RSRS模型算是近几年比较经典的模型了,我在聚宽原有策略的基础上,以class类的形式精简了代码,并且做了一定优化,其他内容不变。

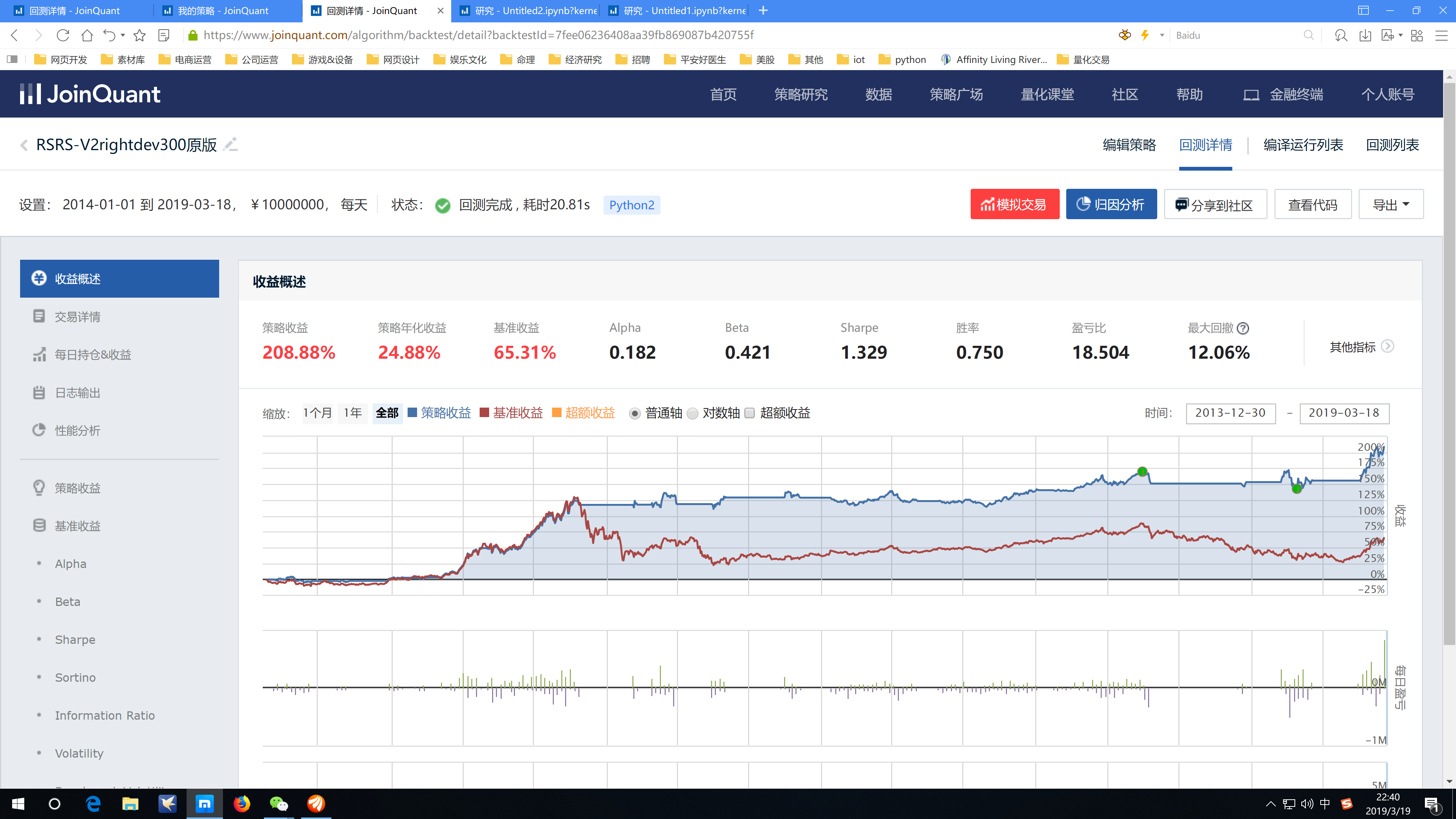

附图是原版代码的回测,只是代码花了1个小时做了优化,并没有在参数和定义上做其他改动。

我个人对RSRS的择时认为肯定有优化空间,比如加入二八滚动等等,但是老代码只是对HS300进行建模,代码集成度不高,如果滚动的话,效果会比较差,之后会优化代码,以及加入更多择时优化比如我最近在研究的,自己开发的角动量择时。

优化好的模型基本都加了注释,希望可以帮到大家,谢谢!

其实,从数据样本选择上来说,我并不是很喜欢RSRS择时,RSRS择时人为选择了右偏态数据,见下图skew达到了1.17 。

金融学意义上,右偏态的肥尾就代表了收益率

优化上,我们完全可以把buy和sell的0.7进行动态化,也就是

取置信区间的[12,82]中间部分,以达到不同区域,始终保持动态的区间效果,优化版代码我并没有加入这个功能,各位可以根据我附上的研究自行编写。

from sklearn import linear_modelfrom jqdata import *import statsmodels.api as smimport scipy.stats as statsimport numpy as npimport pandas as pdimport mathimport matplotlib.pyplot as pltclass RSRS_CALC:N = 18M = 1100def __init__(self,security,date,N,M) :self.date = dateself.security = securityself.N = Nself.M = Mdef get_prices(self,start_date,count) :security = self.securityend_date = self.dateif count > 0 : prices = attribute_history(security, count, '1d', ['high', 'low'])elif start_date is not None: prices = get_price(security = security, start_date = start_date, end_date = end_date, \ frequency='daily', fields=['high', 'low'])if len(prices.values)>0 :highs = prices.highlows = prices.lowreturn highs,lowselse: passdef calc_OLS_list(self,x,y) : #OLS线性回归X = sm.add_constant(x)model = sm.OLS(y,X)results = model.fit()return resultsdef create_base_record(self,start_date = '2005-01-05'):N = self.Nhighs,lows = self.get_prices(start_date,0)beta_list = []rightdev_list = []for i in range(N,len(highs)):y = highs[i-N:i]x = lows[i-N:i]results = self.calc_OLS_list(x,y)beta_list.append(results.params[1])rightdev_list.append(results.rsquared)return beta_list,rightdev_listdef new_beta_record(self):N = self.Nhighs,lows = self.get_prices(None,N)x = lowsy = highsresults = self.calc_OLS_list(x,y)beta = results.params[1]rightdev=results.rsquaredreturn beta,rightdevdef calc_rscore(self,beta_list,rightdev_list):# 计算标准化的RSRS指标M = self.Mif not (len(beta_list) > 0 or len(rightdev_list) > 0 ):beta_list,rightdev_list = self.create_base_record('2005-01-05')beta,rightdev = self.new_beta_record()beta_list.append(beta)rightdev_list.append(rightdev)section = beta_list[-M:] # 计算均值序列 zscore = stats.zscore(section).tolist()[-1] #序列标准分#计算右偏RSRS标准分zscore_rightdev= zscore*beta*rightdevreturn zscore_rightdevsecurity = '000001.XSHG'N = 18date = datetime.datetime.now() - datetime.timedelta(days=1)rs = RSRS_CALC(security,date,18,1100)beta_list,rightdev_list = rs.create_base_record('2005-01-05')#print rs.new_beta_record()print rs.calc_rscore(beta_list,rightdev_list)#plt.hist(beta_list,bins=50)0.551963274782

