前几天看到一篇市场底部特征研究的文章【华创金工】,觉得有点意思,下面就是将这些衡量底部特征的内容在研究里进行实现。

文章的核心逻辑如下所述:

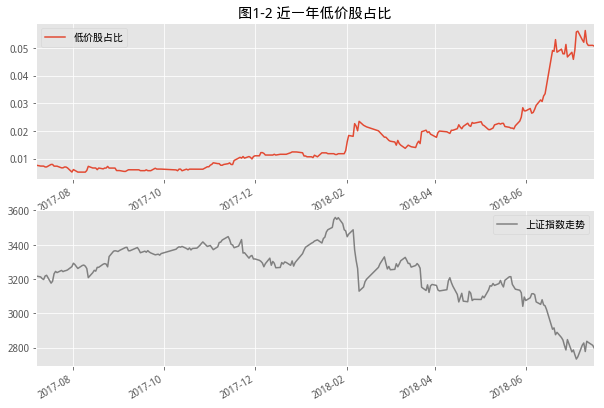

#返回股价低于2元的股票个数占比

def f1(self,date_list):

bei = len(date_list)//13

se_price_2 = []

for i in range(1,13):

e = date_list[i*bei]

s = date_list[(i-1)*bei]

if i == 0:

s = date_list[0]

elif i == 12:

e = date_list[-1]

all_stock = list(get_all_securities(types='stock',date=e).index)

def f1_1(x):

x=x.dropna(axis=0)

return sum(x)

df = get_price(all_stock,start_date=s,end_date=e,fields=['close'],fq=None)['close']

df_1 = df<=2*(1.04)**i

#print(2*(1.04)**i)

se1 = df_1.apply(f1_1,axis=1)

l2 = [len(get_all_securities(types='stock',date=i)) for i in se1.index ]

se2 = pd.Series(l2,index=se1.index)

#se2 = df_1.apply(f1_1[1],axis=1)

se_price_2.append(se1/se2)

return pd.concat(se_price_2)

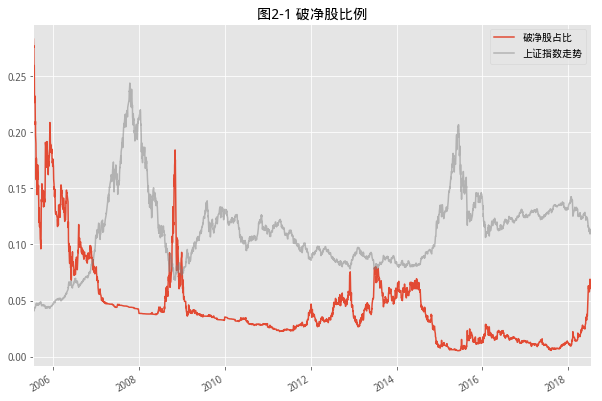

#返回破净股比例

def f2(self,date_list):

pb = []

for d in date_list:

df_temp = get_fundamentals(query(valuation.code,valuation.pb_ratio,valuation.circulating_market_cap,valuation.pe_ratio),date=d)

a = len(df_temp)

b = len(df_temp[df_temp['pb_ratio']<=1])

#b = len(df_temp[(df_temp['pb_ratio']<=1)&(df_temp['pb_ratio']>=0)])

pb.append(b/a)

df_2 = pd.DataFrame(pb,index=date_list,columns=['pb_ratio'])

return df_2['pb_ratio']

def f3_1(self,date_list):

M2_date = pd.read_excel('M2.xls')

M2_date = M2_date[(M2_date['time']>date_list[0]) & (M2_date['time']<date_list[-1])]

M2_date.index = M2_date['time'].values

date_list_new = M2_date.time

market = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.circulating_market_cap),date=d)

c = df_temp['circulating_market_cap'].quantile(0.5)

market.append(c)

df_3 = pd.DataFrame(market,index=date_list_new,columns=['market_50%'])

df_3['m2'] = M2_date['M2']

df_3['M2/总市值中位数'] = df_3['m2']/df_3['market_50%']

df_3 = df_3.sort_index(ascending=1)

return df_3#['M2/总市值中位数']

