最近好久没发文章了,猫在家里研究宏观经济数据怎样预测股市走势。经过反复研究,终于有一个不错的结果。赶紧拿出来分享给小伙伴。讲真,看到结果的时候我是震惊的,只用了宏观数据,没有使用任何其他复合策略,结果竟能有这么高的准确率。

本文的策略可以用于宏观择时,配合行业分析和个股分析,定能有不错的结果。

本文代码大概600行左右,尽量呈现完整简练的策略开发代码框架,另有中间的数据分析和可视化部分删掉了,在其他类似策略研究时只要改一下数据和参数代码就可以直接使用,省时高效。

以下为策略介绍:

量化分析工作从大的方面可以分三部分:宏观、中观和微观。

宏观:通过研究宏观经济数据来分析、判断未来经济走势。

中观:依据行业数据,对行业趋势、轮动等进行分析。

微观:依据公司基本面数据,进行选股。

经济走势很大程度上会反应到股市当中,经济形式向好则股市为牛市的概率大。当经济基本面较弱,下行压力大,则股市冷淡。例如,2018年整体经济下行,股市下跌幅度较大,股市走势和宏观经济走势呈现强相关。在投资决策时,宏观经济预测将是最为重要的参考,在此基础上再做行业和企业层面的分析。

本文选用沪深300为标的,用以衡量大盘走势,依据宏观数据分析,预测未来走势。

采用的预测方法:经过机器学习算法和神经网络算法尝试,最后发现LSTM算法预测效果最好。

训练数据:采用2005年到2016年共11年数据作为训练数据。

预测范围:2016年至2019年,共3年。

预测周期:3个月,即用当前宏观数据预测未来3个月大盘走势。

LSTM数据周期:5,即用过去5期的数据作为输入数据。也就是说,认为过去5个月的宏观数据对未来预测有影响。

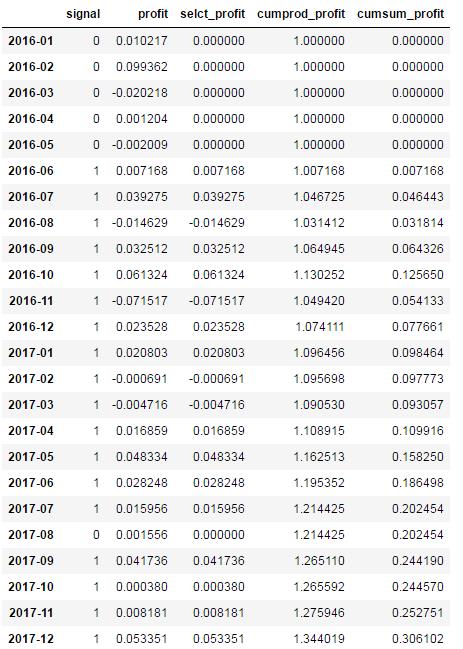

预测结果:

上图为基于预测结果进行买卖决策的收益,下图为沪深300走势图,从两图的对比中可以明显看出,在上升趋势时基本做了买入决定,在下降趋势时选择空仓。时机把握非常准确,回撤很小,曲线基本是一路上升。

预测数据:

在对预测结果分析时发现,如果有做空机制,策略收益会更高,因为在下跌预测中也有不错的效果。A股正在慢慢放开做空,以后将会有正反两个盈利方向,策略效率翻倍。

不足之处:

本文代码使用数据量较大,算法耗时时间长,我的结果是在自己机器上跑的,在云端跑数据耗时太久,我就不跑了,大家可以复制代码到自己机器上跑,如果有问题欢迎交流。

由于聚宽云端策略模块尚不支持tensorflow和lightGBM等库,所以没法写成策略,只能以研究的方式分享,聚宽现在有客户端了,可以自己安装各种库,很好用,我在客户端写成策略,效果基本一致。

本策略只考虑了一个因素,不可能解释股市的复杂,需要结合其他策略配合使用。

import pandas as pd

import numpy as np

import datetime

from sklearn.svm import SVC,LinearSVC

from sklearn.ensemble import RandomForestClassifier,AdaBoostClassifier

from sklearn.tree import DecisionTreeClassifier

import lightgbm as lgb

from sklearn.model_selection import train_test_split,GridSearchCV

import tensorflow as tf

import warnings

warnings.filterwarnings('ignore')

from sklearn.metrics import accuracy_score,recall_score

from sklearn.feature_selection import SelectKBest,SelectPercentile,SelectFromModel,chi2,f_classif,mutual_info_classif,RFE

from scipy.stats import pearsonr

from sklearn.ensemble import RandomForestRegressor,RandomForestClassifier

from sklearn.svm import SVC,LinearSVC,LinearSVR,SVR

from sklearn.tree import DecisionTreeClassifier

from sklearn.model_selection import train_test_split

import gc

import pickle

import matplotlib.pyplot as plt

import time

from jqdata import *

start_date = '2005-01-01'

end_date = '2015-12-31'

test_start_date = '2016-01-01'

test_end_date = '2018-11-30'

start_year = start_date[:4]

end_year = end_date[:4]

select_index = '000300.XSHG'

n = 3 #data_y延期n月

stat_quarter = '2015-03'

stat_month = '2015-02'

seq_len = 5 #lstm back num

def get_year_list(start_year,end_year):

sy = int(start_year)

ey = int(end_year)

l = []

for i in range(sy,ey+1):

l.append(str(i))

return l

def get_quarter_list(start_year,end_year):

sy = int(start_year)

ey = int(end_year)

l = []

for y in range(sy,ey+1):

for q in range(3,13,3):

if q < 10:

s = str(y) + '-' + '0' + str(q)

l.append(s)

else:

s = str(y) + '-' + str(q)

l.append(s)

return l

def get_month_list(start_date,end_date):

sy = int(start_date[:4])

ey = int(end_date[:4])

sm = int(start_date[5:7])

em = int(end_date[5:7])

l = []

for y in range(sy,ey+1):

if y == sy:

for i in range(sm,13):

if i< 10:

s = str(y) + '-' + '0' + str(i)

l.append(s)

else:

s = str(y) + '-' + str(i)

l.append(s)

elif y == ey:

for i in range(1,em+1):

if i < 10:

s = str(y) + '-' + '0' + str(i)

l.append(s)

else:

s = str(y) + '-' + str(i)

l.append(s)

else:

for i in range(1,13):

if i < 10:

s = str(y) + '-' + '0' + str(i)

l.append(s)

else:

s = str(y) + '-' + str(i)

l.append(s)

return l

##获取宏观数据

def get_macro_data(month_list,start_date,end_date):

#社会消费品销售总额

sr = macro.MAC_SALE_RETAIL_MONTH

q = query(sr.stat_month,sr.retail_sin,sr.retail_sin_yoy,sr.retail_acc_yoy)\

.filter(macro.MAC_SALE_RETAIL_MONTH.stat_month.in_(month_list))\

.order_by(macro.MAC_SALE_RETAIL_MONTH.stat_month)

sale = macro.run_query(q).dropna(axis=1,how='all').fillna(method='ffill')

q_a = query(sr).filter(macro.MAC_SALE_RETAIL_MONTH.stat_month.in_(month_list))\

.order_by(macro.MAC_SALE_RETAIL_MONTH.stat_month)

sale_a = macro.run_query(q_a).dropna(axis=1,how='all').fillna(method='ffill').fillna(method='bfill')

#房地产开发投资情况表

ie = macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH

q_estate = query(macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.stat_month,macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.invest,\

macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.invest_yoy)\

.filter(macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.stat_month.in_(month_list))\

.order_by(macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.stat_month)

estate = macro.run_query(q_estate)

q_estate_a = query(ie).filter(macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.stat_month.in_(month_list)).order_by(macro.MAC_INDUSTRY_ESTATE_INVEST_MONTH.stat_month)

estate_a = macro.run_query(q_estate_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#70个大中城市房屋销售价格指数(月度)

q_70city_eatate = query(macro.MAC_INDUSTRY_ESTATE_70CITY_INDEX_MONTH.stat_month,macro.MAC_INDUSTRY_ESTATE_70CITY_INDEX_MONTH.commodity_house_idx)\

.filter(macro.MAC_INDUSTRY_ESTATE_70CITY_INDEX_MONTH.stat_month.in_(month_list)).order_by(macro.MAC_INDUSTRY_ESTATE_70CITY_INDEX_MONTH.stat_month)

city_eatate_all = macro.run_query(q_70city_eatate).fillna(method='ffill')

city_eatate = city_eatate_all.groupby(['stat_month']).mean()

#黄金和外汇储备

#数据从2008年开始

gf = macro.MAC_GOLD_FOREIGN_RESERVE

q_gold_foreign = query(gf.stat_date,gf.gold,gf.foreign).filter(gf.stat_date.in_(month_list)).order_by(gf.stat_date)

gold_foreign_0 = macro.run_query(q_gold_foreign)

gold_foreign_0['stat_month'] = gold_foreign_0['stat_date']

gold_foreign = gold_foreign_0.drop(['stat_date'],axis=1)

q_gold_foreign_a = query(gf).filter(gf.stat_date.in_(month_list)).order_by(gf.stat_date)

gold_foreign_1 = macro.run_query(q_gold_foreign_a)

gold_foreign_1['stat_month'] = gold_foreign_1['stat_date']

gold_foreign_a = gold_foreign_1.drop(['stat_date'],axis=1).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#固定资产投资

fi = macro.MAC_FIXED_INVESTMENT

q_fixed_inv = query(fi.stat_month,fi.fixed_assets_investment_yoy,fi.primary_yoy,fi.secondary_yoy,fi.tertiary_yoy,fi.centre_project_yoy)\

