大家好,今天和大家分享一个基于Z-score建立的投资策略。Z-score是金融学教授Edward Altman于1968年提出的衡量公司破产可能性的综合指标。Z-score的适用范围是公开上市的制造业公司。

其计算公式如下:

Z = 1.2X1 1.4X2 3.3X3 0.6X4 1.0X5.

X1 = working capital / total assets. Measures liquid assets in relation to the size of the company.

X2 = retained earnings / total assets. Measures profitability that reflects the company's age and earning power.

X3 = earnings before interest and taxes / total assets. Measures operating efficiency apart from tax and leveraging factors. It recognizes operating earnings as being important to long-term viability.

X4 = market value of equity / book value of total liabilities. Adds market dimension that can show up security price fluctuation as a possible red flag.

X5 = sales / total assets. Standard measure for total asset turnover (varies greatly from industry to industry).

虽然Z-score本质上是一个预测公司未来破产可能性的指标,但从另一个角度来看也是衡量公司经营稳健能力和盈余质量的标准。利用Z-score对制造业股票池中的股票进行排序选股也有不错的效果。

在这里构建的策略是针对制造业公司和针对ST公司的。通过Z-score排序选出前10名的股票作为持仓股票。

制造业公司是Z-score在提出时的适用公司范围。而对于ST公司而言,其存在着破产或摘帽两个方向的可能性,因此Z-score可以说能够甄别出ST公司中相对较好的那些。初步的策略没有对ST公司的Z-score进行系数调整,但是也取得了不错的收益。

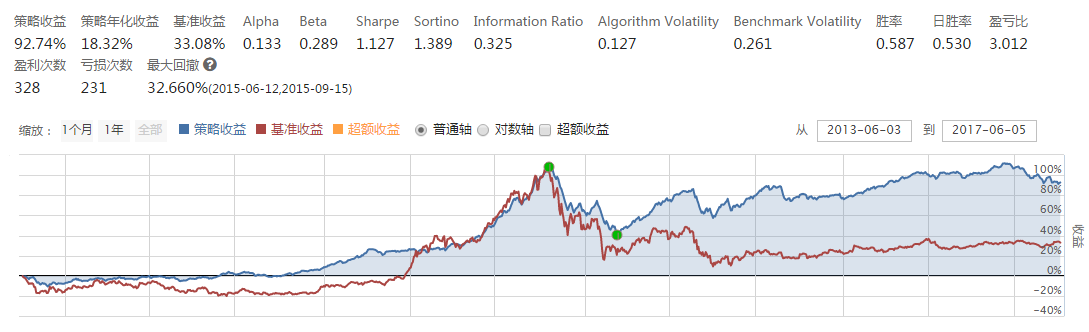

制造业:

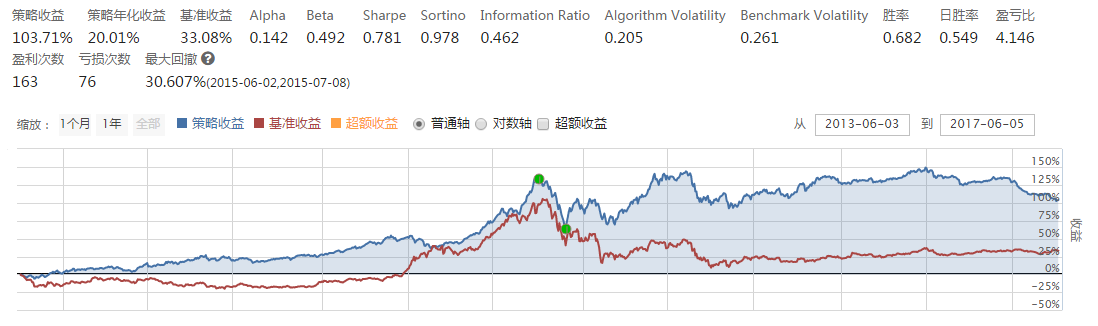

ST股票: