#模拟生成两个的权重

def weight(n):

w = np.random.random(n)

return w/sum(w)

#定义计算收益、风险、夏普率的函数

def portfolio_test(w):

r1,r2 = 0.08,0.12

sigma1,sigma2 = 0.12,0.25

rho1,rho2,rho3,rho4,rho5 = -1,-0.5,0,0.5,1

p_mean = r1*w[0] r2*w[1]

p_var1 = (w[0]**2)*(sigma1**2) (w[1]**2)*(sigma2**2) 2*w[0]*w[1]*rho1*sigma1*sigma2

p_var2 = (w[0]**2)*(sigma1**2) (w[1]**2)*(sigma2**2) 2*w[0]*w[1]*rho2*sigma1*sigma2

p_var3 = (w[0]**2)*(sigma1**2) (w[1]**2)*(sigma2**2) 2*w[0]*w[1]*rho3*sigma1*sigma2

p_var4 = (w[0]**2)*(sigma1**2) (w[1]**2)*(sigma2**2) 2*w[0]*w[1]*rho4*sigma1*sigma2

p_var5 = (w[0]**2)*(sigma1**2) (w[1]**2)*(sigma2**2) 2*w[0]*w[1]*rho5*sigma1*sigma2

p_sigma1 = np.sqrt(p_var1)

p_sigma2= np.sqrt(p_var2)

p_sigma3 = np.sqrt(p_var3)

p_sigma4 = np.sqrt(p_var4)

p_sigma5 = np.sqrt(p_var5)

return w[0],w[1],p_mean,p_sigma1,p_sigma2,p_sigma3,p_sigma4,p_sigma5

df_value =np.column_stack([portfolio_test(weight(2)) for i in range(10)]) #产生随机组合

df = pd.DataFrame(df_value.T,columns = ['A资产比例','B资产比例','r_期望收益','p_rho1','p_rho2','p_rho3','p_rho4','p_rho5'])

随机取了十组权重,计算组合收益和风险,其中A、B资产的权重之和为1,

组合收益为

组合风险为

计算之后结果如下图所示

给出的10组测试中,每组组合权重相同的情况下,预期收益是一样的,组合风险从1到5逐渐增加,即两资产的相关系数越高,风险越大,下图是十组收益在不同相关系数下的标准差值,可以清楚的看到-1最小而1最大

其实如果存在两个标的收益相关系数为-1,则组合收益理论上相互抵消了,所以在实际当中,能够寻找到低相关且都有正收益的标的就是极好的,分散化投资降低风险,其实就是在寻找相关度低的资产作为投资标的,在保证期望收益损失较小的情况下最大化的降低组合风险。

在这个例子中,我们取更多组的权重进行模拟,来观察下组合的期望收益和组合风险的变化情况

df_value1 =np.column_stack([portfolio_test(weight(2)) for i in range(200)]) #产生随机组合

df1= pd.DataFrame(df_value1.T,columns = ['A资产比例','B资产比例','p_mean','p_rho1','p_rho2','p_rho3','p_rho4','p_rho5'])

plt.scatter(df1['p_rho1'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho2'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho3'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho4'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho5'],df1['p_mean'],marker = 'o')

在不同的相关系数下,投资组合标准差随投资比例变动的情况呈现如上关系,横轴为组合标准差值,纵轴为组合期望收益值,除去最外面和最里边极端 -1的相关系数下的线性关系外,组合的预期收益和风险呈现的样子就是著名的Markowitz均值-方差模型里面的子弹图雏形了。

#选出几个标的数据,进行演示计算

#这里选取HS300里面近一年涨幅大于4%的5只股票

stock_list = get_index_stocks('000300.XSHG')

pool = []

for i in stock_list:

price_df = get_price(i,start_date='2017-9-1',end_date='2018-9-1',fields=['close'])

pct = price_df['close'].values[-1]/price_df['close'].values[0]

if pct>1.04:

pool.append(i)

if len(pool)==5:

break

pool

#数据准备

#计算股票池的涨跌幅、回报率

def get_return(pool):

prices = get_price(list(pool), end_date='2017-9-1', frequency='1d', fields=['close'],count=252).close

returns = (prices/prices.shift(1)).iloc[1:]

rets = returns.dropna(axis=1)

return rets

#随机权重设置

def weight(n):

w = np.random.random(n)

return w/sum(w)

#获取回报值

returns = get_return(pool)

#输入收益returns,权重

#返回年化收益、标准差、夏普率

def portfolio(returns,w):

#无风险收益年化设置为0.04

r_b = 0.04

returns = np.log(returns)

r_mean = returns.mean()*252

p_mean = np.sum(r_mean*w)

r_cov = returns.cov()*252

p_var = np.dot(w.T,np.dot(r_cov,w))

p_std = np.sqrt(p_var)

p_sharpe = (p_mean-r_b)/p_std

return p_mean,p_std,p_sharpe

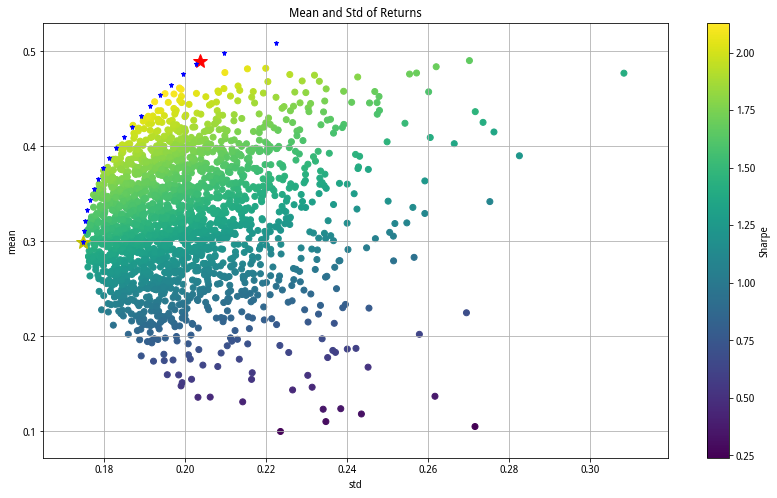

step4 蒙特卡洛模拟

p_mean,p_std,p_sharpe = np.column_stack([portfolio(returns,weight(5)) for i in range(2000)]) #产生随机组合

plt.figure(figsize = (14,8))

plt.scatter(p_std, p_mean, c=p_sharpe, marker = 'o')

plt.grid(True) #显示网格

plt.xlabel('std')

plt.ylabel('mean')

plt.colorbar(label = 'Sharpe')

plt.title('Mean and Std of Returns')

将随机权重的组合收益风险进行图形化展示

step5 找出风险最小的组合权重、找出夏普率最大的组合权重

from scipy.optimize import minimize

#最小方差函数

def min_variance(w):

return portfolio(returns,w)[1]**2

#最大夏普函数(转化为求最小值)

def min_sharpe(w):

return -portfolio(returns,w)[2]

#约束条件,权重总和为1

cons = ({'type':'eq', 'fun':lambda x: np.sum(x)-1})

#夏普率最大

opt_sharpe = minimize(min_sharpe,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons)

#方差最小

opt_var = minimize(min_variance,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons)

step6 找出有效前沿

#有效前沿

#最小方差下的收益率

r_min = portfolio(returns,opt_var['x'])[0]

r_mean_list = np.linspace(r_min,r_min*1.7,20)

v_list = []

for r in r_mean_list:

cons1 = ({'type':'eq','fun':lambda w:portfolio(returns,w)[0]-r},{'type':'eq','fun':lambda w:np.sum(w)-1})

opt_var_1 = minimize(min_variance,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons1)

#最小方差下的收益率

v_min = portfolio(returns,opt_var_1['x'])[1]

print v_min

v_list.append(v_min)

有这么一个策略,每月换仓HS300前5只涨幅超过4%的股票进行买入持仓,具体操作如下

代码较长可以在研究里面参考,组合模拟结果如下

#计算总收益率

total_return1,total_return2 = df_returns.cumprod().values[-1]-1,df_a.cumprod().values[-1]-1

#计算年化收益

total_a_r1,total_a_r2 = (1 total_return1)**(250.0/len(df_returns))-1,(1 total_return2)**(250.0/len(df_a))-1

#计算夏普率

sharpe1,sharpe2 = (total_a_r1-0.04)/np.std(df_returns.cumprod()),(total_a_r2-0.04)/np.std(df_a.cumprod())

df_summary = pd.DataFrame([],index=['均值方差优化组合','平均分仓组合'])

df_summary['总收益'] = [total_return1,total_return2]

df_summary['年化收益'] = [total_a_r1,total_a_r2]

df_summary['sharpe'] = [sharpe1,sharpe2]

df_summary

可以看到优化后的组合获得了更好的表现

import numpy as np

import pandas as pd

import math

import matplotlib.pyplot as plt

#模拟生成两个的权重

def weight(n):

w = np.random.random(n)

return w/sum(w)

