在我解决问题之前,我必须要自己声明它。当我认为找到方案时,我必须证明我是对的。

我仅知道一种方式来证明它; 它就是, 用我自己的钱。

Jesse Livermore

在 The Last Crusade - 最新的改革 中我们回顾了一个相当有趣但目前没有被广泛使用的显示市场信息的方法 - 点数图。所提供的脚本可以在图表上绘图。然而,它并不建议交易自动化。现在我们可以尝试将交易过程自动化,使用点数图来分析,并根据方向和交易量制定交易决定。

我无法在此写出基本的绘制原理; 就看看一个经典的图表吧:

Copyright (c) 2012-2014 Roman Rich Euro vs US Dollar, Box-20, Reverse-3 1.4588 | \.....\.................................................................... | 1.4588 1.4521 | X\....X\................................................................... | 1.4521 1.4454 | XO\.\.XO\.................................................................. | 1.4454 1.4388 | XOX\X\XO.\................................................................. | 1.4388 1.4322 | XOXOXOXO..\................................................................ | 1.4322 1.4256 | XOXOXOXO...\....\.......................................................... | 1.4256 1.4191 | XOXO/OXO....\...X\......................................................... | 1.4191 1.4125 | XOX/.O/O.....\..XO\........................................................ | 1.4125 1.4060 | XO/../.O......\.XO.\....................................................... | 1.4060 1.3996 | ./.....O.......\XO..\...................................................... | 1.3996 1.3932 | .......OX.......XO...\....................................................X | 1.3932 1.3868 | .......OXO..X.X.XOX...\.................................................X.X | 1.3868 1.3804 | .......OXO..XOXOXOXOX..\..............................................X.XOX | 1.3804 1.3740 | .......OXO..XOXOXOXOXO..\.................................\...........XOXOX | 1.3740 1.3677 | .......OXOX.XO.O.OXOXO...\................................X\..........XOXOX | 1.3677 1.3614 | .......OXOXOX....O.OXO....\...............................XO\.........XOXOX | 1.3614 1.3552 | .......O.OXOX...../OXO.....\..............................XO.\........XOXOX | 1.3552 1.3490 | .........OXOX..../.O.OX.....\.............................XO..\.......XOXO. | 1.3490 1.3428 | .........OXOX.../....OXO.....\X.\.........................XO...\\...X.XOX.. | 1.3428 1.3366 | .........O.OX../.....OXO......XOX\........................XO....X\..XOXOX.. | 1.3366 1.3305 | ...........OX./......OXO....X.XOXO\.....................X.XO....XO\.XOXO... | 1.3305 1.3243 | ...........OX/.......O.O....XOXOXOX\....................XOXO....XO.\XOX.../ | 1.3243 1.3183 | ...........O/..........OX...XOXOXOXO\...................XOXOX.X.XOX.XOX../. | 1.3183 1.3122 | .........../...........OXO..XOXOXOXO.\..........X...X.X.XOXOXOXOXOXOXO../.. | 1.3122 1.3062 | .......................OXOX.XOXO.OXO..\.........XOX.XOXOXOXOXOXOXOXOX../... | 1.3062 1.3002 | .......................O.OXOXO...O/O...\........XOXOXOXOXO.OXO.OXOXO../.... | 1.3002 1.2942 | .........................OXOX..../.O....\.......XOXOXOXOX..OX..OXOX../..... | 1.2942 1.2882 | .........................O.OX.../..O.....\......XOXO.OXO...OX..OXOX./...... | 1.2882 1.2823 | ...........................OX../...OX.....\.....XO...OX.../OX..O/OX/....... | 1.2823 1.2764 | ...........................OX./....OXO.....\....X....OX../.O.../.O/........ | 1.2764 1.2706 | ...........................OX/.....OXO..X...\...X....O../......../......... | 1.2706 1.2647 | ...........................O/......O.OX.XOX..\..X....../................... | 1.2647 1.2589 | .........................../.........OXOXOXO..\.X...../.................... | 1.2589 1.2531 | .....................................OXOXOXO...\X..../..................... | 1.2531 1.2474 | .....................................OXO.OXO....X.../...................... | 1.2474 1.2417 | .....................................OX..O.O..X.X../....................... | 1.2417 1.2359 | .....................................OX....OX.XOX./........................ | 1.2359 1.2303 | .....................................O.....OXOXOX/......................... | 1.2303 1.2246 | ...........................................OXOXO/.......................... | 1.2246 1.2190 | ...........................................OXO./........................... | 1.2190 1.2134 | ...........................................OX.............................. | 1.2134 1.2078 | ...........................................O............................... | 1.2078 1.2023 | ........................................................................... | 1.2023 222222222222222222222222222222222222222222222222222222222222222222222222222 000000000000000000000000000000000000000000000000000000000000000000000000000 111111111111111111111111111111111111111111111111111111111111111111111111111 111111111111111111111111112222222222222222222222222222222333333333333333344 ........................................................................... 000000000001111111111111110000000000000000000000011111111000000000000011100 788888899990000001111112221122233445566666677888900001222123444567778901213 ........................................................................... 200011211220111220011231220101212121201112222001100010001002123110112020231 658801925683489071404504193396436668111288937260415979579417630739120547713 000100001012111111110111111100112010210001111101101101011111111101011101110 910501876933613095500253237788652909250001557626626824655375907538165785367 ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: 550433251023230204310404232105354323532031240033315125241340044324523153453 000000000000000000000000000000000000000000000000000000000000000000000000000

我不认为交易机会在这个图表上都清晰可见; 我只建议您检查两个交易假定:

顺势交易 — 在牛势中买,在熊势里卖。

使用止损, 在您入场前定义。

让您的利润增长。

平掉亏损单 (好的交易通常立即显示获利)。

注意上边股票推测高手的报价: 使用挂单。我更喜欢以确定的交易量入场,这样当触发止损时,损失不会超出我可接受的百分比 (这就是 Ralph Vince 在他的书中 The Mathematics of Money Management - 资金管理中的数学 所谓的优化)。每笔交易的亏损风险是一个好的可优化变量 (在以下代码中 opt_f)。

因此, 我们有一个函数,依据每笔交易的可接受风险计算交易量,并放置买/卖订单:

//+------------------------------------------------------------------+ //| The function places an order with a precalculated volume | //+------------------------------------------------------------------+ void PlaceOrder() { //--- Variables for calculating the lot uint digits_2_lot=(uint)SymbolInfoInteger(symbol,SYMBOL_DIGITS); double trade_risk=AccountInfoDouble(ACCOUNT_EQUITY)*opt_f; double one_tick_loss_min_lot=SymbolInfoDouble(symbol,SYMBOL_TRADE_TICK_VALUE_LOSS)*SymbolInfoDouble(symbol,SYMBOL_VOLUME_STEP); //--- Заполняем основные поля запроса trade_request.magic=magic; trade_request.symbol=symbol; trade_request.action=TRADE_ACTION_PENDING; trade_request.tp=NULL; trade_request.comment=NULL; trade_request.type_filling=NULL; trade_request.stoplimit=NULL; trade_request.type_time=NULL; trade_request.expiration=NULL; if(is_const_lot==true) { order_vol=SymbolInfoDouble(symbol,SYMBOL_VOLUME_MIN); } else { order_vol=trade_risk/(MathAbs(trade_request.price-trade_request.sl)*MathPow(10,digits_2_lot)*one_tick_loss_min_lot)*SymbolInfoDouble(symbol,SYMBOL_VOLUME_STEP); order_vol=MathMax(order_vol,SymbolInfoDouble(symbol,SYMBOL_VOLUME_MIN)); if(SymbolInfoDouble(symbol,SYMBOL_VOLUME_LIMIT)!=0) order_vol=MathMin(order_vol,SymbolInfoDouble(symbol,SYMBOL_VOLUME_LIMIT)); order_vol=NormalizeDouble(order_vol,(int)MathAbs(MathLog10(SymbolInfoDouble(symbol,SYMBOL_VOLUME_STEP)))); } //--- Place an order while(order_vol>0) { trade_request.volume=MathMin(order_vol,SymbolInfoDouble(symbol,SYMBOL_VOLUME_MAX)); if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); order_vol=order_vol-SymbolInfoDouble(symbol,SYMBOL_VOLUME_MAX); }; ticket=trade_result.order; };

其实只有两种优化准则:给定的回报的最小级别回撤,或给定的余额的最大回撤。我更喜欢依第二种准则优化:

//+------------------------------------------------------------------+ //| Result of strategy run in the testing mode | //+------------------------------------------------------------------+ double OnTester() { if(TesterStatistics(STAT_EQUITY_DDREL_PERCENT)>(risk*100)) return(0); else return(NormalizeDouble(TesterStatistics(STAT_PROFIT),(uint)SymbolInfoInteger(symbol,SYMBOL_DIGITS))); };

此处 risk 是上述的回撤级别,即我不能接受的级别。这个变量也被优化。

重新优化策略,有人按照时间间隔(如,每周一次,一个月),有人按照交易间隔(50,100 交易之后),有人当市场变化时开始新的优化。实际上,重新优化的需要只依赖于在前段所选择的优化准则。如果回撤低于最大允许风险参数, 我们重新优化策略; 如果一切工作顺利, 则让它如常工作。回撤大于 10% 对于我是不可接受的。所以如果系统操作期间回撤过大,我将对它重新优化。

不幸地, 在策略测试员的 "所有品种在市场报价中选择" 模式中您不能优化外部变量。所以让我们选择市场工具以及其它可优化的外部变量如下:

//+------------------------------------------------------------------+ //| Enumeration of symbols | //+------------------------------------------------------------------+ enum SYMBOLS { AA=1, AIG, AXP, BA, C, CAT, DD, DIS, GE, HD, HON, HPQ, IBM, IP, INTC, JNJ, JPM, KO, MCD, MMM, MO, MRK, MSFT, PFE, PG, QQQ, T, SPY, UTX, VZ, WMT, XOM }; //+------------------------------------------------------------------+ //| Symbol selection function | //+------------------------------------------------------------------+ void SelectSymbol() { switch(selected_symbol) { case 1: symbol="#AA"; break; case 2: symbol="#AIG"; break; case 3: symbol="#AXP"; break; case 4: symbol="#BA"; break; case 5: symbol="#C"; break; case 6: symbol="#CAT"; break; case 7: symbol="#DD"; break; case 8: symbol="#DIS"; break; case 9: symbol="#GE"; break; case 10: symbol="#HD"; break; case 11: symbol="#HON"; break; case 12: symbol="#HPQ"; break; case 13: symbol="#IBM"; break; case 14: symbol="#IP"; break; case 15: symbol="#INTC"; break; case 16: symbol="#JNJ"; break; case 17: symbol="#JPM"; break; case 18: symbol="#KO"; break; case 19: symbol="#MCD"; break; case 20: symbol="#MMM"; break; case 21: symbol="#MO"; break; case 22: symbol="#MRK"; break; case 23: symbol="#MSFT"; break; case 24: symbol="#PFE"; break; case 25: symbol="#PG"; break; case 26: symbol="#QQQ"; break; case 27: symbol="#T"; break; case 28: symbol="#SPY"; break; case 29: symbol="#UTX"; break; case 30: symbol="#VZ"; break; case 31: symbol="#WMT"; break; case 32: symbol="#XOM"; break; default: symbol="#SPY"; break; }; };

如有必要, 您可以在品种选择函数中加入所需的品种,并枚举 (函数在 OnInit() 中调用)。

即时价格处理器:

//+------------------------------------------------------------------+ //| A typical ticks handler OnTick() | //| Draw the chart only based on complete bars but first | //| check if it is a new bar. | //| If the bar is new and there is a position, check | //| whether we need to move the stop loss, | //| if the bar is new and no position, check | //| if we have conditions for opening a deal. | //+------------------------------------------------------------------+ void OnTick() { //--- If the bar is new if(IsNewBar()==true) { RecalcIndicators(); //--- Tester/optimizer mode? if((MQLInfoInteger(MQL_TESTER)==true) || (MQLInfoInteger(MQL_OPTIMIZATION)==true)) { //--- Is it the testing period? if(cur_bar_time_dig[0]>begin_of_test) { //--- If there is an open position on the symbol if(PositionSelect(symbol)==true) //--- check if we need to move SL; if need, move it TrailCondition(); //--- If there are no positions else //--- check if we need to open a position; if we need, open it TradeCondition(); } } else { //--- if there is an oprn position on the symbol if(PositionSelect(symbol)==true) //--- check if we need to move SL; if need, move it TrailCondition(); //--- If there are no positions else //--- check if we need to open a position; if we need, open it TradeCondition(); } }; };