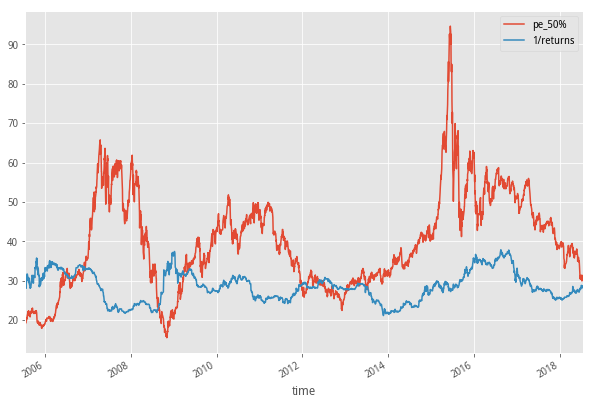

#PE中位数和十年国债收益率倒数的比较

def f4_1(self,date_list):

deb_date = pd.read_excel('10年国债数据.xls')

deb_date = deb_date[(deb_date['time']>date_list[0]) & (deb_date['time']<date_list[-1])]

deb_date.index = deb_date['time'].values

date_list_new = deb_date.time

pe = []

cir_market_ratio = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio,valuation.circulating_market_cap),date=d)

a = len(df_temp)

b = len(df_temp[df_temp['circulating_market_cap']<45])

#print(df_temp['circulating_market_cap'].quantile(0.5))

c = df_temp['pe_ratio'].quantile(0.5)

cir_market_ratio.append(b/a)

pe.append(c)

df_4 = pd.DataFrame(pe,index=date_list_new,columns=['pe_50%'])

df_4['returns'] = deb_date['returns']

df_4['1/returns'] = 100/deb_date['returns']

df_4['cir_market_ratio'] = cir_market_ratio

#df_4['pe中位数/10年国债收益倒数'] = df_4['pe_50%']/df_4['1/returns']

return df_4[['pe_50%','1/returns','cir_market_ratio']]

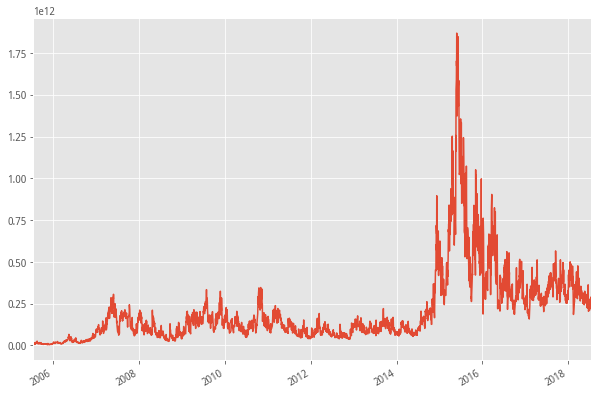

#全市场成交额

#输出两个市场成交额数据变化

def f5(self,date_list):

s,e = date_list[0],date_list[-1]

pl = get_price(['399001.XSHE','000001.XSHG'],start_date=s,end_date=e,fields=['money'])['money']

pl['money'] = pl['399001.XSHE'] pl['000001.XSHG']

return pl['money']

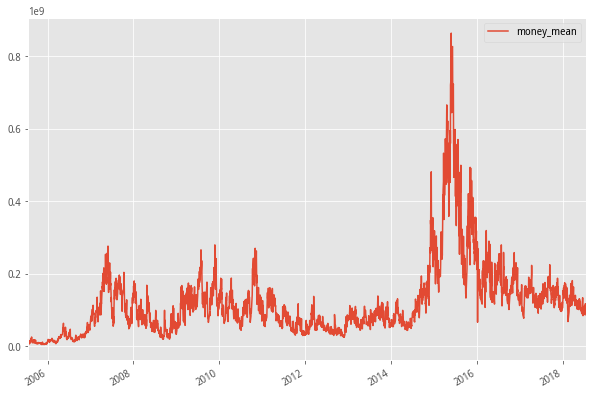

#个股成交的冷淡

#返回个股成交金额

def f6(self,date_list):