#定义计算收益、风险、夏普率的函数

def portfolio_test(w):

r1,r2 = 0.08,0.12

sigma1,sigma2 = 0.12,0.25

rho1,rho2,rho3,rho4,rho5 = -1,-0.5,0,0.5,1

p_mean = r1*w[0]+r2*w[1]

p_var1 = (w[0]**2)*(sigma1**2)+(w[1]**2)*(sigma2**2)+2*w[0]*w[1]*rho1*sigma1*sigma2

p_var2 = (w[0]**2)*(sigma1**2)+(w[1]**2)*(sigma2**2)+2*w[0]*w[1]*rho2*sigma1*sigma2

p_var3 = (w[0]**2)*(sigma1**2)+(w[1]**2)*(sigma2**2)+2*w[0]*w[1]*rho3*sigma1*sigma2

p_var4 = (w[0]**2)*(sigma1**2)+(w[1]**2)*(sigma2**2)+2*w[0]*w[1]*rho4*sigma1*sigma2

p_var5 = (w[0]**2)*(sigma1**2)+(w[1]**2)*(sigma2**2)+2*w[0]*w[1]*rho5*sigma1*sigma2

p_sigma1 = np.sqrt(p_var1)

p_sigma2= np.sqrt(p_var2)

p_sigma3 = np.sqrt(p_var3)

p_sigma4 = np.sqrt(p_var4)

p_sigma5 = np.sqrt(p_var5)

return w[0],w[1],p_mean,p_sigma1,p_sigma2,p_sigma3,p_sigma4,p_sigma5

df_value =np.column_stack([portfolio_test(weight(2)) for i in range(10)]) #产生随机组合

df = pd.DataFrame(df_value.T,columns = ['A资产比例','B资产比例','r_期望收益','p_rho1','p_rho2','p_rho3','p_rho4','p_rho5'])

df

| A资产比例 | B资产比例 | p_mean | p_rho1 | p_rho2 | p_rho3 | p_rho4 | p_rho5 | |

|---|---|---|---|---|---|---|---|---|

| 0 | 0.698865 | 0.301135 | 0.092045 | 0.008580 | 0.079920 | 0.112698 | 0.137893 | 0.159148 |

| 1 | 0.668762 | 0.331238 | 0.093250 | 0.002558 | 0.081561 | 0.115316 | 0.141221 | 0.163061 |

| 2 | 0.416181 | 0.583819 | 0.103353 | 0.096013 | 0.128482 | 0.154263 | 0.176313 | 0.195896 |

| 3 | 0.828637 | 0.171363 | 0.086855 | 0.056596 | 0.086389 | 0.108273 | 0.126423 | 0.142277 |

| 4 | 0.525211 | 0.474789 | 0.098992 | 0.055672 | 0.102861 | 0.134392 | 0.159819 | 0.181723 |

| 5 | 0.220925 | 0.779075 | 0.111163 | 0.168258 | 0.182960 | 0.196565 | 0.209287 | 0.221280 |

| 6 | 0.559924 | 0.440076 | 0.097603 | 0.042828 | 0.096055 | 0.128914 | 0.154955 | 0.177210 |

| 7 | 0.654125 | 0.345875 | 0.093835 | 0.007974 | 0.082770 | 0.116783 | 0.142918 | 0.164964 |

| 8 | 0.235294 | 0.764706 | 0.110588 | 0.162941 | 0.178739 | 0.193250 | 0.206745 | 0.219412 |

| 9 | 0.584404 | 0.415596 | 0.096624 | 0.033770 | 0.091797 | 0.125351 | 0.151655 | 0.174027 |

df[['p_rho1','p_rho2','p_rho3','p_rho4','p_rho5']].plot()

<matplotlib.axes._subplots.AxesSubplot at 0x7f7a452da610>

给出的10组测试中,每组组合的预期收益是一样的,组合风险从1到4逐渐增加,两资产的相关系数越高,风险越大。

df_value1 =np.column_stack([portfolio_test(weight(2)) for i in range(200)]) #产生随机组合

df1= pd.DataFrame(df_value1.T,columns = ['A资产比例','B资产比例','p_mean','p_rho1','p_rho2','p_rho3','p_rho4','p_rho5'])

plt.scatter(df1['p_rho1'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho2'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho3'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho4'],df1['p_mean'],marker = 'o')

plt.scatter(df1['p_rho5'],df1['p_mean'],marker = 'o')

<matplotlib.collections.PathCollection at 0x7f7a98957990>

以上是不同的相关系数下,投资组合标准差随投资比例变动的情况

接下来是马科维兹均值方差模型

从上面部分我们看到,几种资产的相关度越低,他们的组合收益?