对于策略 1: "在支撑线以上,并且高于之前 X 列价格的位置放置买挂单, 在阻力线以下,并且低于之前 O 列价格的位置放置卖挂单; 在轴点水平使用追随止损":

//+------------------------------------------------------------------+ //| Function checks trade conditions for opening a deal | //+------------------------------------------------------------------+ void TradeCondition() { if(order_col_number!=column_count) //--- Are there any orders on the symbol? { if(OrdersTotal()>0) { //--- Delete them! for(int loc_count_1=0;loc_count_1<OrdersTotal();loc_count_1++) { ticket=OrderGetTicket(loc_count_1); if(!OrderSelect(ticket)) Print("Failed to select order #",ticket); if(OrderGetString(ORDER_SYMBOL)==symbol) { trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); }; }; order_col_number=column_count; return; } else { order_col_number=column_count; return; } } else if((MathPow(10,pnf[column_count-1].resist_price)<SymbolInfoDouble(symbol,SYMBOL_ASK)) && (pnf[column_count-1].column_type=='X') && (pnf[column_count-1].max_column_price<=pnf[column_count-3].max_column_price)) { //--- Conditions for BUY met; let's see if there are any pending Buy orders for the symbol with the price we need? trade_request.price=NormalizeDouble(MathPow(10,pnf[column_count-3].max_column_price+double_box),digit_2_orders); trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-3].max_column_price-(reverse-1)*double_box),digit_2_orders); trade_request.type=ORDER_TYPE_BUY_STOP; if(OrderSelect(ticket)==false) //--- No pending orders - place an order { PlaceOrder(); order_col_number=column_count; } else //--- If there is a pending order { //--- what is the type and price of the pending order? if((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_SELL_STOP) || ((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_BUY_STOP) && (OrderGetDouble(ORDER_PRICE_OPEN)!=trade_request.price))) { //--- The wrong type or the price differs - close the order trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); //--- open with the desired price PlaceOrder(); order_col_number=column_count; }; }; return; } else if((MathPow(10,pnf[column_count-1].resist_price)>SymbolInfoDouble(symbol,SYMBOL_ASK)) && (pnf[column_count-1].column_type=='O') && (pnf[column_count-1].min_column_price>=pnf[column_count-3].min_column_price)) { //--- Conditions for SELL met; let's see if there are any pending Sell orders for the symbol with the price we need? trade_request.price=NormalizeDouble(MathPow(10,pnf[column_count-3].min_column_price-double_box),digit_2_orders); trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-3].min_column_price+(reverse-1)*double_box),digit_2_orders); trade_request.type=ORDER_TYPE_SELL_STOP; if(OrderSelect(ticket)==false) //--- No pending orders, place an order { PlaceOrder(); order_col_number=column_count; } else //--- or there is a pending order { //--- what is the type and price of the pending order? if((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_BUY_STOP) || ((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_SELL_STOP) && (OrderGetDouble(ORDER_PRICE_OPEN)!=trade_request.price))) { //--- The wrong type or the price differs - close the order trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); //--- and open with the desired price PlaceOrder(); order_col_number=column_count; }; }; return; } else return; }; //+------------------------------------------------------------------+ //| The function checks conditions for moving Stop Loss | //+------------------------------------------------------------------+ void TrailCondition() { if(PositionGetInteger(POSITION_TYPE)==POSITION_TYPE_BUY) trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-1].max_column_price-reverse*double_box),digit_2_orders); else trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-1].min_column_price+reverse*double_box),digit_2_orders); if(PositionGetDouble(POSITION_SL)!=trade_request.sl) PlaceTrailOrder(); };

