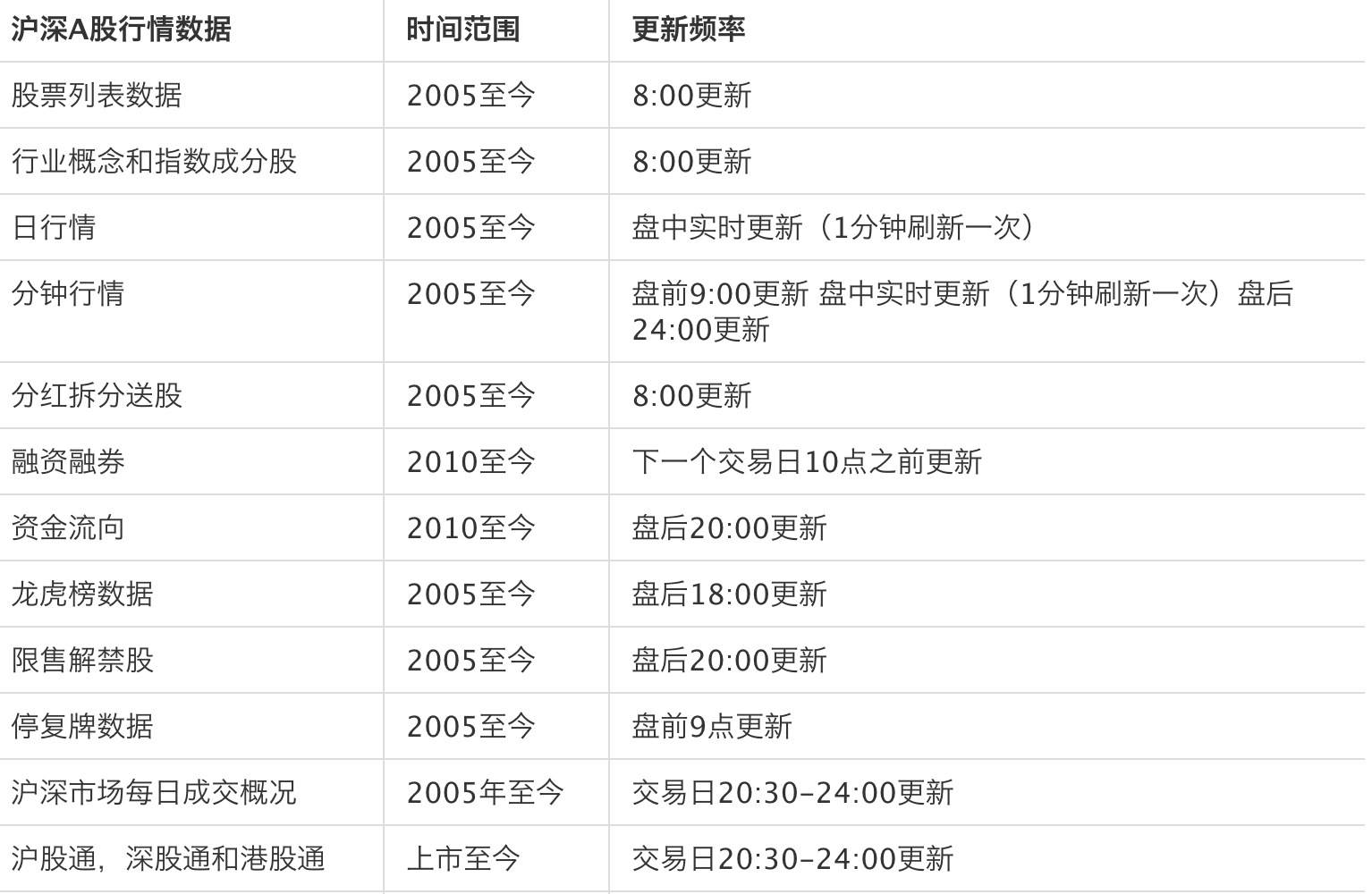

JQData提供哪些数据

数据更新时间

举个例子:

API:数据获取函数

| 函数名 | 取数类型 | 返回类型 |

|---|---|---|

| get_price | 多标的、多字段 | DataFrame |

| get_bars | 多标的、多字段 | numpy.ndarray |

| get_extras | 多标的、单字段(基金单位/累计净值,期货结算价/持仓量,ST等) | DataFrame / Dict |

具体字段查看SecurityUnitData

| 函数名 | 取数类型 | 返回类型 |

|---|---|---|

| history | 多标的、单字段 | DataFrame / Dict |

| attribute_history | 单标的、多字段 | DataFrame / Dict |

| get_current_data | 单标的、多字段 | Dict |

get_fundamentals 返回一个DataFrame

get_fundamentals_continuously 返回一个pandas.Panel

财务数据文档

get_billboard_list 获取龙虎榜数据

get_locked_shares 获取限售解禁数据

其他函数详见API

| 股票 | 期货 | 场外公募基金 | 行业指数 |

|---|---|---|---|

| 国际指数行情 | 雪球热度数据 | 新闻联播文本数据 | --- |

opt 期权数据

macro 宏观经济数据

jy 聚源数据

查询聚源数据的简单例子

get_all_factors 获取聚宽因子库中所有因子的信息

get_factor_values 质量、基础、情绪、成长、风险、每股等数百个因子数据

因子库文档

get_factor_kanban_values 获取因子看板列表数据

alpha101

alpha191

technical_analysis

基本的查询方式

详细说明见Query对象的简单使用教程

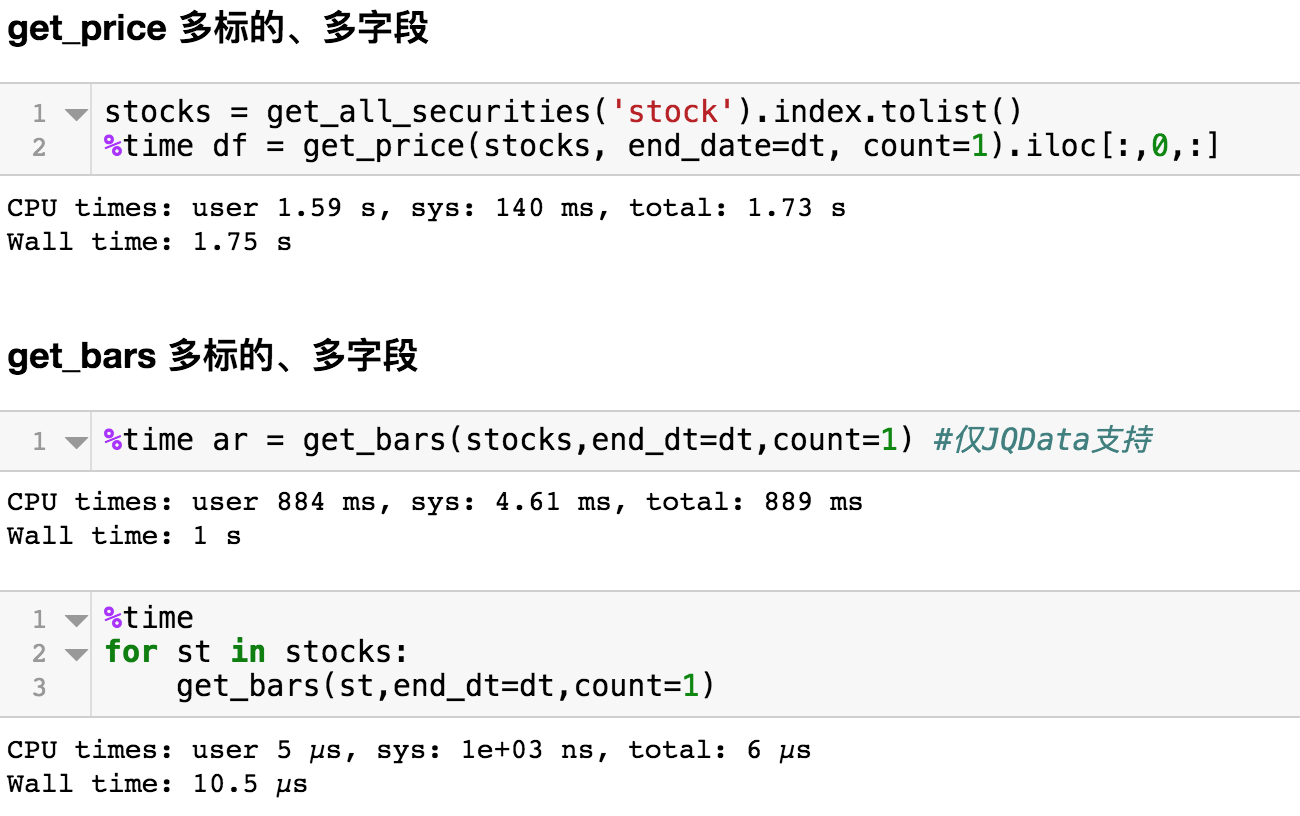

# get_price

stocks = get_all_securities('stock').index.tolist()

dt = datetime.datetime.now()

%time df = get_price(stocks, end_date=dt, count=1).iloc[:,0,:]

# get_bars

%time ar = get_bars(stocks,end_dt=dt,count=1) #仅JQData支持

%time

for st in stocks:

get_bars(st,end_dt=dt,count=1)