#选出几个标的数据,进行演示计算

#这里选取HS300里面近一年涨幅大于4%的5只股票

stock_list = get_index_stocks('000300.XSHG')

pool = []

for i in stock_list:

price_df = get_price(i,start_date='2017-9-1',end_date='2018-9-1',fields=['close'])

pct = price_df['close'].values[-1]/price_df['close'].values[0]

if pct>1.04:

pool.append(i)

if len(pool)==5:

break

pool

[u'000002.XSHE', u'000333.XSHE', u'000338.XSHE', u'000425.XSHE', u'000786.XSHE']

#数据准备

#计算股票池的涨跌幅、回报率

def get_return(pool):

prices = get_price(list(pool), end_date='2017-9-1', frequency='1d', fields=['close'],count=252).close

returns = (prices/prices.shift(1)).iloc[1:]

rets = returns.dropna(axis=1)

return rets

#随机权重设置

def weight(n):

w = np.random.random(n)

return w/sum(w)

#获取回报值

returns = get_return(pool)

1.计算取的是对数收益率,研究中收益率都是用对数收益率,理论上对数收益率才是正态分布 2.求组合的方差、组合的标准差。 求方差时是收益率序列的协方差矩阵加权出来,并年化(*252)的。

np.log(returns).mean()*252

000002.XSHE 0.106476 000333.XSHE 0.042645 000338.XSHE 0.208467 000425.XSHE 0.081795 000786.XSHE 0.103304 dtype: float64

#输入收益returns,权重

#返回年化收益、标准差、夏普率

def portfolio(returns,w):

#无风险收益年化设置为0.04

r_b = 0.04

returns = np.log(returns)

r_mean = returns.mean()*252

p_mean = np.sum(r_mean*w)

r_cov = returns.cov()*252

p_var = np.dot(w.T,np.dot(r_cov,w))

p_std = np.sqrt(p_var)

p_sharpe = (p_mean-r_b)/p_std

return p_mean,p_std,p_sharpe

p_mean,p_std,p_sharpe = np.column_stack([portfolio(returns,weight(5)) for i in range(2000)]) #产生随机组合

plt.figure(figsize = (14,8))

plt.scatter(p_std, p_mean, c=p_sharpe, marker = 'o')

plt.grid(True) #显示网格

plt.xlabel('std')

plt.ylabel('mean')

plt.colorbar(label = 'Sharpe')

plt.title('Mean and Std of Returns')

<matplotlib.text.Text at 0x7f7a940f2850>

找到方差最小的点

optimize.minimize(target_fun,init_val,method,jac,hess) target_fun:函数的表达式计算; init_val:初始值; method:最小化的算法; jac:雅各比矩阵 hess:黑塞矩阵。

from scipy.optimize import minimize

#最小方差函数

def min_variance(w):

return portfolio(returns,w)[1]**2

#最大夏普函数(转化为求最小值)

def min_sharpe(w):

return -portfolio(returns,w)[2]

#约束条件,权重总和为1

cons = ({'type':'eq', 'fun':lambda x: np.sum(x)-1})

#夏普率最大

opt_sharpe = minimize(min_sharpe,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons)

#方差最小

opt_var = minimize(min_variance,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons)

print("Sharpe最大时的组合最优解是:")

print "组合仓位比例:",'%s' % (opt_sharpe['x'].round(3))

print('组合收益:%s' % (portfolio(returns,opt_sharpe['x'].round(3))[0]))

print('组合标准差(波动率):%s' % (portfolio(returns,opt_sharpe['x'].round(3))[1]) )

print('组合sharpe:%s' % (portfolio(returns,opt_sharpe['x'].round(3))[2]) )

Sharpe最大时的组合最优解是: 组合仓位比例: [ 0. 0.383 0.471 0. 0.147] 组合收益:0.489976378043 组合标准差(波动率):0.204062548869 组合sharpe:2.20509045161

plt.figure(figsize = (14,8))

plt.scatter(p_std, p_mean, c=p_sharpe, marker = 'o')

