前些天发布了,多因子模型(一)-因子生成 (针对聚宽新增多因子相关功能)。

这周按照计划又重新整理了 多因子模型(二)-因子检验 这部分。步入正题:

第一步,读取上一篇因子生成的的因子,如果第一次看到这篇帖子的朋友可有查看 多因子模型(一)-因子生成。

第二步,针对因子进行一系列计算,来判断哪些因子是有效的。其中包括以下几点:

下一次,就是把这些有效因子带入回测模块了。Good Luck~!

大家多多交流,欢迎批评指正。

# Step I: 读取第一步因子生成的数据数据

import time

import datetime

import jqdata

import datetime

from multiprocessing.dummy import Pool as ThreadPool

from jqfactor import Factor,calc_factors

import pandas as pd

import statsmodels.api as sm

import scipy.stats as st

import pickle

pkl_file = open('MyPackage.pkl', 'rb')

load_Package = pickle.load(pkl_file)

g_univ_dict,return_df,all_return_df,raw_factor_dict,all_factor_dict,all_industry_df=load_Package

univ_dict=g_univ_dict

#factor_dict={}

#factor_dict['cfo_to_ev']=all_factor_dict['cfo_to_ev']

#all_factor_dict=factor_dict

/opt/conda/envs/python3new/lib/python3.6/site-packages/statsmodels/compat/pandas.py:56: FutureWarning: The pandas.core.datetools module is deprecated and will be removed in a future version. Please use the pandas.tseries module instead. from pandas.core import datetools

# Step II: 因子筛选用到的函数

def ic_calculator(factor,return_df,univ_dict):

ic_list=[]

p_value_list=[]

for date in list(univ_dict.keys()): #这里是循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index)&set(return_df.loc[date].dropna().index))

if len(univ)<10:

continue

factor_se=factor.loc[date,univ]

return_se=return_df.loc[date,univ]

ic,p_value=st.spearmanr(factor_se,return_se)

ic_list.append(ic)

p_value_list.append(p_value)

return ic_list

# 1.回测基础数据计算

def all_Group_Return_calculator(factor,univ_dict,all_return_df,GroupNum=10):

all_date_list=list(all_return_df.index)

date_list=list(univ_dict.keys())

all_Group_Ret_df=pd.DataFrame(index=all_date_list,columns=list(np.array(range(GroupNum))))

for n in range(len(date_list)-1):

start=date_list[n]

end=date_list[n+1]

univ=univ_dict[start]

univ=set(univ)&set(factor.loc[start].dropna().index)

factor_se_stock=list(factor.loc[start,univ].dropna().sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

# 下面两行是关键

cumret=(all_return_df.loc[start:end,group_stock]+1).cumprod().mean(axis=1)

all_Group_Ret_df.loc[start:end,i]=cumret.shift(1).fillna(1).pct_change().shift(-1)

#(((all_return_df.loc[start:end,group_stock]+1).cumprod()-1).mean(axis=1)+1).pct_change().shift(-1)

all_Group_Ret_df=all_Group_Ret_df[date_list[0]:].shift(1).fillna(0)

return all_Group_Ret_df

def Group_Return_calculator(factor,univ_dict,return_df,GroupNum=10):

GroupRet_df=pd.DataFrame(index=list(list(univ_dict.keys())),columns=list(np.array(range(GroupNum))))

for date in list(univ_dict.keys()): #这个也是个循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index)&set(return_df.loc[date].dropna().index))

factor_se_stock=list(factor.loc[date,univ].sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

GroupRet_df.loc[date,i]=return_df.loc[date,group_stock].mean()

return GroupRet_df.shift(1).fillna(0)

def get_index_return(univ_dict,index,count=250):

trade_date_list=list(univ_dict.keys())

date=max(trade_date_list)

price=get_price(index,end_date=date,count=count,fields=['close'])['close']

price_return=price.loc[trade_date_list[0]:].pct_change().fillna(0)

price_return_by_tradeday=price.loc[trade_date_list].pct_change().fillna(0)

return price_return,price_return_by_tradeday

def effect_test(univ_dict,key,group_return,group_excess_return):

daylength=(list(univ_dict.keys())[-1]-list(univ_dict.keys())[0]).days

annual_return=np.power(cumprod(group_return+1).iloc[-1,:],365/daylength)

index_annual_return=np.power((index_return+1).cumprod().iloc[-1],365/daylength)