DF = pd.DataFrame([beta_list,rightdev_list],index=['beta','rdev']).TDF['zscore'] = DF.beta.apply(lambda x: (x-DF.beta.mean())/DF.beta.std())DF['rscore'] = DF.apply(lambda x: x.beta*x.rdev*x.zscore,axis=1)print DF

beta rdev zscore rscore 0 0.765083 0.762357 -1.120898 -0.653782 1 0.794287 0.807790 -0.878130 -0.563423 2 0.840015 0.836338 -0.498004 -0.349866 3 0.698184 0.645090 -1.677007 -0.755310 4 0.726553 0.640668 -1.441187 -0.670842 5 0.769735 0.622825 -1.082221 -0.518829 6 0.830108 0.699983 -0.580363 -0.337227 7 0.855516 0.737383 -0.369149 -0.232875 8 0.851725 0.750464 -0.400663 -0.256100 9 0.866546 0.771813 -0.277467 -0.185573 10 0.899543 0.810496 -0.003172 -0.002313 11 0.882656 0.851527 -0.143546 -0.107890 12 0.846255 0.864751 -0.446139 -0.326484 13 0.891465 0.896693 -0.070317 -0.056209 14 0.889193 0.905200 -0.089203 -0.071799 15 0.878066 0.910658 -0.181700 -0.145291 16 0.885322 0.913907 -0.121385 -0.098213 17 0.871379 0.913378 -0.237284 -0.188854 18 0.839568 0.907286 -0.501724 -0.382177 19 0.777681 0.882753 -1.016173 -0.697603 20 0.644092 0.886277 -2.126658 -1.213990 21 0.770415 0.895896 -1.076569 -0.743061 22 0.783835 0.837594 -0.965016 -0.633567 23 0.884549 0.820159 -0.127812 -0.092724 24 0.845566 0.780138 -0.451865 -0.298076 25 0.790113 0.763104 -0.912825 -0.550378 26 0.819636 0.797077 -0.667414 -0.436030 27 0.912117 0.841795 0.101356 0.077823 28 0.916219 0.904901 0.135450 0.112300 29 0.975287 0.925865 0.626465 0.565688 ... ... ... ... ... 3403 0.802709 0.842770 -0.808119 -0.546692 3404 1.045433 0.889722 1.209568 1.125073 3405 1.042320 0.868709 1.183692 1.071801 3406 0.971707 0.860436 0.596712 0.498906 3407 1.066329 0.893351 1.383271 1.317712 3408 1.011117 0.916028 0.924313 0.856109 3409 1.125825 0.929343 1.877843 1.964744 3410 1.035792 0.938179 1.129431 1.097535 3411 1.062039 0.948993 1.347616 1.358219 3412 1.083898 0.960001 1.529318 1.591322 3413 1.079256 0.968833 1.490729 1.558734 3414 1.055139 0.970204 1.290256 1.320835 3415 1.062598 0.975922 1.352260 1.402311 3416 1.097139 0.973328 1.639391 1.750668 3417 1.197086 0.965339 2.470214 2.854563 3418 1.138085 0.971286 1.979762 2.188440 3419 1.127496 0.977275 1.891736 2.084454 3420 1.095680 0.975204 1.627259 1.738745 3421 1.099220 0.976844 1.656686 1.778895 3422 1.101289 0.979616 1.673886 1.805856 3423 1.081550 0.977879 1.509801 1.596804 3424 1.062357 0.977926 1.350260 1.402795 3425 1.052379 0.978224 1.267310 1.304647 3426 1.056061 0.973358 1.297920 1.334165 3427 1.064357 0.971895 1.366882 1.413962 3428 1.045723 0.972495 1.211984 1.232540 3429 1.025941 0.968228 1.047538 1.040566 3430 1.025635 0.961934 1.044999 1.030988 3431 1.004339 0.954159 0.867970 0.831774 3432 0.963998 0.945923 0.532625 0.485684 [3433 rows x 4 columns]

list = DF.rscoreplt.hist(list, bins=50, rwidth=0.5, normed=True)print pd.Series(list).kurt(),pd.Series(list).skew()

3.57447564885 1.17876393794

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...

移动端课程