#红星:标记最高sharpe组合

plt.plot(portfolio(returns,opt_sharpe['x'])[1],portfolio(returns,opt_sharpe['x'])[0], 'r*', markersize = 15.0)

#黄星:标记最小方差组合

plt.plot(portfolio(returns,opt_var['x'])[1], portfolio(returns,opt_var['x'])[0], 'y*', markersize = 15.0)

plt.grid(True) #显示网格

plt.xlabel('std')

plt.ylabel('mean')

plt.colorbar(label = 'Sharpe')

plt.title('Mean and Std of Returns')

<matplotlib.text.Text at 0x7f7a467ec210>

#有效前沿

#最小方差下的收益率

r_min = portfolio(returns,opt_var['x'])[0]

r_mean_list = np.linspace(r_min,r_min*1.7,20)

v_list = []

for r in r_mean_list:

cons1 = ({'type':'eq','fun':lambda w:portfolio(returns,w)[0]-r},{'type':'eq','fun':lambda w:np.sum(w)-1})

opt_var_1 = minimize(min_variance,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons1)

#最小方差下的收益率

v_min = portfolio(returns,opt_var_1['x'])[1]

print v_min

v_list.append(v_min)

0.175019898941 0.175114714577 0.175411195452 0.175913650611 0.176615582056 0.177519122871 0.178616014397 0.179908116449 0.181387427862 0.183051479008 0.184894460286 0.186910174387 0.18909558519 0.191441857239 0.193945694052 0.196649131372 0.199629477745 0.202879148981 0.209608338398 0.222411666394

plt.figure(figsize = (14,8))

plt.scatter(p_std, p_mean, c=p_sharpe, marker = 'o')

#红星:标记最高sharpe组合

plt.plot(portfolio(returns,opt_sharpe['x'])[1],portfolio(returns,opt_sharpe['x'])[0], 'r*', markersize = 15.0)

#黄星:标记最小方差组合

plt.plot(portfolio(returns,opt_var['x'])[1], portfolio(returns,opt_var['x'])[0], 'y*', markersize = 15.0)

#标记有效前沿

plt.plot(v_list,r_mean_list, 'b*', markersize = 5.0)

plt.grid(True) #显示网格

plt.xlabel('std')

plt.ylabel('mean')

plt.colorbar(label = 'Sharpe')

plt.title('Mean and Std of Returns')

<matplotlib.text.Text at 0x7f7a464d38d0>

#最小方差下的收益率

r_min = portfolio(returns,opt_var['x'])[0]

r_min

0.300883836813862

一个示例 1.取HS300前一年涨幅超过4%的5只股票 2.每月调仓,更换股票池 3.在同一个股票池下,A组合平均分仓,B组合取最大夏普权重 4.比较股票收益的波动情况和年化收益

#输入日期

#返回HS300中股票收益超过4%的前5只股票

def get_pool(date):

stock_list = get_index_stocks('000300.XSHG',date=date)

pool = []

for i in stock_list:

price_df = get_price(i,end_date=date,fields=['close'],count=252)

pct = price_df['close'].values[-1]/price_df['close'].values[0]

if pct>1.04:

pool.append(i)

if len(pool)==5:

break

return pool

#输入股票列表

#返回一个组合的权重配比

def opt_func(pool,date):

prices = get_price(list(pool), end_date=date, frequency='1d', fields=['close'],count=252).close

returns = (prices/prices.shift(1)).iloc[1:]

returns = returns.dropna(axis=1)

def portfolio(returns,w):

#无风险收益年化设置为0.04

r_b = 0.04

returns = np.log(returns)

r_mean = returns.mean()*252

p_mean = np.sum(r_mean*w)

r_cov = returns.cov()*252

p_var = np.dot(w.T,np.dot(r_cov,w))

p_std = np.sqrt(p_var)

p_sharpe = (p_mean-r_b)/p_std

return p_mean,p_std,p_sharpe

def weight(n):

w = np.random.random(n)

return w/sum(w)

#最大夏普函数(转化为求最小值)

def min_sharpe(w):

return -portfolio(returns,w)[2]

#约束条件,权重总和为1

cons = ({'type':'eq', 'fun':lambda x: np.sum(x)-1})

#夏普率最大

opt_sharpe = minimize(min_sharpe,weight(5),bounds=((0,1),(0,1),(0,1),(0,1),(0,1)),constraints = cons)

return opt_sharpe['x'].round(3)

date = '2018-1-1'

pool = get_pool(date)

res = opt_func(pool,date).round(3)

res

array([ 0.314, 0.204, 0.482, 0. , 0. ])