.filter(fi.stat_month.in_(month_list)).order_by(fi.stat_month)

fixed_inv = macro.run_query(q_fixed_inv).fillna(method='ffill')

q_fixed_inv_a = query(fi).filter(fi.stat_month.in_(month_list)).order_by(fi.stat_month)

fixed_inv_a = macro.run_query(q_fixed_inv_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#利用外资情况表

fc = macro.MAC_FOREIGN_CAPITAL_MONTH

q_foreign_cap = query(fc.stat_month,fc.num_acc_yoy).filter(fc.stat_month.in_(month_list)).order_by(fc.stat_month)

foreign_cap = macro.run_query(q_foreign_cap).fillna(method='ffill')

q_foreign_cap_a = query(fc).filter(fc.stat_month.in_(month_list)).order_by(fc.stat_month)

foreign_cap_a = macro.run_query(q_foreign_cap_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#宏观经济景气指数

eb = macro.MAC_ECONOMIC_BOOM_IDX

q_eco_boom = query(eb.stat_month,eb.early_warning_idx,eb.consistency_idx,eb.early_warning_idx,eb.lagging_idx)\

.filter(eb.stat_month.in_(month_list)).order_by(eb.stat_month)

economic_boom = macro.run_query(q_eco_boom)

q_eco_boom_a = query(eb).filter(eb.stat_month.in_(month_list)).order_by(eb.stat_month)

economic_boom_a = macro.run_query(q_eco_boom_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#制造业采购经理指数(PMI)

mf = macro.MAC_MANUFACTURING_PMI

q_pmi = query(mf.stat_month,mf.pmi).filter(mf.stat_month.in_(month_list)).order_by(mf.stat_month)

pmi = macro.run_query(q_pmi)

pmi_m = pmi['pmi'] - 50 #该指数以50为中心,大于表示制造业扩张,反之表示衰退

pmi['pmi'] = pmi_m

q_pmi_a = query(mf).filter(mf.stat_month.in_(month_list)).order_by(mf.stat_month)

pmi_a = macro.run_query(q_pmi_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#全国工业增长速度

ig = macro.MAC_INDUSTRY_GROWTH

q_industry_growth = query(ig.stat_month,ig.growth_yoy,ig.growth_acc).filter(ig.stat_month.in_(month_list)).order_by(ig.stat_month)

industry_growth = macro.run_query(q_industry_growth).fillna(method='ffill')

industry_growth_diff = industry_growth['growth_acc'].diff().fillna(0)

industry_growth['growth_acc_diff'] = industry_growth_diff

q_industry_growth_a = query(ig).filter(ig.stat_month.in_(month_list)).order_by(ig.stat_month)

industry_growth_a = macro.run_query(q_industry_growth_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#全国工业企业主要经济指标

ii = macro.MAC_INDUSTRY_INDICATOR

q_industry_indicator = query(ii.stat_month,ii.enterprise_value_acc,ii.loss_enterprise_ratio_acc,\

ii.total_interest_ratio_acc).filter(ii.stat_month.in_(month_list)).order_by(ii.stat_month)

industry_indicator = macro.run_query(q_industry_indicator)

industry_indicator_diff = industry_indicator['enterprise_value_acc'].diff().fillna(method='bfill')

industry_indicator['enterprise_value_acc_diff'] = industry_indicator_diff/industry_indicator['enterprise_value_acc'].shift().fillna(method='bfill')

industry_indicator['loss_enterprise_ratio_acc_diff'] = industry_indicator['loss_enterprise_ratio_acc'].diff()

industry_indicator['total_interest_ratio_acc_diff'] = industry_indicator['total_interest_ratio_acc'].diff()

industry_indicator = industry_indicator.fillna(method='bfill')

l = ['stat_month','enterprise_value_acc_diff','loss_enterprise_ratio_acc_diff','total_interest_ratio_acc_diff']

industry_indicator = industry_indicator[l]

q_industry_indicator_a = query(ii).filter(ii.stat_month.in_(month_list)).order_by(ii.stat_month)

industry_indicator_a = macro.run_query(q_industry_indicator_a).dropna(how='all',axis=1).fillna(method='ffill').fillna(method='bfill')