l_money_mean = []

for i in date_list:

all_stock = list(get_all_securities(types='stock',date=i).index)

df_money = get_price(all_stock,end_date=i,count=1)['money']

df_money = df_money.dropna(axis=1)

money_mean = sum(df_money.T)/df_money.shape[1]

l_money_mean.append(money_mean.values)

df_money_mean = pd.DataFrame(l_money_mean,index=date_list,columns=['money_mean'])

return df_money_mean

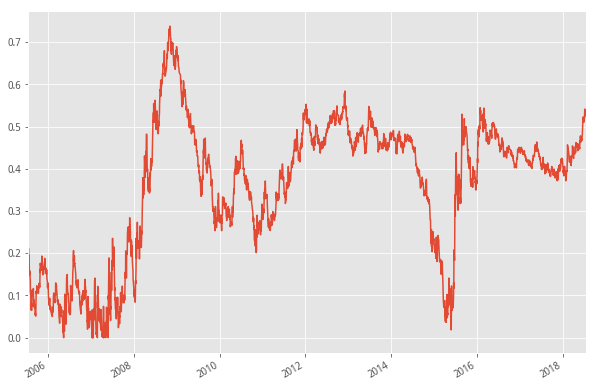

#个股区间最大跌幅中位数

def f7(self,date_list):

date = date_list[-1]

#all_stock = list(get_all_securities(types='stock',date=date).index)

all_stock = get_index_stocks('000300.XSHG')

df_temp = get_price(all_stock,start_date='2005-4-1',end_date=date,fields=['close'])['close']

se_l = []

for i in date_list:

df_temp_1 = df_temp[df_temp.index<i]

#回撤

se = 1-df_temp_1[-1:]/df_temp_1.max()

#格式为series

se_l.append(se.T.quantile(0.5))

return pd.concat(se_l)

次新股,一般是指上市一年以内的股票,可以通过以下代码获取近一年上市的所有股票,共计241只,占全市场股票6.8%,取出全市场换手率最高的前100只股票,其中次新股却有57只,对广大股民来讲,次新确实有着绝对的人气。

import datetime

#获取所有的股票信息

df = get_all_securities()

#筛选出近一年的股票

df[df['start_date']>datetime.date(2017,7,20)]

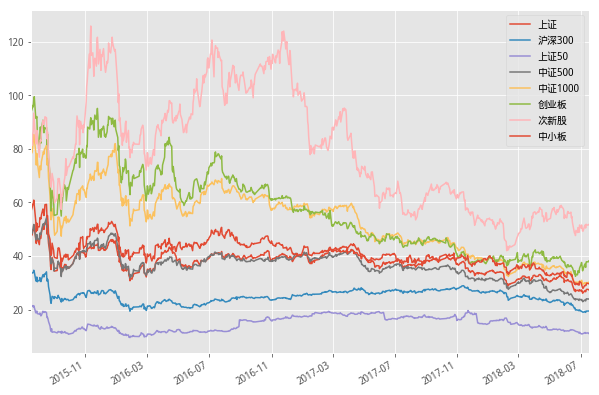

下面是次新股和全市场股票的PE中位数的数据,就最近一次的牛市行情来看,次新是不一样的,在2015股灾之后,依然走出了一波行情,直到2016年年底才开始跳水,这与IPO加速都有着直接的关系。数据往前推几年,牛熊交替的过程中我们看到,市场好的时候,大家各有各的花样,市场不好的时候,看起来都是一个样。最低点时次新股与全市场估值接近,就是所谓通杀。就目前来看,次新还是有着自己的想法。