#工具函数

#获取日期列表

def get_tradeday_list(s='2017-1-1',e='2018-7-25',label='month',count=None):

if count != None:

df = get_price('000001.XSHG',end_date=e,count=count)

else:

df = get_price('000001.XSHG',start_date=s,end_date=e)

if label==None:

return df.index

else:

df['year-month'] = [str(i)[0:7] for i in df.index]

if label == 'month':

return df.drop_duplicates('year-month').index

elif label == 'quarter':

df['month'] = [str(i)[5:7] for i in df.index]

df = df[(df['month']=='01') | (df['month']=='04') | (df['month']=='07') | (df['month']=='10') ]

return df.drop_duplicates('year-month').index

elif label =='halfyear':

df['month'] = [str(i)[5:7] for i in df.index]

df = df[(df['month']=='01') | (df['month']=='06')]

return df.drop_duplicates('year-month').index

#获取股票池的组合收益(不进行市值加权)

def ret_se(sl,start_date='2018-6-1',end_date='2018-7-1',w=[1.0/len(sl)]*len(sl)):

if len(sl) != 0:

#得到股票的历史价格数据

df = get_price(list(sl),start_date=start_date,end_date=end_date,fields=['close']).close

df = df.dropna(axis=1)

#获取列表中的股票流通市值对数值

df_mkt = get_fundamentals(query(valuation.code,valuation.circulating_market_cap).filter(valuation.code.in_(df.columns)))

df_mkt.index = df_mkt['code'].values

fact_se =pd.Series(df_mkt['circulating_market_cap'].values,index = df_mkt['code'].values)

fact_se = np.log(fact_se)

else:

df = get_price('000001.XSHG',start_date=start_date,end_date=end_date,fields=['close'])

df['v'] = [1]*len(df)

del df['close']

#相当于昨天的百分比变化

pct = df.pct_change()+1

pct.iloc[0,:] = 1

#df1 = pct.cumprod()

#等权重平均收益结果

#按权重的方式计算

se1 = (pct*w).cumsum(axis=1).iloc[:,-1]

se2 = pct.cumsum(axis=1).iloc[:,-1]/pct.shape[1]

return se1,se2

def f_sum(x):

return sum(x)

#设置回测时间

start,end = '2016-9-1','2018-9-1'

#获取交易日列表

trade_list = get_tradeday_list(start,end,'month')

num = 1

for s,e in zip(trade_list[:-1],trade_list[1:]):

#获取满足条件的股票列表

pool = get_pool(s)

#获取优化权重

w = opt_func(pool,s)

if num == 0:

df_returns1 = ret_se(pool,s,e,w)[0]

df_a1 = ret_se(pool,s,e,w)[1]

df_returns = pd.concat([df_returns,df_returns1])

df_a = pd.concat([df_a,df_a1])

else:

df_returns = ret_se(pool,s,e,w)[0]

df_a = ret_se(pool,s,e,w)[1]

num = 0

#进行图表展示

df_returns.cumprod().plot(figsize=(12,7),legend=True,label='组合优化收益',title='图2 组合收益走势')

df_a.cumprod().plot(figsize=(12,7),legend=True,label='平均分仓收益')

<matplotlib.axes._subplots.AxesSubplot at 0x7f7a45724f90>

#计算总收益率

total_return1,total_return2 = df_returns.cumprod().values[-1]-1,df_a.cumprod().values[-1]-1

#计算年化收益

total_a_r1,total_a_r2 = (1+total_return1)**(250.0/len(df_returns))-1,(1+total_return2)**(250.0/len(df_a))-1

#计算夏普率

sharpe1,sharpe2 = (total_a_r1-0.04)/np.std(df_returns.cumprod()),(total_a_r2-0.04)/np.std(df_a.cumprod())

df_summary = pd.DataFrame([],index=['均值方差优化组合','平均分仓组合'])

df_summary['总收益'] = [total_return1,total_return2]

df_summary['年化收益'] = [total_a_r1,total_a_r2]

df_summary['sharpe'] = [sharpe1,sharpe2]

df_summary

| 总收益 | 年化收益 | sharpe | |

|---|---|---|---|

| 均值方差优化组合 | 0.106654 | 0.053288 | 0.056197 |

| 平均分仓组合 | -0.175383 | -0.094066 | -0.969469 |

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...

移动端课程