#月度宏观经济指标

month_macro_indicators = [sale,estate,fixed_inv,foreign_cap,economic_boom,pmi,industry_growth,industry_indicator]

mg = sale['stat_month'].to_frame()

for ind in month_macro_indicators:

mg = pd.merge(mg,ind,left_on=['stat_month'],right_on=['stat_month'],how='left')

res = mg.fillna(method='ffill').fillna(method='bfill')

month_macro_indicators_a = [sale_a,estate_a,fixed_inv_a,foreign_cap_a,economic_boom_a,\

pmi_a,industry_growth_a,industry_indicator_a]

for ind in month_macro_indicators_a:

mg_a = pd.merge(mg,ind,left_on=['stat_month'],right_on=['stat_month'],how='left')

res_a = mg_a.fillna(method='ffill').fillna(method='bfill')

price = get_price(select_index,start_date=start_date,end_date=end_date,fields=['close'])

data = [res,res_a,price]

return data

#获取月度价格数据

def get_price_month_data(price,n='mean',mean_num=1):

'''

:param price: 输入价格数据,index为datetime类型

:param type: 计算方式,’mean‘取月平均值,若为int,则从第几个交易日开始计算均值,长度为mean_num,

:param mean_num: 计算均值的长度

:return:

'''

ind = list(price.index)

s_ind = [datetime.datetime.strftime(i, '%Y%m%d') for i in ind]

price.index = s_ind

num_ind = [int(i) for i in s_ind]

cut_ind = [int(i / 100) for i in num_ind]

cut_s_ind = [(str(i)[:4] + '-' + str(i)[4:]) for i in cut_ind]

price['stat_date'] = cut_s_ind

if n == 'mean':

res = price.groupby(by=['stat_date']).mean()

else:

ind_sig = list(set(price['stat_date'].values))

index_list = []

mean_list = []

for ind in ind_sig:

df = price[price['stat_date']==ind]

sel_df = df.iloc[n-1:n+mean_num-1,0]

index = list(sel_df.index)

if len(index) == 0:

continue

index = index[0]

index_list.append(index)

mean_df = sel_df.mean()

mean_list.append(mean_df)

res_df = pd.DataFrame(mean_list,index=index_list,columns=['month_price'])

res = res_df.sort_index()

res_index = list(res.index)

ind_s_cut = [i[:4] + '-' + i[4:6] for i in res_index]

res.index = ind_s_cut

return res

def get_pure_values(data):

'''

获取纯净数值,将DataFrame中的非数值项剔除,例如‘code’项(str)

input:

data:pd.DataFrame,index为股票代码

putput:

DataFrame:只含数值项

'''

columns = list(data.columns)

for column in columns:

if not(isinstance(data[column][0],int) or isinstance(data[column][0],float)):

data = data.drop([column],axis=1)

return data

def winsorize_and_standarlize(data, qrange=[0.05, 0.95], axis=0):

if isinstance(data, pd.DataFrame):

if axis == 0:

q_down = data.quantile(qrange[0])

q_up = data.quantile(qrange[1])

col = data.columns

for n in col:

data[n][data[n] > q_up[n]] = q_up[n]

data[n][data[n] < q_down[n]] = q_down[n]

data = (data - data.mean()) / data.std()

data = data.fillna(0)

else:

data = data.stack()

data = data.unstack(0)

q_down = data.quantile(qrange[0])

q_up = data.quantile(qrange[1])

col = data.columns

for n in col:

data[n][data[n] > q_up[n]] = q_up[n]

data[n][data[n] < q_down[n]] = q_down[n]

data = (data - data.mean()) / data.std()

data = data.stack().unstack(0)

data = data.fillna(0)

elif isinstance(data, pd.Series):

q_down = data.quantile(qrange[0])

q_up = data.quantile(qrange[1])

data[data > q_up] = q_up

data[data < q_down] = q_down

data = (data - data.mean()) / data.std()

return data

def get_profit_class(data):

'''

对数据进行分类标记

'''

data_diff = data.diff(n)

data_diff[data_diff > 0] = 1

data_diff[data_diff < 0] = 0

#data_diff[data_diff == 2] = -1

#data_diff[data_diff == -2] = 1

return data_diff

def get_final_data(input_x,input_y):

input_y = input_y.shift(-n).to_frame().fillna(method='ffill')

data_m = pd.merge(input_x,input_y,left_index=True,right_index=True,how='right')

columns_m = data_m.columns

data_x = data_m[columns_m[:-1]]

data_y = data_m[columns_m[-1]]

return data_x,data_y

class FeatureSelection():

'''

特征选择:

identify_collinear:基于相关系数,删除小于correlation_threshold的特征

identify_importance_lgbm:基于LightGBM算法,得到feature_importance,选择和大于p_importance的特征

filter_select:单变量选择,指定k,selectKBest基于method提供的算法选择前k个特征,selectPercentile选择前p百分百的特征

wrapper_select:RFE,基于estimator递归特征消除,保留n_feature_to_select个特征

'''

def __init__(self):

self.filter_supports = None #bool型,特征是否被选中

self.wrapper_supports = None

self.embedded_supports = None

self.lgbm_columns = None #选择的特征

self.filter_columns = None

self.wrapper_columns = None

self.embedded_columns = None

self.record_collinear = None #自相关矩阵大于门限值

def identify_collinear(self, data, correlation_threshold):

columns = data.columns

self.correlation_threshold = correlation_threshold

# Calculate the correlations between every column

corr_matrix = data.corr()

self.corr_matrix = corr_matrix

# Extract the upper triangle of the correlation matrix

upper = corr_matrix.where(np.triu(np.ones(corr_matrix.shape), k = 1).astype(np.bool))

# Select the features with correlations above the threshold

# Need to use the absolute value

to_drop = [column for column in upper.columns if any(upper[column].abs() > correlation_threshold)]

obtain_columns = [column for column in columns if column not in to_drop]

self.columns = obtain_columns

# Dataframe to hold correlated pairs

record_collinear = pd.DataFrame(columns = ['drop_feature', 'corr_feature', 'corr_value'])

# Iterate through the columns to drop

for column in to_drop:

# Find the correlated features

corr_features = list(upper.index[upper[column].abs() > correlation_threshold])

# Find the correlated values

corr_values = list(upper[column][upper[column].abs() > correlation_threshold])

drop_features = [column for _ in range(len(corr_features))]

# Record the information (need a temp df for now)

temp_df = pd.DataFrame.from_dict({'drop_feature': drop_features,

'corr_feature': corr_features,

'corr_value': corr_values})

# Add to dataframe

record_collinear = record_collinear.append(temp_df, ignore_index = True)

self.record_collinear = record_collinear

return data[obtain_columns]

def identify_importance_lgbm(self, features, labels,p_importance=0.8, eval_metric='auc', task='classification',

n_iterations=10, early_stopping = True):

# One hot encoding

data = features

features = pd.get_dummies(features)

# Extract feature names

feature_names = list(features.columns)

# Convert to np array

features = np.array(features)

labels = np.array(labels).reshape((-1, ))

# Empty array for feature importances

feature_importance_values = np.zeros(len(feature_names))

#print('Training Gradient Boosting Model\n')

# Iterate through each fold

for _ in range(n_iterations):

if task == 'classification':

model = lgb.LGBMClassifier(n_estimators=100, learning_rate = 0.05, verbose = -1)

elif task == 'regression':

model = lgb.LGBMRegressor(n_estimators=100, learning_rate = 0.05, verbose = -1)

else:

raise ValueError('Task must be either "classification" or "regression"')

# If training using early stopping need a validation set

if early_stopping:

train_features, valid_features, train_labels, valid_labels = train_test_split(features, labels, test_size = 0.15)

# Train the model with early stopping

model.fit(train_features, train_labels, eval_metric = eval_metric,

eval_set = [(valid_features, valid_labels)],

verbose = -1)

# Clean up memory

gc.enable()

del train_features, train_labels, valid_features, valid_labels

gc.collect()

else:

model.fit(features, labels)

# Record the feature importances

feature_importance_values += model.feature_importances_ / n_iterations

feature_importances = pd.DataFrame({'feature': feature_names, 'importance': feature_importance_values})

# Sort features according to importance

feature_importances = feature_importances.sort_values('importance', ascending = False).reset_index(drop = True)

# Normalize the feature importances to add up to one

feature_importances['normalized_importance'] = feature_importances['importance'] / feature_importances['importance'].sum()

feature_importances['cumulative_importance'] = np.cumsum(feature_importances['normalized_importance'])

select_df = feature_importances[feature_importances['cumulative_importance']<=p_importance]

select_columns = select_df['feature']

self.lgbm_columns = list(select_columns.values)

res = data[self.columns]

return res

def filter_select(self, data_x, data_y, k=None, p=50,method=f_classif):

columns = data_x.columns

if k != None:

model = SelectKBest(method,k)

res = model.fit_transform(data_x,data_y)

supports = model.get_support()

else:

model = SelectPercentile(method,p)

res = model.fit_transform(data_x,data_y)

supports = model.get_support()

self.filter_support_ = supports

self.filter_columns = columns[supports]

return res

def wrapper_select(self,data_x,data_y,n,estimator):

columns = data_x.columns

model = RFE(estimator=estimator,n_features_to_select=n)