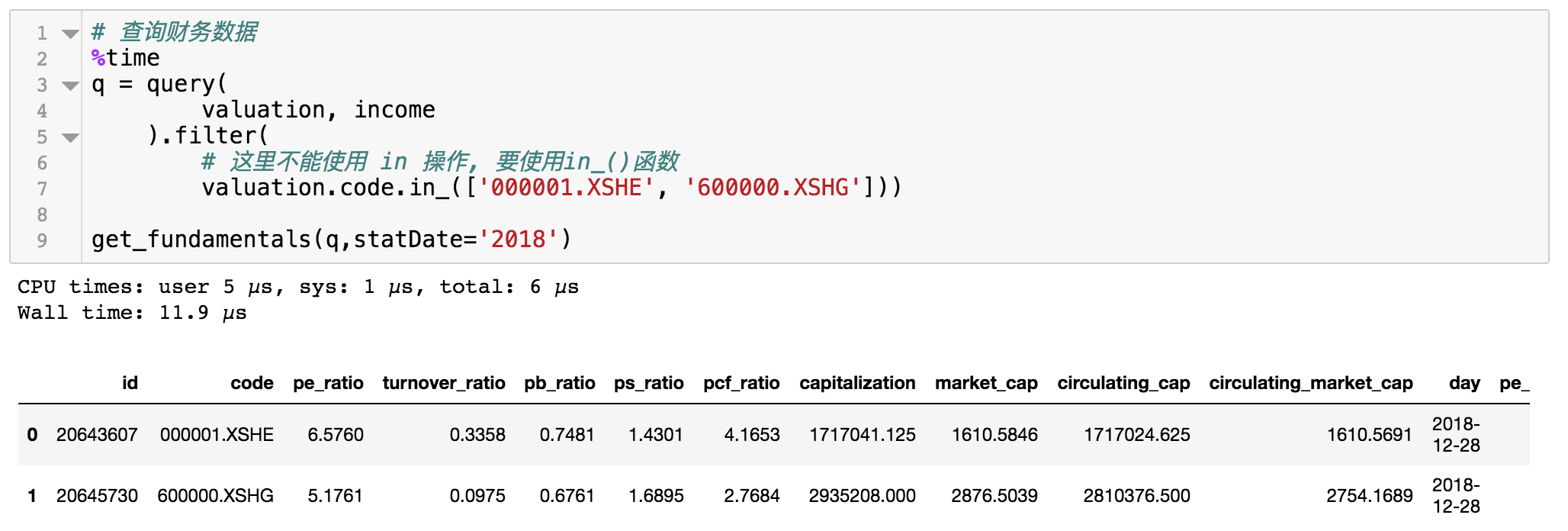

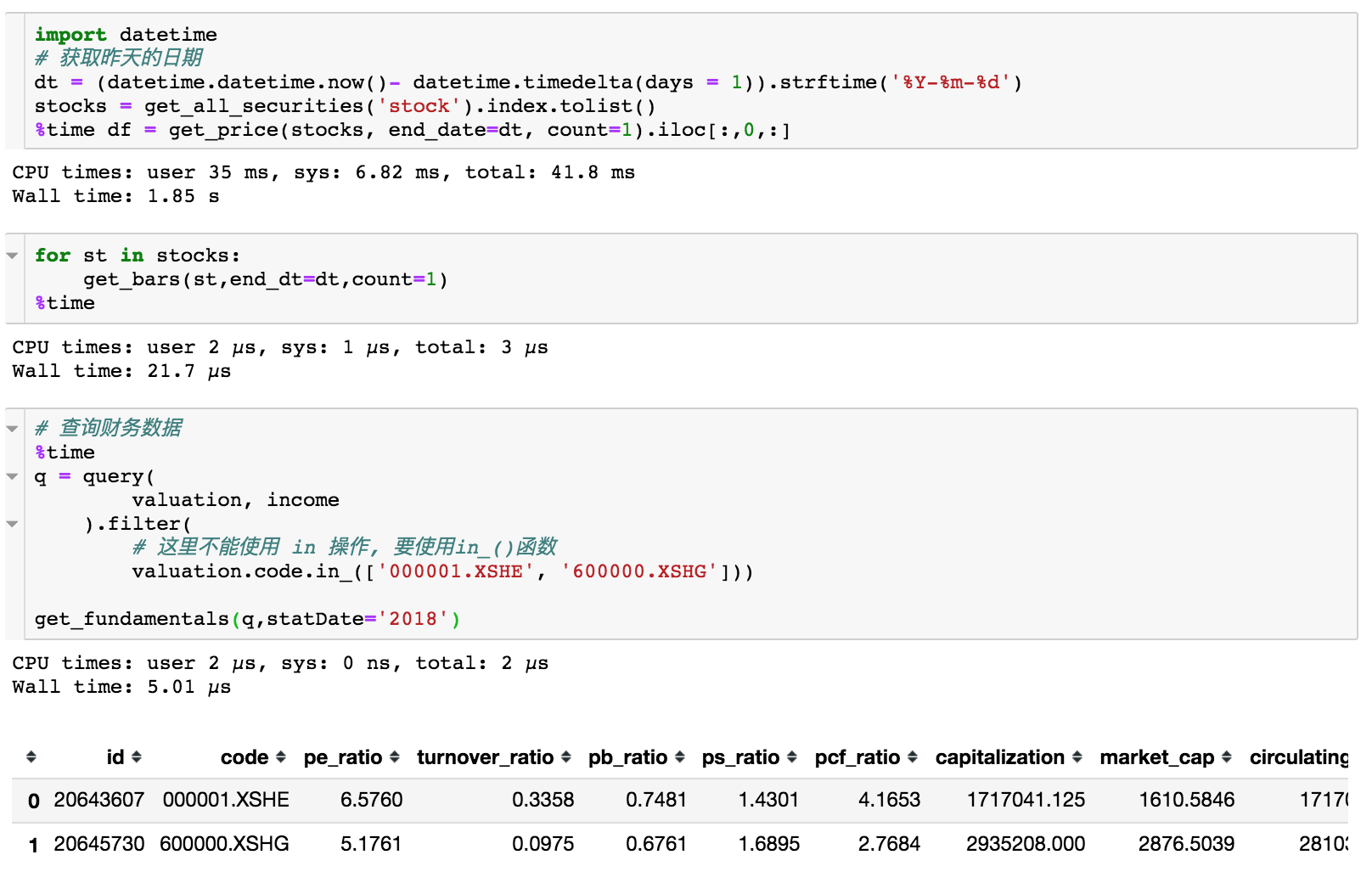

# 查询财务数据

%time

q = query(

valuation, income

).filter(

# 这里不能使用 in 操作, 要使用in_()函数

valuation.code.in_(['000001.XSHE', '600000.XSHG']))

get_fundamentals(q,statDate='2018')

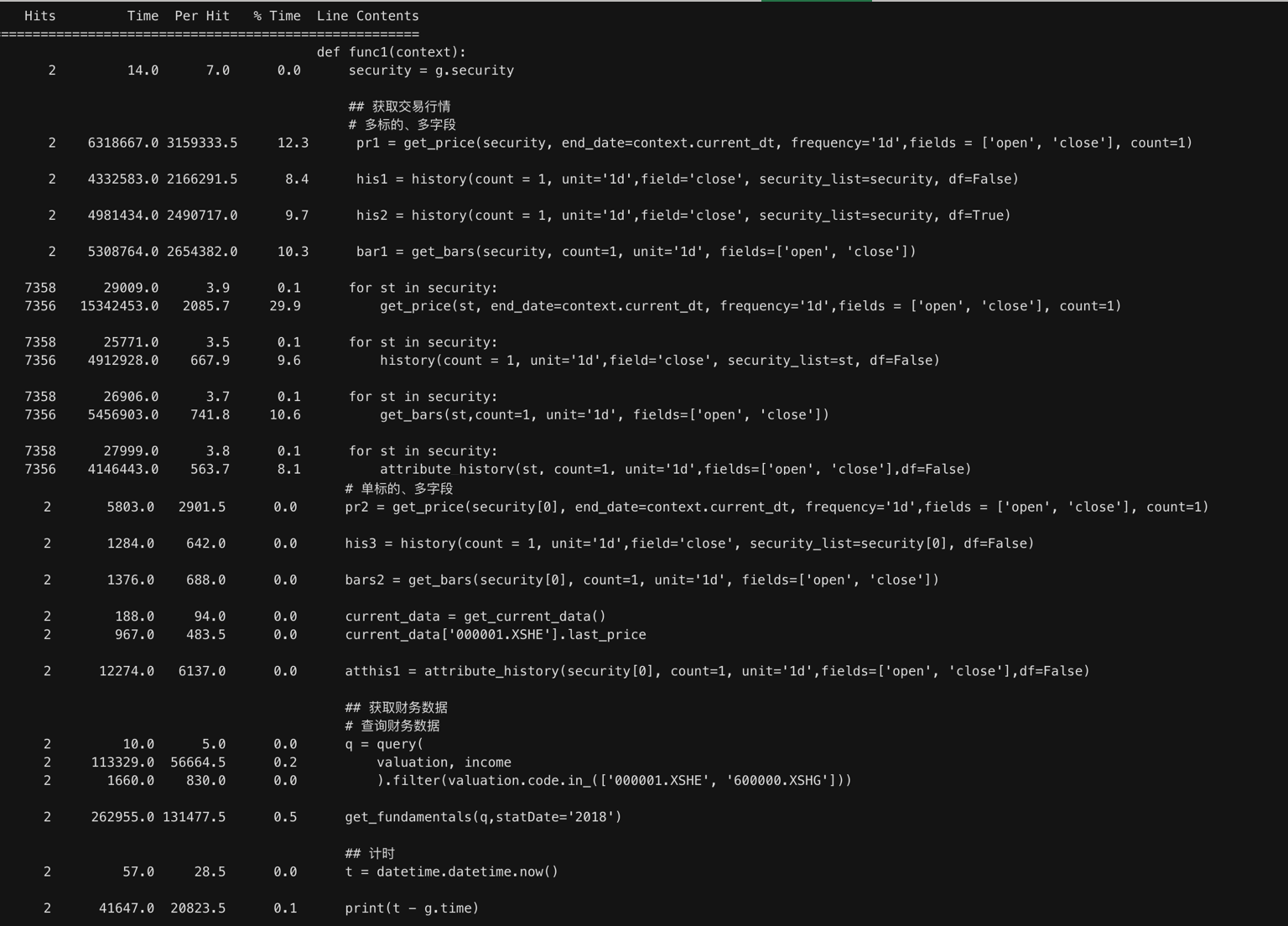

enable_proile()计算

# 打开性能分析

enable_profile()

import datetime

# 导入函数库

from jqdata import *

# 初始化函数,设定基准等等

def initialize(context):

run_daily(func1, time='open', reference_security='000300.XSHG')

g.security = get_all_securities('stock').index.tolist()

g.time = datetime.datetime.now()

## 开盘时运行函数

def func1(context):

security = g.security

## 获取交易行情

# 多标的、多字段

pr1 = get_price(security, end_date=context.current_dt, frequency='1d',fields = ['open', 'close'], count=1)

his1 = history(count = 1, unit='1d',field='close', security_list=security, df=False)

his2 = history(count = 1, unit='1d',field='close', security_list=security, df=True)

bar1 = get_bars(security, count=1, unit='1d', fields=['open', 'close'])

for st in security:

get_price(st, end_date=context.current_dt, frequency='1d',fields = ['open', 'close'], count=1)

for st in security:

history(count = 1, unit='1d',field='close', security_list=st, df=False)

for st in security:

get_bars(st,count=1, unit='1d', fields=['open', 'close'])

for st in security:

attribute_history(st, count=1, unit='1d',fields=['open', 'close'],df=False)

# 单标的、多字段

pr2 = get_price(security[0], end_date=context.current_dt, frequency='1d',fields = ['open', 'close'], count=1)

his3 = history(count = 1, unit='1d',field='close', security_list=security[0], df=False)

bars2 = get_bars(security[0], count=1, unit='1d', fields=['open', 'close'])

current_data = get_current_data()

current_data['000001.XSHE'].last_price

atthis1 = attribute_history(security[0], count=1, unit='1d',fields=['open', 'close'],df=False)

## 获取财务数据

# 查询财务数据

q = query(

valuation, income

).filter(valuation.code.in_(['000001.XSHE', '600000.XSHG']))

get_fundamentals(q,statDate='2018')

## 计时

t = datetime.datetime.now()

print(t - g.time)

datatime.datetime.now()计算在初始化函数中获取并保存第一次时间g.time = datatime.datetime.now(),在需要计时的函数后再次获取时间time_i = datatime.datetime.now(),计算时间差time_i - g.time即可得到该函数耗时,可以通过打印在日志中输出

get_bars速度最快get_bars(df=False)速度最快,使用循环时,attribute_history速度最快 get_current_data速度最快对于能获取多个标的的API,尽量传入多个标的;

能使用其他非DataFrame格式的尽量使用;

您可以使用性能分析等方式分析策略耗时,并有针对性地优化策略。

history和attribute_history的区别?

JoinQuant 心得——股票行情数据

新手入门:数据提取逻辑

【算命师系列】2:6000倍!平台上最快的取数据方法和最慢的取数据方法之间居然能差6000倍!

import pandas as pd

from jqdata import *

import warnings

warnings.filterwarnings('ignore')

dt = '2019-04-01'

stocks = get_all_securities('stock',dt).index.tolist()

%time df = get_price(stocks, end_date=dt, count=1).iloc[:,0,:]

CPU times: user 1.71 s, sys: 131 ms, total: 1.84 s Wall time: 1.85 s

%time ar = get_bars(stocks,end_dt=dt,count=1) #仅JQData支持

CPU times: user 871 ms, sys: 3.99 ms, total: 875 ms Wall time: 892 ms

%time

for st in stocks:

get_bars(st,end_dt=dt,count=1)

CPU times: user 4 µs, sys: 0 ns, total: 4 µs Wall time: 9.54 µs

ls = ['000001.XSHE','000002.XSHE','159001.XSHE','A1905.XDCE']

inf = ['is_st', # stock

'acc_net_value', 'unit_net_value', # fund

'futures_sett_price', 'futures_positions'] # future

st = get_extras(inf[0], ls[0:2],end_date=dt, df=True, count=1)

fund = get_extras(inf[1],ls[2],end_date=dt,df=True,count=1)

future = get_extras(inf[3],ls[3],end_date=dt,df=True,count=1)

st

| 000001.XSHE | 000002.XSHE | |

|---|---|---|

| 2019-04-01 | False | False |

fund

| 159001.XSHE | |

|---|---|

| 2019-04-01 | 2.629 |

future

| A1905.XDCE | |

|---|---|

| 2019-04-01 | 3331.0 |

history 多标的、单字段

attribute_history 单标的、多字段

get_current_data 单标的、多字段

# 查询财务数据

%time

q = query(

valuation, income

).filter(

# 这里不能使用 in 操作, 要使用in_()函数

valuation.code.in_(['000001.XSHE', '600000.XSHG']))

get_fundamentals(q,statDate='2018')

CPU times: user 6 µs, sys: 0 ns, total: 6 µs Wall time: 11 µs

| id | code | pe_ratio | turnover_ratio | pb_ratio | ps_ratio | pcf_ratio | capitalization | market_cap | circulating_cap | circulating_market_cap | day | pe_ratio_lyr | id.1 | code.1 | statDate | pubDate | statDate.1 | total_operating_revenue | operating_revenue | interest_income | premiums_earned | commission_income | total_operating_cost | operating_cost | interest_expense | commission_expense | refunded_premiums | net_pay_insurance_claims | withdraw_insurance_contract_reserve | policy_dividend_payout | reinsurance_cost | operating_tax_surcharges | sale_expense | administration_expense | financial_expense | asset_impairment_loss | fair_value_variable_income | investment_income | invest_income_associates | exchange_income | operating_profit | non_operating_revenue | non_operating_expense | disposal_loss_non_current_liability | total_profit | income_tax_expense | net_profit | np_parent_company_owners | minority_profit | basic_eps | diluted_eps | other_composite_income | total_composite_income | ci_parent_company_owners | ci_minority_owners | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 20643607 | 000001.XSHE | 6.5760 | 0.3358 | 0.7481 | 1.4301 | 4.1653 | 1717041.125 | 1610.5846 | 1717024.625 | 1610.5691 | 2018-12-28 | 6.9455 | 69861 | 000001.XSHE | 2018-12-31 | 2019-03-07 | 2018-12-31 | 1.167160e+11 | 1.167160e+11 | 1.628880e+11 | NaN | 3.936200e+10 | 3.654000e+10 | NaN | 8.814300e+10 | 8.065000e+09 | NaN | NaN | NaN | NaN | NaN | 1.149000e+09 | NaN | 3.539100e+10 | NaN | NaN | 892000000.0 | 9.186000e+09 | NaN | 2.090000e+08 | 3.230500e+10 | 28000000.0 | 102000000.0 | NaN | 3.223100e+10 | 7.413000e+09 | 2.481800e+10 | 2.481800e+10 | NaN | 1.39 | 1.39 | 9.120000e+08 | 2.573000e+10 | NaN | NaN |

| 1 | 20645730 | 600000.XSHG | 5.1761 | 0.0975 | 0.6761 | 1.6895 | 2.7684 | 2935208.000 | 2876.5039 | 2810376.500 | 2754.1689 | 2018-12-28 | 5.3015 | 70340 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 2018-12-31 | 1.715420e+11 | 1.715420e+11 | 2.674880e+11 | NaN | 4.620500e+10 | 1.061990e+11 | NaN | 1.556440e+11 | 7.196000e+09 | NaN | NaN | NaN | NaN | NaN | 1.852000e+09 | NaN | 4.309400e+10 | NaN | NaN | 798000000.0 | 1.476500e+10 | 164000000.0 | 1.155000e+09 | 6.534300e+10 | 104000000.0 | 163000000.0 | NaN | 6.528400e+10 | 8.769000e+09 | 5.651500e+10 | 5.591400e+10 | 601000000.0 | 1.85 | 1.85 | 6.983000e+09 | 6.349800e+10 | 6.289300e+10 | 605000000.0 |

# 查询多日的财务数据

q = query(valuation.turnover_ratio,

valuation.market_cap,

indicator.eps

).filter(valuation.code.in_(['000001.XSHE', '600000.XSHG']))

panel = get_fundamentals_continuously(q, end_date='2018-01-01', count=5)

panel

<class 'pandas.core.panel.Panel'> Dimensions: 3 (items) x 5 (major_axis) x 2 (minor_axis) Items axis: turnover_ratio to eps Major_axis axis: 2017-12-25 to 2017-12-29 Minor_axis axis: 000001.XSHE to 600000.XSHG

panel.minor_xs('600000.XSHG')

| turnover_ratio | market_cap | eps | |

|---|---|---|---|

| day | |||

| 2017-12-25 | 0.0687 | 3695.4270 | 0.48 |

| 2017-12-26 | 0.0542 | 3710.1030 | 0.48 |

| 2017-12-27 | 0.1165 | 3704.2324 | 0.48 |

| 2017-12-28 | 0.0849 | 3680.7510 | 0.48 |

| 2017-12-29 | 0.0582 | 3695.4270 | 0.48 |

get_billboard_list(stocks, end_date = dt, count =1).head()

| code | day | direction | rank | abnormal_code | abnormal_name | sales_depart_name | buy_value | buy_rate | sell_value | sell_rate | total_value | net_value | amount | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 603956.XSHG | 2019-04-01 | ALL | 0 | 106004 | 换手率达20%的证券 | None | 40024206.57 | 10.7445 | 21611165.62 | 5.8015 | 61635372.19 | 18413040.95 | 372509610.0 |

| 1 | 603956.XSHG | 2019-04-01 | SELL | 4 | 106004 | 换手率达20%的证券 | 东吴证券股份有限公司上海西藏南路证券营业部 | NaN | NaN | 3397111.32 | 0.9120 | 3397111.32 | -3397111.32 | 372509610.0 |

| 2 | 603956.XSHG | 2019-04-01 | BUY | 2 | 106004 | 换手率达20%的证券 | 东海证券股份有限公司长沙岳麓大道证券营业部 | 8571228.57 | 2.3009 | NaN | NaN | 8571228.57 | 8571228.57 | 372509610.0 |

| 3 | 603956.XSHG | 2019-04-01 | SELL | 1 | 106004 | 换手率达20%的证券 | 中国银河证券股份有限公司北京建国路证券营业部 | NaN | NaN | 6887123.35 | 1.8488 | 6887123.35 | -6887123.35 | 372509610.0 |

| 4 | 603956.XSHG | 2019-04-01 | BUY | 5 | 106004 | 换手率达20%的证券 | 东海证券股份有限公司长沙韶山北路证券营业部 | 5218834.00 | 1.4010 | NaN | NaN | 5218834.00 | 5218834.00 | 372509610.0 |

get_locked_shares(stocks, start_date=dt, forward_count=500).head()

| day | code | num | rate1 | rate2 | |

|---|---|---|---|---|---|

| 0 | 2019-04-01 | 603223.XSHG | 33600000.0 | 0.1667 | 0.2000 |

| 1 | 2019-04-01 | 603214.XSHG | 30202839.0 | 0.3020 | 1.2081 |

| 2 | 2019-04-01 | 603128.XSHG | 19850672.0 | 0.0196 | 0.0208 |

| 3 | 2019-04-01 | 603028.XSHG | 105231337.0 | 0.4766 | 0.9106 |

| 4 | 2019-04-01 | 601021.XSHG | 145000.0 | 0.0002 | 0.0002 |

# 十大股东

q=query(finance.STK_SHAREHOLDER_TOP10

).filter(

finance.STK_SHAREHOLDER_TOP10.code == "600000.XSHG",

finance.STK_SHAREHOLDER_TOP10.pub_date >= '2018-12-31'

).order_by(

finance.STK_SHAREHOLDER_TOP10.pub_date.desc()

).limit(5)

finance.run_query(q)

| id | company_name | company_id | code | end_date | pub_date | change_reason_id | change_reason | shareholder_rank | shareholder_name | shareholder_name_en | shareholder_id | shareholder_class_id | shareholder_class | share_number | share_ratio | sharesnature_id | sharesnature | share_pledge_freeze | share_pledge | share_freeze | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1829382 | 上海浦东发展银行股份有限公司 | 420600000 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 306019 | 定期报告 | 1 | 上海国际集团有限公司 | Shanghai International Group Co., Ltd. | 300015309 | 307099 | 其他机构 | 6.331323e+09 | 21.57 | 308025 | 流通A股和流通受限股份 | None | None | None |

| 1 | 1829383 | 上海浦东发展银行股份有限公司 | 420600000 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 306019 | 定期报告 | 2 | 中国移动通信集团广东有限公司 | China Mobile Group Guangdong Co., Ltd. | 300005039 | 307099 | 其他机构 | 5.334893e+09 | 18.18 | 308007 | 流通A股 | None | None | None |

| 2 | 1829384 | 上海浦东发展银行股份有限公司 | 420600000 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 306019 | 定期报告 | 3 | 富德生命人寿保险股份有限公司-传统 | Funde Sino Life Insurance Co., Ltd. - Traditional | 100123472 | 307014 | 保险投资组合 | 2.779437e+09 | 9.47 | 308007 | 流通A股 | None | None | None |

| 3 | 1829385 | 上海浦东发展银行股份有限公司 | 420600000 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 306019 | 定期报告 | 4 | 富德生命人寿保险股份有限公司-资本金 | Funde Sino Life Insurance Co., Ltd. - Capital | 100137437 | 307014 | 保险投资组合 | 1.763232e+09 | 6.01 | 308007 | 流通A股 | None | None | None |

| 4 | 1829386 | 上海浦东发展银行股份有限公司 | 420600000 | 600000.XSHG | 2018-12-31 | 2019-03-26 | 306019 | 定期报告 | 5 | 上海上国投资产管理有限公司 | Shanghai Shangguotou Asset Management Co., Ltd. | 100113208 | 307099 | 其他机构 | 1.395571e+09 | 4.75 | 308007 | 流通A股 | None | None | None |

q=query(opt.OPT_CONTRACT_INFO

).order_by(opt.OPT_CONTRACT_INFO.expire_date.desc()

).limit(5)

opt.run_query(q)

| id | code | trading_code | name | contract_type | exchange_code | currency_id | underlying_symbol | underlying_name | underlying_exchange | underlying_type | exercise_price | contract_unit | contract_status | list_date | list_reason | list_price | high_limit | low_limit | expire_date | last_trade_date | exercise_date | delivery_date | is_adjust | delist_date | delist_reason | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 13824 | RU2003C15250.XSGE | None | 天胶购3月15250 | CO | XSGE | CNY | RU2003.XSGE | 沪天胶2003合约 | XSGE | FUTURE | 15250.0 | 10 | LIST | 2019-03-18 | 合约新挂 | None | 2424.0 | 1.0 | 2020-02-24 | 2020-02-24 | None | None | 0 | None | None |

| 1 | 13825 | RU2003C15500.XSGE | None | 天胶购3月15500 | CO | XSGE | CNY | RU2003.XSGE | 沪天胶2003合约 | XSGE | FUTURE | 15500.0 | 10 | LIST | 2019-03-18 | 合约新挂 | None | 2368.0 | 1.0 | 2020-02-24 | 2020-02-24 | None | None | 0 | None | None |

| 2 | 13826 | RU2003C15750.XSGE | None | 天胶购3月15750 | CO | XSGE | CNY | RU2003.XSGE | 沪天胶2003合约 | XSGE | FUTURE | 15750.0 | 10 | LIST | 2019-03-18 | 合约新挂 | None | 2315.0 | 1.0 | 2020-02-24 | 2020-02-24 | None | None | 0 | None | None |

| 3 | 13827 | RU2003C16000.XSGE | None | 天胶购3月16000 | CO | XSGE | CNY | RU2003.XSGE | 沪天胶2003合约 | XSGE | FUTURE | 16000.0 | 10 | LIST | 2019-03-18 | 合约新挂 | None | 2269.0 | 1.0 | 2020-02-24 | 2020-02-24 | None | None | 0 | None | None |

| 4 | 13828 | RU2003C16250.XSGE | None | 天胶购3月16250 | CO | XSGE | CNY | RU2003.XSGE | 沪天胶2003合约 | XSGE | FUTURE | 16250.0 | 10 | LIST | 2019-03-18 | 合约新挂 | None | 2225.0 | 1.0 | 2020-02-24 | 2020-02-24 | None | None | 0 | None | None |

# 上海银行间同业拆放利率

q = query(macro.MAC_LEND_RATE

).filter(macro.MAC_LEND_RATE.market_id == '5',

).order_by(macro.MAC_LEND_RATE.day.desc()).limit(5)

macro.run_query(q)

| id | day | currency_id | market_id | term_id | interest_rate | currency_name | |

|---|---|---|---|---|---|---|---|

| 0 | 987021 | 2019-04-04 | 1 | 5 | 23 | 2.906 | 人民币 |

| 1 | 987024 | 2019-04-04 | 1 | 5 | 20 | 1.417 | 人民币 |

| 2 | 987020 | 2019-04-04 | 1 | 5 | 14 | 2.376 | 人民币 |

| 3 | 987023 | 2019-04-04 | 1 | 5 | 12 | 3.047 | 人民币 |

| 4 | 987022 | 2019-04-04 | 1 | 5 | 7 | 2.418 | 人民币 |

from jqfactor import get_all_factors

# 获取聚宽因子库中所有因子的信息

print(get_all_factors().head())