# Test One: 组合序列与组合收益的相关性,相关性大于0.5

sequence=pd.Series(np.array(range(10)))

test_one_corr=annual_return.corr(sequence)

test_one_passgrade=0.5

test_one_pass=abs(test_one_corr)>test_one_passgrade

if test_one_corr<0:

wingroup,losegroup=0,9

else:

wingroup,losegroup=9,0

# Test Two: 赢家组合明显跑赢市场,输家组合明显跑输市场,程度大于5%

test_two_passgrade=0.05

test_two_win_excess=annual_return[wingroup]-index_annual_return

test_two_win_pass=test_two_win_excess>test_two_passgrade

test_two_lose_excess=index_annual_return-annual_return[losegroup]

test_two_lose_pass=test_two_lose_excess>test_two_passgrade

test_two_pass=test_two_win_pass&test_two_lose_pass

# Test Tree: 高收益组合跑赢基准的概率,低收益组合跑赢基准的概率,概率大小0.5

test_three_grade=0.5

test_three_win_prob=(group_excess_return[wingroup]>0).sum()/len(group_excess_return[wingroup])

test_three_win_pass=test_three_win_prob>0.5

test_three_lose_prob=(group_excess_return[losegroup]<0).sum()/len(group_excess_return[losegroup])

test_three_lose_pass=test_three_lose_prob>0.5

test_three_pass=test_three_win_pass&test_three_lose_pass

test_result=[test_one_pass,test_two_win_pass,test_two_lose_pass,test_three_win_pass,test_three_lose_pass]

test_score=[test_one_corr,test_two_win_excess,test_two_lose_excess,test_three_win_prob,test_three_lose_prob]

return test_result,test_score

# 计算每个因子的评分和筛选结果

starttime=time.clock()

print('\n计算IC_IR:')

count=1

ic_list_dict={}

for key,factor in all_factor_dict.items():

ic_list=ic_calculator(factor,return_df,univ_dict)

ic_list_dict[key]=ic_list

print(count,end=',')

count=count+1

# 整理结果

ic_df=pd.DataFrame(ic_list_dict,index=list(univ_dict.keys())[:-1])

ic_ir_se=ic_df.mean()/ic_df.std()

ic_avg_se=ic_df.mean().abs()

print('\n计算分组收益:')

count=1

GroupNum=10

all_Factor_Group_Return_dict={} ##这个用于计算NAV,再筛选出因子之后再用更效率

Factor_Group_Return_dict={}

for key,factor in all_factor_dict.items():

# 全return

all_GroupRet_df=all_Group_Return_calculator(factor,univ_dict,all_return_df,GroupNum)

all_Factor_Group_Return_dict[key]=all_GroupRet_df

# 调仓期return

GroupRet_df=Group_Return_calculator(factor,univ_dict,return_df,GroupNum)

Factor_Group_Return_dict[key]=GroupRet_df

print(count,end=',')

count=count+1

print('\n计算指数收益:')

count=1

index='000300.XSHG'

index_return,index_return_by_tradeday=get_index_return(univ_dict,index)

Factor_Group_Excess_Return_dict={}

for key,group_return in Factor_Group_Return_dict.items():

Factor_Group_Excess_Return_dict[key]=group_return.subtract(index_return_by_tradeday,axis=0)

print(count,end=',')

count=count+1

print('\n因子有效性测试:')

count=1

effect_test_result_dict={}

effect_test_score_dict={}

for key,group_return in Factor_Group_Return_dict.items():

group_excess_return=Factor_Group_Excess_Return_dict[key]

effect_test_result_dict[key],effect_test_score_dict[key]=effect_test(univ_dict,key,group_return,group_excess_return)

print(count,end=',')

count=count+1

print('\npickle序列化')

Package_ET=[ic_avg_se,ic_ir_se,effect_test_result_dict,effect_test_score_dict,\

all_Factor_Group_Return_dict,Factor_Group_Return_dict,index_return,index_return_by_tradeday,\

Factor_Group_Excess_Return_dict]

pkl_file = open('MyPackage_ET.pkl', 'wb')

pickle.dump(Package_ET,pkl_file,0)

pkl_file.close()

endtime=time.clock()

runtime=endtime-starttime

print('因子测试运行完成,用时 %.2f 秒' % runtime)

计算IC_IR: 1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149,150,151,152,153,154,155,156, 计算分组收益: 1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149,150,151,152,153,154,155,156, 计算指数收益: 1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149,150,151,152,153,154,155,156, 因子有效性测试: 1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125,126,127,128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149,150,151,152,153,154,155,156, pickle序列化 因子测试运行完成,用时 721.53 秒

# 读取因子

import pickle

pkl_file = open('MyPackage_ET.pkl', 'rb')

load_Package = pickle.load(pkl_file)

ic_avg_se,ic_ir_se,effect_test_result_dict,effect_test_score_dict,\

all_Factor_Group_Return_dict,Factor_Group_Return_dict,index_return,index_return_by_tradeday,\

Factor_Group_Excess_Return_dict=load_Package

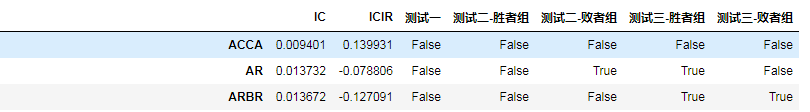

EffectTestresult=pd.concat([ic_avg_se.to_frame('a'),ic_ir_se.to_frame('b'),pd.DataFrame(effect_test_result_dict).T],axis=1)

columns=['IC','ICIR','测试一', '测试二-胜者组', '测试二-败者组', '测试三-胜者组', '测试三-败者组']

EffectTestresult.columns=columns

EffectTestresult2=pd.concat([ic_avg_se.to_frame('a'),ic_ir_se.to_frame('b'),pd.DataFrame(effect_test_score_dict).T],axis=1)

columns=['IC','ICIR','测试一', '测试二-胜者组', '测试二-败者组', '测试三-胜者组', '测试三-败者组']

EffectTestresult2.columns=columns

EffectTestresult

| IC | ICIR | 测试一 | 测试二-胜者组 | 测试二-败者组 | 测试三-胜者组 | 测试三-败者组 | |

|---|---|---|---|---|---|---|---|

| ACCA | 0.009401 | 0.139931 | False | False | False | False | False |

| AR | 0.013732 | -0.078806 | False | False | True | True | False |

| ARBR | 0.013672 | -0.127091 | False | False | False | True | True |

| ATR14 | 0.021501 | 0.136290 | True | True | False | True | True |

| ATR6 | 0.011871 | 0.077995 | True | False | False | True | False |

| BR | 0.016859 | -0.109888 | False | False | True | True | True |

| DAVOL10 | 0.001823 | -0.012251 | False | False | True | False | False |

| DAVOL20 | 0.004819 | 0.030647 | False | False | True | True | True |

| DAVOL5 | 0.003037 | -0.022354 | False | False | True | False | False |

| DEGM | 0.012169 | 0.171164 | False | False | False | True | False |

| EBIT | 0.063861 | 0.358740 | True | True | True | True | False |

| EBITDA | 0.082209 | 0.470460 | True | True | True | True | False |

| Kurtosis120 | 0.053173 | -0.462859 | True | True | False | True | True |

| Kurtosis20 | 0.018192 | -0.193767 | True | False | False | False | False |

| Kurtosis60 | 0.042104 | -0.364970 | True | False | True | False | True |

| MAWVAD | 0.006172 | 0.030128 | False | False | True | True | False |

| MLEV | 0.008373 | 0.076413 | False | False | False | True | False |

| OperateNetIncome | 0.081799 | 0.412676 | True | True | False | True | True |

| OperatingCycle | 0.021735 | -0.247960 | False | False | False | True | False |

| ROAEBITTTM | 0.046961 | 0.311143 | True | True | False | True | False |

| Skewness120 | 0.005261 | -0.042912 | False | False | True | False | True |

| Skewness20 | 0.061784 | -0.532256 | True | False | False | False | True |

| Skewness60 | 0.043946 | -0.376223 | True | False | True | False | True |

| TVMA20 | 0.006112 | 0.038347 | True | True | True | True | False |

| TVMA6 | 0.002190 | -0.013872 | True | False | True | True | True |

| TVSTD20 | 0.016284 | -0.108580 | False | False | True | True | True |

| TVSTD6 | 0.011001 | -0.077822 | False | False | True | True | True |

| VDEA | 0.035765 | -0.247212 | False | False | True | True | True |

| VDIFF | 0.030910 | -0.196195 | False | False | True | True | True |

| VEMA10 | 0.037545 | -0.221708 | True | False | False | True | False |

| ... | ... | ... | ... | ... | ... | ... | ... |

| operating_profit_ttm | 0.087495 | 0.419978 | True | True | True | True | False |

| operating_revenue_growth_rate | 0.026559 | 0.252864 | True | False | False | True | False |

| operating_revenue_per_share | 0.054008 | 0.435991 | True | True | True | True | False |

| operating_revenue_per_share_ttm | 0.055637 | 0.475639 | True | True | True | True | True |

| operating_revenue_ttm | 0.068502 | 0.406241 | True | False | False | True | False |

| operating_tax_to_operating_revenue_ratio_ttm | 0.013722 | 0.146272 | False | False | False | True | False |

| quick_ratio | 0.016010 | 0.319672 | False | False | False | True | False |

| retained_earnings | 0.098462 | 0.514553 | True | True | True | True | True |

| retained_earnings_per_share | 0.084912 | 0.602959 | True | True | False | True | False |

| retained_profit_per_share | 0.085415 | 0.604552 | True | True | False | True | False |

| roa_ttm | 0.036300 | 0.265477 | True | True | False | True | False |

| roe_ttm | 0.061408 | 0.361940 | True | True | True | True | False |

| sale_expense_to_operating_revenue | 0.023429 | 0.231789 | True | False | False | True | False |

| sale_expense_ttm | 0.051854 | 0.345959 | True | True | False | True | True |

| sharpe_ratio_120 | 0.047788 | 0.261143 | True | False | True | True | False |

| sharpe_ratio_20 | 0.049660 | 0.277153 | False | False | True | True | False |

| sharpe_ratio_60 | 0.097423 | 0.609138 | True | True | True | True | False |

| super_quick_ratio | 0.015263 | 0.304757 | False | False | False | True | False |

| surplus_reserve_fund_per_share | 0.060968 | 0.576047 | True | True | False | True | False |

| total_asset_growth_rate | 0.022427 | 0.227200 | True | False | True | True | False |

| total_asset_turnover_rate | 0.025566 | 0.299996 | False | False | True | True | False |

| total_operating_cost_ttm | 0.060801 | 0.384181 | True | True | False | True | False |

| total_operating_revenue_per_share | 0.053949 | 0.435877 | True | True | True | True | False |

| total_operating_revenue_per_share_ttm | 0.055321 | 0.474900 | True | True | True | True | True |

| total_operating_revenue_ttm | 0.068386 | 0.406090 | True | False | False | True | False |

| total_profit_growth_rate | 0.019088 | 0.221173 | True | False | False | True | False |

| total_profit_to_cost_ratio | 0.003624 | -0.045772 | False | False | False | True | False |

| total_profit_ttm | 0.086498 | 0.425162 | True | True | True | True | True |

| turnover_volatility | 0.103638 | -0.604179 | True | False | True | True | True |

| value_change_profit_ttm | 0.011354 | 0.115067 | False | True | False | True | False |

156 rows × 7 columns

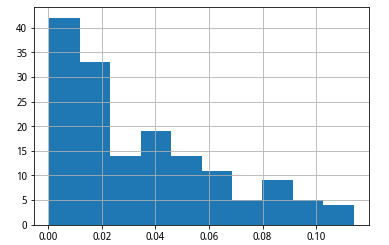

EffectTestresult['IC'].sort_values(ascending=False).hist()

<matplotlib.axes._subplots.AxesSubplot at 0x7f37a7128828>

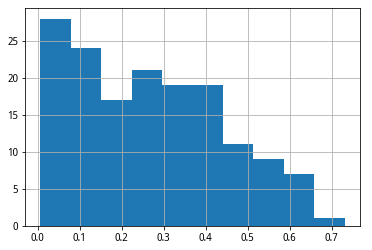

EffectTestresult['ICIR'].abs().sort_values(ascending=False).hist()

<matplotlib.axes._subplots.AxesSubplot at 0x7f37a706ff98>

#筛选有效因子

# IC大于0.07,ICIR大于0.4,测试一,测试二-胜者组,测试三-胜者组,必须通过

# 测试二、测试三中要至少通过3个。

index_ic=EffectTestresult['IC']>0.07

index_icir=EffectTestresult['ICIR'].abs()>0.4

test_index=all(EffectTestresult.iloc[:,[2,3,5]],axis=1)

test2_index=sum(EffectTestresult.iloc[:,3:6],axis=1)>=3

filter_index=index_ic&index_icir&test_index&test2_index

EffectFactorresult=EffectTestresult.loc[filter_index,:]

# 生成有效因子字典

EffectFactor=list(EffectFactorresult.index)

Effect_factor_dict={key:value for key,value in all_factor_dict.items() if key in EffectFactor}

EffectFactorresult

| IC | ICIR | 测试一 | 测试二-胜者组 | 测试二-败者组 | 测试三-胜者组 | 测试三-败者组 | |

|---|---|---|---|---|---|---|---|

| EBITDA | 0.082209 | 0.470460 | True | True | True | True | False |

| VOL120 | 0.104377 | -0.571005 | True | True | True | True | True |

| VOL240 | 0.114056 | -0.592371 | True | True | True | True | True |

| net_profit_ttm | 0.084266 | 0.414061 | True | True | True | True | False |

| np_parent_company_owners_ttm | 0.083697 | 0.409387 | True | True | True | True | False |

| operating_profit_per_share_ttm | 0.083348 | 0.477100 | True | True | True | True | False |

| operating_profit_ttm | 0.087495 | 0.419978 | True | True | True | True | False |

| retained_earnings | 0.098462 | 0.514553 | True | True | True | True | True |

| sharpe_ratio_60 | 0.097423 | 0.609138 | True | True | True | True | False |

| total_profit_ttm | 0.086498 | 0.425162 | True | True | True | True | True |

def Group_Score_calculator(factor,univ_dict,signal,GroupNum=20):

Score_df=pd.DataFrame(index=list(factor.index),columns=list(factor.columns))

for date in list(univ_dict.keys()): #这个也是个循环

univ=univ_dict[date]

univ=list(set(univ)&set(factor.loc[date].dropna().index))

factor_se_stock=list(factor.loc[date,univ].sort_values().index)

N=len(factor_se_stock)

for i in range(GroupNum):

group_stock=factor_se_stock[int(N/GroupNum*i):int(N/GroupNum*(i+1))]

if signal=='ascending':

Score_df.loc[date,group_stock]=i

else:

Score_df.loc[date,group_stock]=GroupNum-i

return Score_df

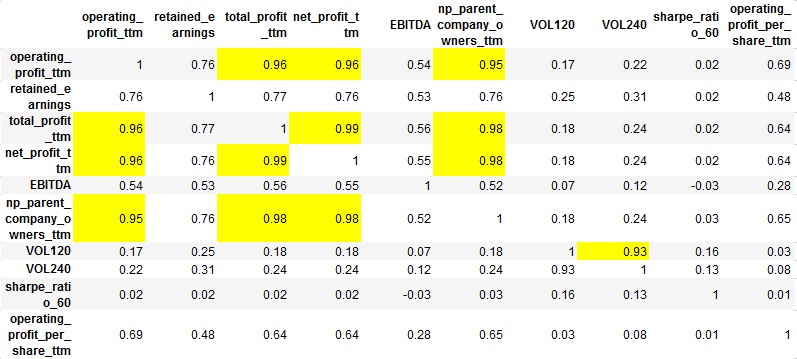

# 计算相关性矩阵

def factor_corr_calculator(Group_Score_Dict,univ_dict):

Group_Score_dict_by_day={}

Group_Score_Corr_dict_by_day={}

# 每日的因子序列

for Date in list(univ_dict.keys()):

Group_Score_df=pd.DataFrame()

univ=univ_dict[Date]

for Factor in list(Group_Score_dict.keys()):

Group_Score_df=Group_Score_df.append(Group_Score_dict[Factor].loc[Date,univ].to_frame(Factor).T)

Group_Score_dict_by_day[Date]=Group_Score_df.T.fillna(4.5)

Group_Score_Corr_dict_by_day[Date]=Group_Score_dict_by_day[Date].corr()

# 算平均数

N=len(list(univ_dict.keys()))

Group_Score_Corr=Group_Score_Corr_dict_by_day[list(univ_dict.keys())[0]]

for Date in list(univ_dict.keys())[1:]:

Group_Score_Corr=Group_Score_Corr+Group_Score_Corr_dict_by_day[Date]

return (Group_Score_Corr/N).round(2)

# 给因子赋值

Group_Score_dict={}

for key,factor in Effect_factor_dict.items():

signal='ascending' if ic_ir_se[key]>0 else 'descending'

Group_Score_dict[key]=Group_Score_calculator(factor,univ_dict,signal,20)

# 计算因子相关系数

factor_corrmatrix=factor_corr_calculator(Group_Score_dict,univ_dict)

factor_corrmatrix

| operating_profit_ttm | retained_earnings | total_profit_ttm | net_profit_ttm | EBITDA | np_parent_company_owners_ttm | VOL120 | VOL240 | sharpe_ratio_60 | operating_profit_per_share_ttm | |

|---|---|---|---|---|---|---|---|---|---|---|

| operating_profit_ttm | 1.00 | 0.76 | 0.96 | 0.96 | 0.54 | 0.95 | 0.17 | 0.22 | 0.02 | 0.69 |

| retained_earnings | 0.76 | 1.00 | 0.77 | 0.76 | 0.53 | 0.76 | 0.25 | 0.31 | 0.02 | 0.48 |

| total_profit_ttm | 0.96 | 0.77 | 1.00 | 0.99 | 0.56 | 0.98 | 0.18 | 0.24 | 0.02 | 0.64 |

| net_profit_ttm | 0.96 | 0.76 | 0.99 | 1.00 | 0.55 | 0.98 | 0.18 | 0.24 | 0.02 | 0.64 |

| EBITDA | 0.54 | 0.53 | 0.56 | 0.55 | 1.00 | 0.52 | 0.07 | 0.12 | -0.03 | 0.28 |

| np_parent_company_owners_ttm | 0.95 | 0.76 | 0.98 | 0.98 | 0.52 | 1.00 | 0.18 | 0.23 | 0.03 | 0.65 |

| VOL120 | 0.17 | 0.25 | 0.18 | 0.18 | 0.07 | 0.18 | 1.00 | 0.93 | 0.16 | 0.03 |

| VOL240 | 0.22 | 0.31 | 0.24 | 0.24 | 0.12 | 0.23 | 0.93 | 1.00 | 0.13 | 0.07 |

| sharpe_ratio_60 | 0.02 | 0.02 | 0.02 | 0.02 | -0.03 | 0.03 | 0.16 | 0.13 | 1.00 | 0.01 |

| operating_profit_per_share_ttm | 0.69 | 0.48 | 0.64 | 0.64 | 0.28 | 0.65 | 0.03 | 0.07 | 0.01 | 1.00 |

# 比较后去掉一些因子

# operating_profit_ttm,net_profit_ttm,np_parent_company_owners_ttm,VOL120

removed_factor=['operating_profit_ttm','net_profit_ttm','np_parent_company_owners_ttm','VOL120']

Effect_factor_dict={key:value for key,value in Effect_factor_dict.items() if key not in removed_factor}

def plot_nav(all_return_df,index_return,key):

# Preallocate figures

fig = plt.figure(figsize=(12,12))

fig.set_facecolor('white')

fig.set_tight_layout(True)

ax1 = fig.add_subplot(211)

ax2 = fig.add_subplot(212)

ax1.grid()

ax2.grid()

ax1.set_ylabel(u"净值", fontsize=16)

ax2.set_ylabel(u"对冲净值", fontsize=16)

ax1.set_title(u"因子选股{} - 净值走势".format(key),fontsize=16)

ax2.set_title(u"因子选股 - 对冲指数后净值走势", fontsize=16)

# preallocate data

date=list(all_return_df.index)

sequence=all_return_df.columns

# plot nav

for sq in sequence:

nav=(1+all_return_df[sq]).cumprod()

nav_excess=(1+all_return_df[sq]-index_return).cumprod()

ax1.plot(date,nav,label=str(sq))

ax2.plot(date,nav_excess,label=str(sq))

ax1.legend(loc=0,fontsize=12)

ax2.legend(loc=0,fontsize=12)

def polish(x):

return '%.2f%%' % (x*100)

def result_stats(key,all_return_df,index_return):

# Preallocate result DataFrame

sequences=all_return_df.columns

cols = [(u'风险指标', u'Alpha'), (u'风险指标', u'Beta'), (u'风险指标', u'信息比率'), (u'风险指标', u'夏普比率'),

(u'纯多头', u'年化收益'), (u'纯多头', u'最大回撤'), (u'纯多头', u'收益波动率'),

(u'对冲后', u'年化收益'), (u'对冲后', u'收益波动率')]

columns = pd.MultiIndex.from_tuples(cols)

result_df = pd.DataFrame(index = sequences,columns=columns)

result_df.index.name = "%s" % (key)

for sq in sequences: #循环在这里开始

# 净值

return_data=all_return_df[sq]

return_data_excess=return_data-index_return

nav=(1+return_data).cumprod()

nav_excess=(1+return_data_excess).cumprod()

nav_index=(1+index_return).cumprod()

# Beta

beta=return_data.corr(index_return)*return_data.std()/index_return.std()

beta_excess=return_data_excess.corr(index_return)*return_data_excess.std()/index_return.std()

#年化收益

daylength=(return_data.index[-1]-return_data.index[0]).days

yearly_return=np.power(nav.iloc[-1],1.0*365/daylength)-1

yearly_return_excess=np.power(nav_excess.iloc[-1],1.0*365/daylength)-1

yearly_index_return=np.power(nav_index.iloc[-1],1.0*365/daylength)-1

# 最大回撤 其实这个完全看不懂

max_drawdown=max([1-v/max(1,max(nav.iloc[:i+1])) for i,v in enumerate(nav)])

#max_drawdown_excess=max([1-v/max(1,max(nav_excess.iloc[:i+1])) for i,v in enumerate(nav_excess)])

# 波动率

vol=return_data.std()*sqrt(252)

vol_excess=return_data_excess.std()*sqrt(252)

# Alpha

rf=0.04

alpha=yearly_return-(rf+beta*(yearly_return-yearly_index_return))

alpha_excess=yearly_return_excess-(rf+beta_excess*(yearly_return-yearly_index_return))

# 信息比率

ir=(yearly_return-yearly_index_return)/(return_data_excess.std()*sqrt(252))

# 夏普比率

sharpe=(yearly_return-rf)/vol

# 美化打印

alpha,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess=\

map(polish,[alpha,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess])

sharpe=round(sharpe,2)

ir=round(ir,2)

beta=round(ir,2)

result_df.loc[sq]=[alpha,beta,ir,sharpe,yearly_return,max_drawdown,vol,yearly_return_excess,vol_excess]

return result_df

def draw_excess_return(excess_return,key):

excess_return_mean=excess_return[1:].mean()

excess_return_mean.index = map(lambda x:int(x)+1,excess_return_mean.index)

excess_plus=excess_return_mean[excess_return_mean>0]

excess_minus=excess_return_mean[excess_return_mean<0]

fig = plt.figure(figsize=(12, 6))

fig.set_facecolor('white')

ax1 = fig.add_subplot(111)

ax1.bar(excess_plus.index, excess_plus.values, align='center', color='r', width=0.35)

ax1.bar(excess_minus.index, excess_minus.values, align='center', color='g', width=0.35)

ax1.set_xlim(left=0.5, right=len(excess_return_mean)+0.5)

ax1.set_ylabel(u'超额收益', fontsize=16)

ax1.set_xlabel(u'十分位分组', fontsize=16)

ax1.set_xticks(excess_return_mean.index)

ax1.set_xticklabels([int(x) for x in ax1.get_xticks()], fontsize=14)

ax1.set_yticklabels([str(x*100)+'0%' for x in ax1.get_yticks()], fontsize=14)

ax1.set_title(u"因子选股分组超额收益{}".format(key), fontsize=16)

ax1.grid()

for key in list(Effect_factor_dict.keys()):

plot_nav(all_Factor_Group_Return_dict[key],index_return,key)

/opt/conda/envs/python3new/lib/python3.6/site-packages/matplotlib/figure.py:1743: UserWarning: This figure includes Axes that are not compatible with tight_layout, so its results might be incorrect.

warnings.warn("This figure includes Axes that are not "

result_dict={}

for key in list(Effect_factor_dict.keys()):

result_df=result_stats(key,all_Factor_Group_Return_dict[key],index_return)

result_dict[key]=result_df

print(result_df)

风险指标 纯多头 \

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤 收益波动率

retained_earnings

0 -10.34% -1.05 -1.05 -1.26 -16.28% 37.83% 16.11%

1 -11.26% -1.24 -1.24 -1.4 -19.52% 39.35% 16.75%

2 -9.64% -0.74 -0.74 -1.03 -12.53% 29.36% 16.08%

3 -7.44% 0.06 0.06 -0.46 -2.92% 16.07% 15.09%

4 -9.39% -0.46 -0.46 -0.85 -10.32% 27.16% 16.87%

5 -6.34% 0.82 0.82 -0.03 3.52% 21.94% 14.95%

6 -6.73% 0.65 0.65 -0.2 1.14% 21.91% 14.35%

7 -6.30% 1.13 1.13 -0.1 2.64% 21.07% 13.35%

8 -6.60% 1.23 1.23 -0.01 3.88% 24.56% 14.72%

9 -4.46% 2.56 2.56 0.76 15.15% 23.02% 14.73%

对冲后

年化收益 收益波动率

retained_earnings

0 -12.57% 12.01%

1 -13.16% 12.81%

2 -7.32% 11.96%

3 2.80% 10.87%

4 -4.15% 14.65%

5 -0.40% 8.66%

6 0.02% 7.38%

7 -0.80% 5.56%

8 -1.78% 6.11%

9 2.09% 7.33%

风险指标 纯多头 对冲后 \

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤 收益波动率 年化收益

total_profit_ttm

0 -9.85% -0.83 -0.83 -1.08 -14.61% 37.17% 17.17% -11.52%

1 -10.28% -0.98 -0.98 -1.2 -16.41% 36.61% 17.03% -10.47%

2 -10.96% -1.06 -1.06 -1.3 -15.16% 32.79% 14.77% -7.87%

3 -7.66% -0.02 -0.02 -0.47 -3.83% 18.41% 16.59% 2.38%

4 -9.00% -0.38 -0.38 -0.81 -8.38% 26.34% 15.36% -6.14%

5 -7.28% 0.13 0.13 -0.44 -2.32% 23.34% 14.27% -2.11%

6 -5.88% 1.07 1.07 0.06 4.85% 22.11% 14.29% -0.18%

7 -6.83% 0.99 0.99 -0.16 1.75% 23.82% 14.29% -1.46%

8 -6.55% 1.15 1.15 0.05 4.74% 24.59% 15.23% -0.87%

9 -5.37% 2.45 2.45 0.61 13.20% 24.32% 15.05% 2.59%

收益波动率

total_profit_ttm

0 13.31%

1 13.02%

2 10.93%

3 12.59%

4 12.55%

5 9.85%

6 7.92%

7 5.44%

8 7.26%

9 6.86%

风险指标 纯多头 对冲后

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤 收益波动率 年化收益 收益波动率

EBITDA

0 -10.17% -0.8 -0.8 -1.1 -13.70% 31.39% 16.12% -6.04% 12.68%

1 -8.83% -0.32 -0.32 -0.74 -7.91% 22.01% 16.16% -1.23% 13.26%

2 -10.68% -0.76 -0.76 -1.13 -12.90% 34.44% 14.98% -10.99% 12.27%

3 -9.73% -0.7 -0.7 -1.03 -11.87% 28.83% 15.35% -4.73% 11.79%

4 -7.43% 0.09 0.09 -0.45 -2.73% 20.98% 15.07% -0.90% 9.45%

5 -9.50% -0.93 -0.93 -1.15 -15.52% 35.02% 17.04% -12.86% 12.85%

6 -7.96% -0.2 -0.2 -0.6 -5.97% 25.39% 16.61% -5.38% 11.58%

7 -6.21% 2.53 2.53 0.58 13.01% 21.61% 15.59% 3.41% 6.56%

8 -4.46% 2.06 2.06 0.61 12.90% 25.12% 14.61% 3.22% 8.02%

9 -6.42% 1.38 1.38 0.19 6.91% 22.73% 15.59% 0.17% 7.65%

风险指标 纯多头 对冲后

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤 收益波动率 年化收益 收益波动率

VOL240

0 -2.11% 1.22 1.22 0.39 8.15% 19.09% 10.61% 0.79% 9.65%

1 -4.45% 1.31 1.31 0.15 5.77% 22.09% 11.74% -1.89% 7.15%

2 -5.52% 1.29 1.29 0.14 5.96% 23.99% 13.91% -2.02% 7.43%

3 -6.20% 0.75 0.75 -0.12 2.39% 16.60% 13.92% 2.96% 7.99%

4 -6.82% 0.73 0.73 -0.17 1.57% 24.36% 14.70% -2.49% 7.16%

5 -7.28% 0.24 0.24 -0.35 -1.48% 21.83% 15.54% -0.50% 9.01%

6 -8.17% -0.31 -0.31 -0.69 -6.43% 24.71% 15.11% -5.89% 9.20%

7 -8.20% -0.49 -0.49 -0.76 -8.86% 26.16% 17.01% -2.02% 10.77%