res = model.fit_transform(data_x,data_y)

supports = model.get_support() #标识被选择的特征在原数据中的位置

self.wrapper_supports = supports

self.wrapper_columns = columns[supports]

return res

def embedded_select(self,data_x,data_y,estimator,threshold=None):

columns = data_x.columns

model = SelectFromModel(estimator=estimator,prefit=False,threshold=threshold)

res = model.fit_transform(data_x,data_y)

supports = model.get_support()

self.embedded_supports = supports

self.embedded_columns = columns[supports]

return res

#调参时计算召回率和准确率

def lstm_recall(prediction,y,n=1,thr=0.5):

len_p = len(prediction)

l = 0

z = 0

res = []

if n == 1:

for i in range(len_p):

if (prediction[i]>= thr):

l = l+1

if (y[i] ==1):

z = z+1

elif n==0:

for i in range(len_p):

if (prediction[i]<=thr):

l = l+1

if (y[i] ==0):

z = z+1

lstm_recall = z/l

return lstm_recall

def lstm_accuracy(prediction,y,thr=0.5):

len_p = len(prediction)

l = 0

for i in range(len_p):

if ((prediction[i]>=thr) & (y[i] ==1)) | ((prediction[i]<thr) & (y[i] ==0)):

l = l + 1

accuracy = l/len_p

return accuracy

def res_output(res,buy_thr=1.6,sell_thr=0.5):

'''

基于lgbm和embedded两组特征选择数据的计算结果确定预测结果

buy_thr:预测股价上升的门限值,默认1.5,

sell_thr:预测股价下降的门限值,默认0.5

大于买入门限标记为1,小于卖出门限标记为-1,中间值认为买入卖出信号不强,选择观望或空仓,卖出信号可用于做空,在无法做空时认为空仓

'''

length = len(res)

l = []

for i in range(length):

if res[i] > buy_thr:

l.append(1)

elif res[i] < sell_thr:

l.append(-1)

else:

l.append(0)

return l

def LSTM_fun(n_input,train_x,train_y,predict_x,seq_len=5):

#LSTM

lr=0.1

lstm_size = 3 #lstm cell数量,基于数据量调整

epoch_num = 10 #打印次数,和n_batch相乘便是迭代次数

n_batch = 300

lookback = seq_len

tf.reset_default_graph()

x = tf.placeholder(tf.float32,[None,lookback,n_input])

y = tf.placeholder(tf.float32,[None,1])

weights = tf.Variable(tf.truncated_normal([lstm_size,1],stddev=0.1))

biases = tf.Variable(tf.constant(0.1,shape=[1]))

def LSTM_net(x,weights,biases):

lstm_cell = tf.contrib.rnn.LSTMCell(lstm_size,name='basic_lstm_cell') #.BasicLSTMCell(lstm_size)

output,final_state = tf.nn.dynamic_rnn(lstm_cell,x,dtype=tf.float32)

results = tf.nn.sigmoid(tf.matmul(final_state[1],weights)+biases)

return results

prediction = LSTM_net(x,weights,biases)

loss = tf.reduce_mean(tf.square(y - prediction))

train_step = tf.train.GradientDescentOptimizer(lr).minimize(loss)

init = tf.global_variables_initializer()

with tf.Session() as sess:

sess.run(init)

for i in range(epoch_num):

for j in range(n_batch):

sess.run(train_step,feed_dict={x:train_x,y:train_y})

#train_loss = sess.run(loss,feed_dict={x:train_x,y:train_y})

# print('train loss is'+ str(train_loss))

prediction_res = sess.run(prediction,feed_dict={x:predict_x})

return prediction_res

def get_test_time_list(start_date,test_start_date,test_end_date):

'''

使用机器学习算法计算时的时间数据

input:

start_date:取宏观数据的开始时间

test_start_date:预测的开始时间,也就是取宏观数据的截止时间

test_end_date:预测的截止时间,对期间的每一个月都要预测,每一个月都要重跑一遍预测函数,每个月的开始使用上个月28号的价格数据作为截止价格时间

output:

m_l:每一次预测时的月份列表,在此列表内跑预测函数,

start_date,取宏观数据和价格数据的开始时间,由全局变量定义

ed:取价格数据截止时间列表,顺序和m_l对应

'''

test_month = get_month_list(test_start_date,test_end_date)

m_l_pre = []

ed = []

for m in test_month:

ml = get_month_list(start_date,m)

m_l_pre.append(ml)

if m == test_month[-1]:

ed.append(test_end_date)

else:

ed.append(m+'-'+'28')

return m_l_pre,start_date,ed

ml,sd,ed = get_test_time_list(start_date,test_start_date,test_end_date)