#获取次新股和全市场股票的PE中位数

def f8(self,date_list):

sec_new_pe = []

pe = []

p_ratio_l = []

all_stock = get_all_securities(types='stock',date=date_list[-1])

all_stock['fir_open'] = [get_price(stock,end_date=all_stock.loc[stock]['start_date'],count=1,fields=['open'])['open'].values[0] for stock in all_stock.index]

for d in date_list:

df_temp = get_price('000001.XSHG',end_date=d,count=252)

year_1,month_1,day_1 = int(str(df_temp.index[0])[:4]), int(str(df_temp.index[0])[5:7]), int(str(df_temp.index[0])[8:10])

year,month,day = int(str(df_temp.index[-1])[:4]), int(str(df_temp.index[-1])[5:7]), int(str(df_temp.index[-1])[8:10])

sec_new_stock_df = all_stock[(all_stock['start_date']>datetime.date(year_1,month_1,day_1)) & (all_stock['start_date']<datetime.date(year,month,day))]

sec_new_stock = sec_new_stock_df.index

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio).filter(valuation.code.in_(sec_new_stock)),date=d)

df_temp_1 = get_fundamentals(query(valuation.code,valuation.pe_ratio),date=d)

pe_sec = df_temp['pe_ratio'].quantile(0.5)

pe_all = df_temp_1['pe_ratio'].quantile(0.5)

sec_new_pe.append(pe_sec)

pe.append(pe_all)

#获取次新股当前价格

sec_new_price = get_price(list(sec_new_stock),end_date=d,fields=['close'],count=1)['close'].T

sec_new_price.columns=['fir_open']

p_ratio = sec_new_price['fir_open']/all_stock.loc[sec_new_price.index,:]['fir_open']

po_ratio = len(p_ratio[p_ratio<1])/len(p_ratio)

p_ratio_l.append(po_ratio)

df_pe = pd.DataFrame(sec_new_pe,index=date_list,columns=['sec_pe'])

df_pe['pe'] = pe

df_pe['p_ratio'] = p_ratio_l

return df_pe

a = f()

#由于部分指数上市较晚,这里开始时间从2015年开始

date_list = a.get_tradeday_list('2015-7-17','2018-7-17')

df9 = a.f9(date_list)

df9 = df9.sort_index(ascending=1)

df9.plot(figsize=(10,7))

#市场大底,行业一片惨淡,无一例外

#行业PE估值

def f9(self,date_list):

#指数用成分股,pe值做市值加权处理

index_list = ['000001.XSHG','000300.XSHG','000016.XSHG','000905.XSHG','000852.XSHG','399006.XSHE','399678.XSHE','399005.XSHE']

index_name = ['上证','沪深300','上证50','中证500','中证1000','创业板','次新股','中小板']

pe_fin = []

for i in date_list:

pe_index = []

for j in index_list:

stock_list = get_index_stocks(j,i)

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio).filter(valuation.code.in_(stock_list)),date=i)

pe = df_temp['pe_ratio'].quantile(0.5)

pe_index.append(pe)

pe_fin.append(pe_index)

pe_df = pd.DataFrame(pe_fin,index=date_list,columns=index_name)

return pe_df

#导入各种包

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

plt.style.use('ggplot')

#方法

#获取交易日期列表

#时间序列函数

class f():

date_now = '2018-7-17'

all_stock_info = get_all_securities(types='stock',date=date_now)

all_stock = list(all_stock_info.index)

#df = get_price(list(all_stock.index),start_date='2008-01-01',end_date=date,fields=['close','money','volume'])['close']

#交易日期列表

def get_tradeday_list(self,s='2017-1-1',e=date_now,count=None):

if count != None:

df = get_price('000001.XSHG',end_date=e,count=count)

return df.index

else:

df = get_price('000001.XSHG',start_date=s,end_date=e)

return df.index

#股票个数序列

def all_stock_num(s,e):

get_all_securities(t)

#返回股价低于2元的股票个数占比

def f1(self,date_list):

bei = len(date_list)//13

se_price_2 = []

for i in range(1,13):

e = date_list[i*bei]

s = date_list[(i-1)*bei]

if i == 0:

s = date_list[0]

elif i == 12:

e = date_list[-1]

all_stock = list(get_all_securities(types='stock',date=e).index)

def f1_1(x):

x=x.dropna(axis=0)

return sum(x)

df = get_price(all_stock,start_date=s,end_date=e,fields=['close'],fq=None)['close']

df_1 = df<=2*(1.04)**i

#print(2*(1.04)**i)

se1 = df_1.apply(f1_1,axis=1)

l2 = [len(get_all_securities(types='stock',date=i)) for i in se1.index ]

se2 = pd.Series(l2,index=se1.index)