8 -8.72% -1.18 -1.18 -1.25 -19.68% 42.15% 18.91% -11.61% 13.59%

9 -9.08% -1.14 -1.14 -1.29 -21.83% 43.53% 20.04% -12.20% 16.04%

风险指标 纯多头 对冲后 \

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤 收益波动率 年化收益

sharpe_ratio_60

0 -10.48% -0.9 -0.9 -1.15 -17.76% 37.04% 18.86% -9.38%

1 -9.69% -0.98 -0.98 -1.13 -13.35% 30.02% 15.33% -7.37%

2 -8.27% -0.53 -0.53 -0.78 -8.24% 26.17% 15.61% -6.71%

3 -6.82% 0.65 0.65 -0.14 1.80% 19.22% 15.41% 2.97%

4 -8.01% -0.26 -0.26 -0.67 -5.63% 25.32% 14.46% -5.12%

5 -6.55% 0.59 0.59 -0.15 1.69% 16.03% 14.93% 3.96%

6 -7.02% 0.33 0.33 -0.33 -0.81% 24.80% 14.43% -4.21%

7 -7.69% -0.03 -0.03 -0.54 -3.94% 32.14% 14.81% -8.39%

8 -5.56% 0.72 0.72 0 4.02% 23.05% 14.54% -1.92%

9 -5.04% 0.7 0.7 0.09 5.43% 17.26% 15.28% 1.24%

收益波动率

sharpe_ratio_60

0 15.71%

1 9.92%

2 8.65%

3 8.28%

4 7.84%

5 9.00%

6 8.51%

7 10.05%

8 10.67%

9 12.86%

风险指标 纯多头 \

Alpha Beta 信息比率 夏普比率 年化收益 最大回撤

operating_profit_per_share_ttm

0 -9.42% -0.56 -0.56 -0.94 -9.84% 28.07%

1 -9.00% -0.59 -0.59 -0.89 -11.09% 31.56%

2 -10.18% -0.89 -0.89 -1.15 -14.33% 32.06%

3 -10.20% -0.85 -0.85 -1.12 -14.16% 33.57%

4 -7.72% -0.03 -0.03 -0.55 -3.98% 17.62%

5 -7.95% -0.15 -0.15 -0.64 -4.96% 24.35%

6 -7.33% 0.17 0.17 -0.44 -2.24% 25.58%

7 -6.52% 1.01 1.01 -0.13 2.16% 18.71%

8 -7.02% 1.37 1.37 0.1 5.56% 26.15%

9 -4.90% 3.24 3.24 0.9 17.42% 15.38%

对冲后

收益波动率 年化收益 收益波动率

operating_profit_per_share_ttm

0 14.68% -7.39% 11.03%

1 16.86% -6.36% 12.69%

2 15.94% -7.35% 11.97%

3 16.15% -11.20% 12.42%

4 14.57% -1.54% 10.31%

5 13.99% -4.09% 8.74%

6 14.28% -3.78% 8.04%

7 13.74% -1.76% 5.72%

8 15.85% 1.55% 6.70%

9 14.94% 6.96% 6.50%

result_dict['VOL240']

| 风险指标 | 纯多头 | 对冲后 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Alpha | Beta | 信息比率 | 夏普比率 | 年化收益 | 最大回撤 | 收益波动率 | 年化收益 | 收益波动率 | |

| VOL240 | |||||||||

| 0 | -2.11% | 1.22 | 1.22 | 0.39 | 8.15% | 19.09% | 10.61% | 0.79% | 9.65% |

| 1 | -4.45% | 1.31 | 1.31 | 0.15 | 5.77% | 22.09% | 11.74% | -1.89% | 7.15% |

| 2 | -5.52% | 1.29 | 1.29 | 0.14 | 5.96% | 23.99% | 13.91% | -2.02% | 7.43% |

| 3 | -6.20% | 0.75 | 0.75 | -0.12 | 2.39% | 16.60% | 13.92% | 2.96% | 7.99% |

| 4 | -6.82% | 0.73 | 0.73 | -0.17 | 1.57% | 24.36% | 14.70% | -2.49% | 7.16% |

| 5 | -7.28% | 0.24 | 0.24 | -0.35 | -1.48% | 21.83% | 15.54% | -0.50% | 9.01% |

| 6 | -8.17% | -0.31 | -0.31 | -0.69 | -6.43% | 24.71% | 15.11% | -5.89% | 9.20% |

| 7 | -8.20% | -0.49 | -0.49 | -0.76 | -8.86% | 26.16% | 17.01% | -2.02% | 10.77% |

| 8 | -8.72% | -1.18 | -1.18 | -1.25 | -19.68% | 42.15% | 18.91% | -11.61% | 13.59% |

| 9 | -9.08% | -1.14 | -1.14 | -1.29 | -21.83% | 43.53% | 20.04% | -12.20% | 16.04% |

for key in list(Effect_factor_dict.keys()):

draw_excess_return(Factor_Group_Excess_Return_dict[key],key)

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...

移动端课程