def monthly_fun(month_list, start_date, end_date):

macro_data_o = get_macro_data(month_list,start_date, end_date)

res = macro_data_o[0]

res_a = macro_data_o[1]

price = macro_data_o[2]

price_month = get_price_month_data(price)

res.index = res['stat_month']

res_a.index = res['stat_month']

sel_data = pd.merge(res_a, price_month, left_index=True, right_index=True).dropna() # 使用全部宏观数据

data_pure = get_pure_values(sel_data)

columns = data_pure.columns

data_x_start = data_pure[columns[:-1]]

data_y_o = data_pure[columns[-1]]

data_x_o = winsorize_and_standarlize(data_x_start)

data_y_class_o = get_profit_class(data_y_o)

data_x, data_y_class = get_final_data(data_x_o, data_y_class_o)

_, data_y = get_final_data(data_x_o, data_y_o)

# 特征选择

f = FeatureSelection()

n_collinear = f.identify_collinear(data_x, correlation_threshold=0.8) #去除一些共线性特征

lgbm_res = f.identify_importance_lgbm(n_collinear, data_y_class, p_importance=0.9)

estimator = LinearSVC()

wrapper_res = f.wrapper_select(data_x=n_collinear, data_y=data_y_class, n=5, estimator=estimator)

est = LinearSVC(C=0.01, penalty='l1', dual=False)

est1 = RandomForestClassifier()

embedded_res = f.embedded_select(data_x=n_collinear, data_y=data_y_class, estimator=est1)

# LSTM数据准备

lgbm_n_input = len(lgbm_res.columns)

lgbm_x_a = np.array(lgbm_res)

lgbm_x_o = [lgbm_x_a[i: i + seq_len, :] for i in range(lgbm_res.shape[0] - seq_len)]

lgbm_x_l = len(lgbm_x_o)

lgbm_x_array = np.reshape(lgbm_x_o, [lgbm_x_l, seq_len, lgbm_n_input])

lgbm_x = lgbm_x_array[:-n]

lgbm_x_prediction = lgbm_x_array[-n:]

lgbm_y_o = np.array([data_y_class[i + seq_len] for i in range(len(data_y_class) - seq_len)])

lgbm_y_array = np.reshape(lgbm_y_o, [lgbm_y_o.shape[0], 1])

lgbm_y = lgbm_y_array[:-n]

lgbm_y_prediction = lgbm_y_array[-n:]

# print(len(lgbm_y))

embedded_n_input = np.shape(embedded_res)[1]

embedded_x_a = np.array(embedded_res)

embedded_x_o = [embedded_x_a[i: i + seq_len, :] for i in range(embedded_res.shape[0] - seq_len)]

embedded_x_l = len(embedded_x_o)

embedded_x_array = np.reshape(embedded_x_o, [embedded_x_l, seq_len, embedded_n_input])

embedded_x = embedded_x_array[:-n]

embedded_x_predition = embedded_x_array[-n:]

embedded_y_o = np.array([data_y_class[i + seq_len] for i in range(len(data_y_class) - seq_len)])

embedded_y_array = np.reshape(embedded_y_o, [embedded_y_o.shape[0], 1])

embedded_y = embedded_y_array[:-n]

# 获取训练数据和测试数据

# lgbm_train_x,lgbm_test_x,lgbm_train_y,lgbm_test_y = train_test_split(lgbm_x,lgbm_y,test_size=0.3,random_state=0)

# embedded_train_x,embedded_test_x,embedded_train_y,embedded_test_y = train_test_split(embedded_x,embedded_y,test_size=0.3,random_state=0)

lgbm_pre_res = LSTM_fun(lgbm_n_input, lgbm_x, lgbm_y, lgbm_x_prediction, seq_len=seq_len)

embedded_pre_res = LSTM_fun(embedded_n_input, embedded_x, embedded_y, embedded_x_predition, seq_len=seq_len)

# print(lgbm_pre_res)

# print(embedded_pre_res)

pre_res = lgbm_pre_res + embedded_pre_res # 将两组数据的的预测结果相加

signal = res_output(pre_res)

# print(signal)

return signal

def get_pre_signal(ml,sd,ed):

'''

在时间序列下计算最后三个月的预测值,以此作为决策信号

'''

start_clock = time.clock()

length = len(ml)

l = []

for i in range(length):

month_l = ml[i]

end_d = ed[i]

pre = monthly_fun(month_l,sd,end_d)

l.append(pre)

end_clock = time.clock()

clofk_diff = (end_clock - start_clock)/60

print('time cost:%0.3f'%clofk_diff)

return l

pre_res_l = get_pre_signal(ml,sd,ed)

#只适应与n=3的情况

def get_buy_sell_signal(pre_res):