#se2 = df_1.apply(f1_1[1],axis=1)

se_price_2.append(se1/se2)

return pd.concat(se_price_2)

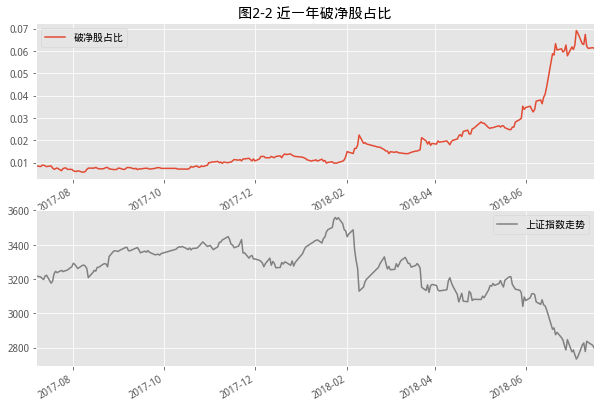

#返回破净股比例

def f2(self,date_list):

pb = []

for d in date_list:

df_temp = get_fundamentals(query(valuation.code,valuation.pb_ratio,valuation.circulating_market_cap,valuation.pe_ratio),date=d)

a = len(df_temp)

b = len(df_temp[df_temp['pb_ratio']<=1])

#b = len(df_temp[(df_temp['pb_ratio']<=1)&(df_temp['pb_ratio']>=0)])

pb.append(b/a)

df_2 = pd.DataFrame(pb,index=date_list,columns=['pb_ratio'])

return df_2['pb_ratio']

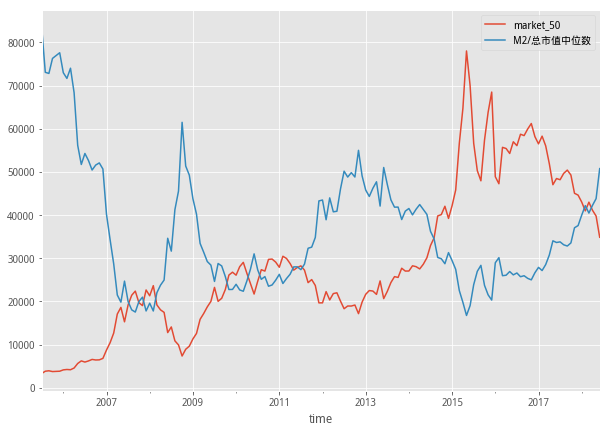

#M2/总市值中位数

def f3(self,date_list):

M2_date = pd.read_excel('M2.xls')

M2_date = M2_date[(M2_date['time']>date_list[0]) & (M2_date['time']<date_list[-1])]

M2_date.index = M2_date['time'].values

date_list_new = M2_date.time

market = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.circulating_market_cap),date=d)

c = df_temp['circulating_market_cap'].quantile(0.5)

market.append(c)

df_3 = pd.DataFrame(market,index=date_list_new,columns=['market_50%'])

df_3['m2'] = M2_date['M2']

df_3['M2/总市值中位数'] = df_3['m2']/df_3['market_50%']

df_3 = df_3.sort_index(ascending=1)

return df_3#['M2/总市值中位数']

#M2/总市值中位数

def f3(self,date_list):

M2_date = pd.read_excel('M2.xls')

M2_date = M2_date[(M2_date['time']>date_list[0]) & (M2_date['time']<date_list[-1])]

M2_date.index = M2_date['time'].values

date_list_new = M2_date.time

market = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.circulating_market_cap),date=d)

c = df_temp['circulating_market_cap'].quantile(0.5)

market.append(c)

df_3 = pd.DataFrame(market,index=date_list_new,columns=['market_50%'])

df_3['m2'] = M2_date['M2']

df_3['M2/总市值中位数'] = df_3['m2']/df_3['market_50%']

df_3 = df_3.sort_index(ascending=1)

return df_3#['M2/总市值中位数']

def f3_1(self,date_list):

