_point = int(sel_percent[1] * length)

sel_data = all_data[start_point:end_point]

return sel_data

def cut_data(data,n):

'''

将数据分层,基于分位数,最后一列作为收益不进行分层

input:

data:dataframe or series, 输入数据

n: 分层数

'''

f = 1 / n

l = []

for i in range(n):

l.append(f*(i+1))

q = data.quantile(l)

qv = q.values

shape = qv.shape

col = data.columns

for i in range(shape[1] - 1): #最后一层收益不分层

for j in range(shape[0]):

data[col[i]][data[col[i]] <= qv[j][i]] = j + 1

return data.dropna()

#单维度分析

def calculate_IC(factor,profit,method='pearson'):

'''

input:

factor: 因子值

profit:收益值

me t hod:默认计算pearson相关系数

输出:

i c值和对应的pvalue

'''

if method == 'pearson':

ic,pvalue = st.spearmanr(factor,profit)

else:

ic,pvalue = st.pearsonr(factor,profit)

return ic,pvalue

def draw_heatmap(data):

'''

输入的数据必须是三列,最后一列计算均值,前两列分组

'''

col = data.columns

#group_res = data.groupby([col[0],col[1]]).count()

group_res = data.groupby([col[0],col[1]]).mean()

group_res = group_res.unstack(0).fillna(0)

plt.figure(figsize=(10,6))

ax = sns.heatmap(group_res)

plt.show()

def draw_bar(data):

'''

输入data: 两列,第一列为factor值,第二列为收益值

'''

col = data.columns

group_data = data.groupby(col[0]).mean()

y_data = group_data[col[1]].values

index = np.arange(1,len(group_data)+1)

plt.figure(figsize=(8,4))

plt.bar(index,y_data)

plt.title('profit bar')

plt.xlabel(col[0])

plt.ylabel(col[1])

plt.xticks(index,fontsize=15)

return group_data

sel_data = combine_data(dic_res,sel_percent)

cut_res = cut_data(sel_data,cut_layer)

draw_heatmap(cut_res)

d = cut_res[['open_profit','next_profit']]

draw_bar(d)

back_next = cut_res[['back_profit','next_profit']]

t = draw_bar(back_next)

195900

#对每一天的数据分组,多天数据合并

def get_day_profit(day_data,date,sel_n):

'''

获取每天的收益列表,

'''

day_data = day_data.dropna()

new_col = ['back_profit','open_profit','next_profit']

day_data = day_data[new_col]

#删除开盘没有涨跌的股票

sel_data = day_data[day_data['open_profit'] == 0].index

day_data = day_data.drop(sel_data,axis=0)

cut_day_data = cut_data(day_data,cut_layer)

col = cut_day_data.columns

#选出对应股票

#sel_day_data = cut_day_data[col[0]][cut_day_data[col[0]] == sel_n]

#sel_day_stocks = list(sel_day_data.index)

group_day_data = cut_day_data.groupby(['open_profit']).mean()

day_profit = group_day_data.iloc[sel_n-1,-1]

day_profit = pd.DataFrame([day_profit],index=[date],columns=['profit'])

return day_profit

keys = list(dic_res.keys())

day_data = dic_res[keys[4]]

get_day_profit(day_data,keys[4],10)

| profit | |

|---|---|

| 2017-01-09 | 0.005867 |

#选择每天的分层数据中收益较高的层

sel_n = 10

day_profit_l = []

for key in keys:

day_data = dic_res[key]

day_profit = get_day_profit(day_data,key,sel_n)

day_profit_l.append(day_profit)

profit_df = pd.concat(day_profit_l)

index = list(profit_df.index)

base_start_date = index[0]

base_end_date = index[-1]

base_price = get_price('000300.XSHG',start_date=base_start_date,end_date = base_end_date,fields=['close'])['close']

profit_df['cum_profit'] = (profit_df['profit'] + 1).cumprod()

#计算基准收益,以沪深300为准

base_price = get_price('000300.XSHG',start_date=base_start_date,end_date = base_end_date,fields=['close'])['close']

base_pofit = base_price.pct_change().dropna()

base_profit_cump = (base_pofit + 1).cumprod()

index = list(base_profit_cump.index)

new_index = [datetime.datetime.strftime(i,'%Y-%m-%d') for i in index ]

base_profit_cump.index = new_index

base_profit_cump.name = 'base_profit'

profit_df_combine = pd.concat([profit_df,base_profit_cump],axis=1).dropna()

print(profit_df_combine.tail())

draw_profit = profit_df_combine[['cum_profit','base_profit']]

draw_profit.plot(figsize=(15,8))

plt.show()

base_profit_show = profit_df_combine['base_profit'][-1]

stratage_profit_show = profit_df_combine['cum_profit'][-1]

print('base profit is: %s'%(str(round((base_profit_show-1)*100,2)) + '%'))

print('base profit is: %s'%(str(round((stratage_profit_show-1)*100,2)) + '%'))

max_drawdown = find_max_drawdown(profit_df_combine['cum_profit'])

print('max drawdown is: %s' %(str(round(max_drawdown*100,2)) + '%'))

profit cum_profit base_profit 2019-08-29 0.004259 1.765107 1.134030 2019-08-30 -0.008628 1.749877 1.136843 2019-09-02 0.005525 1.759545 1.151423 2019-09-03 0.006958 1.771789 1.153006 2019-09-04 0.015245 1.798800 1.162697

base profit is: 16.27% base profit is: 79.88% max drawdown is: 14.16%

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...

移动端课程