'''

由于预测的是未来三个月(n=3)的的情况,预测有重合部分,将重合部分取平均,基于均值做买卖决策,提高精度

此函数只适应与n=3的情况

'''

length = len(pre_res)

l = []

for i in range(length):

if i == 0:

l.append(pre_res[0][0])

elif i == 1:

s = (pre_res[0][1]+pre_res[1][0])/2

l.append(s)

elif i == length-1:

l.append((pre_res[i][0]+pre_res[i-1][1]+pre_res[i-2][2])/3)

l.append((pre_res[i][1]+pre_res[i-1][2])/2)

l.append(pre_res[i][2])

else:

t = (pre_res[i][0]+pre_res[i-1][1]+pre_res[i-2][2])/3

l.append(t)

return l

bs_signal = get_buy_sell_signal(pre_res_l)

def get_buy_month_list(signal,test_start_date,test_end_date):

test_month = get_month_list(test_start_date,test_end_date)

length = len(signal)

dic = {}

for i in range(n,length+1):

l = []

for j in range(n):

l.append(signal[i-(n-j)])

dic[test_month[i-n]] = l

return dic

dic = get_buy_month_list(bs_signal,test_start_date,test_end_date)

def get_month_buy_signal(dic,test_start_date,test_end_date):

'''

获取每月买卖信号,卖出信号为[0,0,0]、[1,0,0]、[1,1,0],其余为卖出信号,001、010、011、101、111为买入信号,信号分析没有考虑做空

input:

dic: dic,key为月份,value为对应的信号

'''

test_month = get_month_list(test_start_date,test_end_date)

dic_month_signal = {}

for m in test_month:

l = dic[m]

if (l[0]<0.5) & (l[1]<0.5) & (l[2]<0.5):

dic_month_signal[m] = 0

elif (l[0]>0.5) & (l[1]<0.5) & (l[2]<0.5):

dic_month_signal[m] = 0

elif (l[0]>0.5) & (l[1]>0.5) & (l[2]<0.5):

dic_month_signal[m] = 0

else:

dic_month_signal[m] = 1

v = list(dic_month_signal.values())

df = pd.DataFrame(v,index=dic_month_signal.keys(),columns=['signal'])

return df

month_signal = get_month_buy_signal(dic,test_start_date,test_end_date)

def get_month_profit(stocks,start_date,end_date):

'''

获取月收益率数据,数据为本月相对于上月的增长率,计算时用每月最后MONTH_MEAN_DAY_NUM天的均值

input:

data:dataframe,index为股票代码,values为因子值

start_date:str, 初始日期

end_date:str,终止日期

output:

month_profit_df: Dataframe,columns为每月第一天的收盘价

'''

start_year = int(start_date[:4])

end_year = int(end_date[:4])

start_month = int(start_date[5:7])

end_month = int(end_date[5:7])

len_month = (end_year - start_year)*12 + (end_month - start_month) + 2

price_list = []

for i in range(len_month):

date = str(start_year+i//12)+'-'+str(start_month+i%12)+'-'+'01'

price = get_price(stocks,fields=['close'],count=1,end_date=date)['close']

price_list.append(price)

month_profit = pd.concat(price_list,axis=0)

v = list(month_profit.values)

month_profit_df = pd.DataFrame(v,index=month_profit.index,columns=['profit'])

return month_profit_df

month_profit = get_month_profit(select_index,test_start_date,test_end_date)

month_profit_pct = month_profit.pct_change(1,axis=0).dropna(how='all')

def get_strategy_profit(month_signal,month_profit_pct):

length_signal = len(month_signal)

length_pct = len(month_profit_pct)

if length_signal != length_pct:

print('input references must have same length')

month_profit_pct_shift = month_profit_pct['profit'].shift(-1)

month_signal['profit'] = month_profit_pct_shift.values

month_signal = month_signal.dropna()

month_signal['profit'][month_signal['signal']==0] = 0

month_signal['selct_profit'] = month_signal['profit']

month_signal['cumprod_profit'] = (month_signal['selct_profit']+1).cumprod()

month_signal['cumsum_profit'] = month_signal['selct_profit'].cumsum()

return month_signal

strategy_profit = get_strategy_profit(month_signal,month_profit_pct)

sp_cumprod = strategy_profit['cumprod_profit']

p_hs300 = get_price(select_index,start_date=test_start_date,end_date=test_end_date,fields=['close'])

fig = plt.figure(figsize=(20,10))

ax0 = fig.add_subplot(2,1,1)

ax1 = fig.add_subplot(2,1,2)

ax0.plot(sp_cumprod)

ax1.plot(p_hs300)

plt.show()

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

4秒后跳转登录页面...