M2_date = pd.read_excel('M2.xls')

M2_date = M2_date[(M2_date['time']>date_list[0]) & (M2_date['time']<date_list[-1])]

M2_date.index = M2_date['time'].values

date_list_new = M2_date.time

market = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.circulating_market_cap),date=d)

c = df_temp['circulating_market_cap'].quantile(0.5)

market.append(c)

df_3 = pd.DataFrame(market,index=date_list_new,columns=['market_50%'])

df_3['m2'] = M2_date['M2']

df_3['M2/总市值中位数'] = df_3['m2']/df_3['market_50%']

df_3 = df_3.sort_index(ascending=1)

return df_3#['M2/总市值中位数']

#PE中位数和十年国债收益率倒数的比较

def f4(self,date_list):

deb_date = pd.read_excel('10年国债.xls')

deb_date = deb_date[(deb_date['time']>date_list[0]) & (deb_date['time']<date_list[-1])]

deb_date.index = deb_date['time'].values

date_list_new = deb_date.time

pe = []

cir_market_ratio = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio,valuation.circulating_market_cap),date=d)

a = len(df_temp)

b = len(df_temp[df_temp['circulating_market_cap']<45])

#print(df_temp['circulating_market_cap'].quantile(0.5))

c = df_temp['pe_ratio'].quantile(0.5)

cir_market_ratio.append(b/a)

pe.append(c)

df_4 = pd.DataFrame(pe,index=date_list_new,columns=['pe_50%'])

df_4['returns'] = deb_date['returns']

df_4['1/returns'] = 100/deb_date['returns']

df_4['cir_market_ratio'] = cir_market_ratio

#df_4['pe中位数/10年国债收益倒数'] = df_4['pe_50%']/df_4['1/returns']

return df_4[['pe_50%','1/returns','cir_market_ratio']]

#PE中位数和十年国债收益率倒数的比较

def f4_1(self,date_list):

deb_date = pd.read_excel('10年国债数据.xls')

deb_date = deb_date[(deb_date['time']>date_list[0]) & (deb_date['time']<date_list[-1])]

deb_date.index = deb_date['time'].values

date_list_new = deb_date.time

pe = []

cir_market_ratio = []

for d in date_list_new:

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio,valuation.circulating_market_cap),date=d)

a = len(df_temp)

b = len(df_temp[df_temp['circulating_market_cap']<45])

#print(df_temp['circulating_market_cap'].quantile(0.5))

c = df_temp['pe_ratio'].quantile(0.5)

cir_market_ratio.append(b/a)

pe.append(c)

df_4 = pd.DataFrame(pe,index=date_list_new,columns=['pe_50%'])

df_4['returns'] = deb_date['returns']

df_4['1/returns'] = 100/deb_date['returns']

df_4['cir_market_ratio'] = cir_market_ratio

#df_4['pe中位数/10年国债收益倒数'] = df_4['pe_50%']/df_4['1/returns']

return df_4[['pe_50%','1/returns','cir_market_ratio']]

#全市场成交额

#输出两个市场成交额数据变化

def f5(self,date_list):

s,e = date_list[0],date_list[-1]

pl = get_price(['399001.XSHE','000001.XSHG'],start_date=s,end_date=e,fields=['money'])['money']

pl['money'] = pl['399001.XSHE']+pl['000001.XSHG']

return pl['money']

#个股成交的冷淡

#返回个股成交金额

def f6(self,date_list):

l_money_mean = []

for i in date_list:

all_stock = list(get_all_securities(types='stock',date=i).index)

df_money = get_price(all_stock,end_date=i,count=1)['money']

df_money = df_money.dropna(axis=1)

money_mean = sum(df_money.T)/df_money.shape[1]

l_money_mean.append(money_mean.values)

df_money_mean = pd.DataFrame(l_money_mean,index=date_list,columns=['money_mean'])

return df_money_mean

#个股区间最大跌幅中位数

def f7(self,date_list):

date = date_list[-1]