factor ... category_intro 0 administration_expense_ttm ... 基础科目及衍生类因子 1 asset_impairment_loss_ttm ... 基础科目及衍生类因子 2 EBIT ... 基础科目及衍生类因子 3 EBITDA ... 基础科目及衍生类因子 4 financial_expense_ttm ... 基础科目及衍生类因子 [5 rows x 4 columns]

from jqfactor import get_factor_values

# 质量、基础、情绪、成长、风险、每股等数百个因子数据

# 获取因子Skewness60(个股收益的60日偏度)从 2017-01-01 至 2017-03-04 的因子值

factor_data = get_factor_values(securities=['000001.XSHE'], factors=['Skewness60'], start_date='2017-01-01', end_date='2017-03-04')

# 查看因子值

factor_data['Skewness60'].head()

| code | 000001.XSHE |

|---|---|

| 2017-01-03 | -0.002081 |

| 2017-01-04 | 0.021962 |

| 2017-01-05 | -0.003263 |

| 2017-01-06 | -0.007545 |

| 2017-01-09 | -0.007441 |

# 获取因子看板列表数据

from jqfactor import get_factor_kanban_values

df = get_factor_kanban_values(universe='hs300',bt_cycle='month_3',

model='long_only',category=['quality'])

df.head()

| date | universe | bt_cycle | category | code | compound_return_1q | compound_return_5q | annual_return_1q | annual_return_5q | max_drawdown_1q | max_drawdown_5q | sharpe_1q | sharpe_5q | turnover_mean_1q | turnover_mean_5q | annual_return_bm | ic_mean | ir | good_ic | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2019-04-04 | hs300 | month_3 | quality | operating_cost_to_operating_revenue_ratio | 0.361848 | 0.300939 | 2.969988 | 2.236498 | 0.038352 | 0.046835 | 12.140436 | 8.950136 | 0.003571 | 0.004762 | 2.299182 | -0.018442 | -0.233116 | 0.803571 |

| 1 | 2019-04-04 | hs300 | month_3 | quality | financial_expense_rate | 0.425024 | 0.398847 | 3.860780 | 3.474657 | 0.045869 | 0.049295 | 15.083800 | 12.609282 | 0.001429 | 0.002150 | 2.299182 | -0.011219 | -0.116209 | 0.821429 |

| 2 | 2019-04-04 | hs300 | month_3 | quality | intangible_asset_ratio | 0.304671 | 0.306365 | 2.278151 | 2.297204 | 0.049559 | 0.040803 | 8.576084 | 9.112623 | 0.001488 | 0.000298 | 2.299182 | -0.007822 | -0.130018 | 0.714286 |

| 3 | 2019-04-04 | hs300 | month_3 | quality | invest_income_associates_to_total_profit | 0.280638 | 0.314116 | 2.017044 | 2.385441 | 0.067890 | 0.074217 | 7.734128 | 7.838341 | 0.018452 | 0.022917 | 2.299182 | -0.007334 | -0.098196 | 0.767857 |

| 4 | 2019-04-04 | hs300 | month_3 | quality | cash_to_current_liability | 0.316702 | 0.349292 | 2.415284 | 2.809170 | 0.053259 | 0.046298 | 9.423543 | 11.356771 | 0.010714 | 0.006195 | 2.299182 | -0.005947 | -0.097873 | 0.714286 |

from jqlib.alpha101 import *

#传入一个股票list,获取股票list的alpha_001因子值

a101=alpha_001(dt,'000300.XSHG')

a101.head()

000001.XSHE -0.423333 000002.XSHE -0.423333 000063.XSHE -0.423333 000069.XSHE -0.423333 000100.XSHE -0.423333 Name: rank_value_boolean, dtype: float64

from jqlib.alpha191 import *

a191 = alpha_001(stocks,dt)

a191.head()

000001.XSHE 0.169009 000002.XSHE -0.067180 000004.XSHE -1.000000 000005.XSHE -0.950777 000006.XSHE -0.382764 dtype: float64

from jqlib.technical_analysis import *

security_list1 = '000001.XSHE'

security_list2 = ['000001.XSHE','000002.XSHE','600001.XSHG','600002.XSHG']

# 计算并输出 security_list1 的 MACD 值

macd_dif, macd_dea, macd_macd = MACD(security_list1,check_date='2017-01-04', SHORT = 12, LONG = 26, MID = 9)

print(macd_dif[security_list1])

print(macd_dea[security_list1])

print(macd_macd[security_list1])

print('-'*20)

# 输出 security_list2 的 MACD 值

macd_dif, macd_dea, macd_macd = MACD(security_list2,check_date='2017-01-04', SHORT = 12, LONG = 26, MID = 9)

for stock in security_list2:

print(macd_dif[stock])

print(macd_dea[stock])

print(macd_macd[stock])

print('='*20)

-0.06663409333148707 -0.057120768967898014 -0.019026648727178103 -------------------- -0.06663409333148707 -0.057120768967898014 -0.019026648727178103 ==================== -1.106615196370992 -1.1518450238134519 0.0904596548849197 ==================== 0.042721033329423896 0.09561322733906769 -0.10578438801928758 ==================== 0.12283360382906672 0.1677319794789868 -0.08979675129984016 ====================

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...

移动端课程