#all_stock = list(get_all_securities(types='stock',date=date).index)

all_stock = get_index_stocks('000300.XSHG')

df_temp = get_price(all_stock,start_date='2005-4-1',end_date=date,fields=['close'])['close']

se_l = []

for i in date_list:

df_temp_1 = df_temp[df_temp.index<i]

#回撤

se = 1-df_temp_1[-1:]/df_temp_1.max()

#格式为series

se_l.append(se.T.quantile(0.5))

return pd.concat(se_l)

#次新股的破发率

#获取次新股和全市场股票的PE中位数

def f8(self,date_list):

sec_new_pe = []

pe = []

p_ratio_l = []

all_stock = get_all_securities(types='stock',date=date_list[-1])

all_stock['fir_open'] = [get_price(stock,end_date=all_stock.loc[stock]['start_date'],count=1,fields=['open'])['open'].values[0] for stock in all_stock.index]

for d in date_list:

df_temp = get_price('000001.XSHG',end_date=d,count=252)

year_1,month_1,day_1 = int(str(df_temp.index[0])[:4]), int(str(df_temp.index[0])[5:7]), int(str(df_temp.index[0])[8:10])

year,month,day = int(str(df_temp.index[-1])[:4]), int(str(df_temp.index[-1])[5:7]), int(str(df_temp.index[-1])[8:10])

sec_new_stock_df = all_stock[(all_stock['start_date']>datetime.date(year_1,month_1,day_1)) & (all_stock['start_date']<datetime.date(year,month,day))]

sec_new_stock = sec_new_stock_df.index

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio).filter(valuation.code.in_(sec_new_stock)),date=d)

df_temp_1 = get_fundamentals(query(valuation.code,valuation.pe_ratio),date=d)

pe_sec = df_temp['pe_ratio'].quantile(0.5)

pe_all = df_temp_1['pe_ratio'].quantile(0.5)

sec_new_pe.append(pe_sec)

pe.append(pe_all)

#获取次新股当前价格

sec_new_price = get_price(list(sec_new_stock),end_date=d,fields=['close'],count=1)['close'].T

sec_new_price.columns=['fir_open']

p_ratio = sec_new_price['fir_open']/all_stock.loc[sec_new_price.index,:]['fir_open']

po_ratio = len(p_ratio[p_ratio<1])/len(p_ratio)

p_ratio_l.append(po_ratio)

df_pe = pd.DataFrame(sec_new_pe,index=date_list,columns=['sec_pe'])

df_pe['pe'] = pe

df_pe['p_ratio'] = p_ratio_l

return df_pe

#市场大底,行业一片惨淡,无一例外

#行业PE估值

def f9(self,date_list):

#指数用成分股,pe值做市值加权处理

index_list = ['000001.XSHG','000300.XSHG','000016.XSHG','000905.XSHG','000852.XSHG','399006.XSHE','399678.XSHE','399005.XSHE']

index_name = ['上证','沪深300','上证50','中证500','中证1000','创业板','次新股','中小板']

pe_fin = []

for i in date_list:

pe_index = []

for j in index_list:

stock_list = get_index_stocks(j,i)

df_temp = get_fundamentals(query(valuation.code,valuation.pe_ratio).filter(valuation.code.in_(stock_list)),date=i)

pe = df_temp['pe_ratio'].quantile(0.5)

pe_index.append(pe)

pe_fin.append(pe_index)

pe_df = pd.DataFrame(pe_fin,index=date_list,columns=index_name)

return pe_df

a = f()

date_list = a.get_tradeday_list('2005-7-17','2018-7-17')

df1 = a.f1(date_list)

df1.plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f67db8ce668>

df2 = a.f2(date_list)

df2.plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f67f80112b0>

df3 = a.f3(date_list)

#df3.plot(figsize=(10,7))

df3['market_50'] = df3['market_50%']*10**3

df3[['market_50','M2/总市值中位数']].plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f67e2c38908>

df4 = a.f4_1(date_list)

df4.plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f67e6a24780>

df4[['pe_50%','1/returns']].plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f6805a19898>

df7 = a.f7(date_list)

df7.plot(figsize=(10,7))

<matplotlib.axes._subplots.AxesSubplot at 0x7f67ddb6db38>

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...