对于策略 2 "在突破阻力线买入,在突破支撑线卖出; 在轴点水平设置止损,在趋势线附近使用追随止损":

//+------------------------------------------------------------------+ //| The function checks trade conditions for opening a deal | //+------------------------------------------------------------------+ void TradeCondition() { if(order_col_number!=column_count) //--- Are there any orders for the symbol? { if(OrdersTotal()>0) { //--- Delete them! for(int loc_count_1=0;loc_count_1<OrdersTotal();loc_count_1++) { ticket=OrderGetTicket(loc_count_1); if(!OrderSelect(ticket)) Print("Failed to select order #",ticket); if(OrderGetString(ORDER_SYMBOL)==symbol) { trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); }; }; order_col_number=column_count; return; } else { order_col_number=column_count; return; } } else if(MathPow(10,pnf[column_count-1].resist_price)>SymbolInfoDouble(symbol,SYMBOL_ASK)) { //--- Conditions for BUY met; let's see if there are any pending Buy orders for the symbol with the price we need? trade_request.price=NormalizeDouble(MathPow(10,pnf[column_count-1].resist_price),digit_2_orders); trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-1].resist_price-(reverse-1)*double_box),digit_2_orders); trade_request.type=ORDER_TYPE_BUY_STOP; if(OrderSelect(ticket)==false) //--- No pending orders - place an order { PlaceOrder(); order_col_number=column_count; } else //--- or there is a pending order { //--- what is the type and price of the pending order? if((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_SELL_STOP) || ((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_BUY_STOP) && (OrderGetDouble(ORDER_PRICE_OPEN)!=trade_request.price))) { //--- The wrong type or the price differs - close the order trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); //--- open with the desired price PlaceOrder(); order_col_number=column_count; }; }; return; } else if(MathPow(10,pnf[column_count-1].resist_price)<SymbolInfoDouble(symbol,SYMBOL_ASK)) { //--- Conditions for SELL met; let's see if there are any pending Sell orders for the symbol with the price we need? trade_request.price=NormalizeDouble(MathPow(10,pnf[column_count-1].supp_price),digit_2_orders); trade_request.sl=NormalizeDouble(MathPow(10,pnf[column_count-1].supp_price+(reverse-1)*double_box),digit_2_orders); trade_request.type=ORDER_TYPE_SELL_STOP; if(OrderSelect(ticket)==false) //--- No pending orders - place an order { PlaceOrder(); order_col_number=column_count; } else //--- If there is a pending order { //--- what is the type and price of the pending order? if((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_BUY_STOP) || ((OrderGetInteger(ORDER_TYPE)==ORDER_TYPE_SELL_STOP) && (OrderGetDouble(ORDER_PRICE_OPEN)!=trade_request.price))) { //--- The wrong type or the price differs - close the order trade_request.order=ticket; trade_request.action=TRADE_ACTION_REMOVE; if(!OrderSend(trade_request,trade_result)) Print("Failed to send order #",trade_request.order); //--- open with the desired price PlaceOrder(); order_col_number=column_count; }; }; return; } else return; }; //+------------------------------------------------------------------+ //| The function checks conditions for moving Stop Loss | //+------------------------------------------------------------------+ void TrailCondition() { if(PositionGetInteger(POSITION_TYPE)==POSITION_TYPE_BUY) trade_request.sl=NormalizeDouble(MathMax(SymbolInfoDouble(symbol,SYMBOL_ASK),MathPow(10,pnf[column_count-1].max_column_price-reverse*double_box)),digit_2_orders); else trade_request.sl=NormalizeDouble(MathMin(SymbolInfoDouble(symbol,SYMBOL_BID),MathPow(10,pnf[column_count-1].min_column_price+reverse*double_box)),digit_2_orders); if(PositionGetDouble(POSITION_SL)!=trade_request.sl) PlaceTrailOrder(); };

亲爱的读者, 请注意几件事情。

参见下面的附件中的辅助函数代码。图表代码很庞大, 所以我没有在本文中写出; 参见下面附件中带有注释的代码。

我已经在 symbol_list_1.mhq 和 symbol_list_2.mhq 中准备了两套品种来优化; 它们包括货币对和来自道琼斯指数的股票期货。

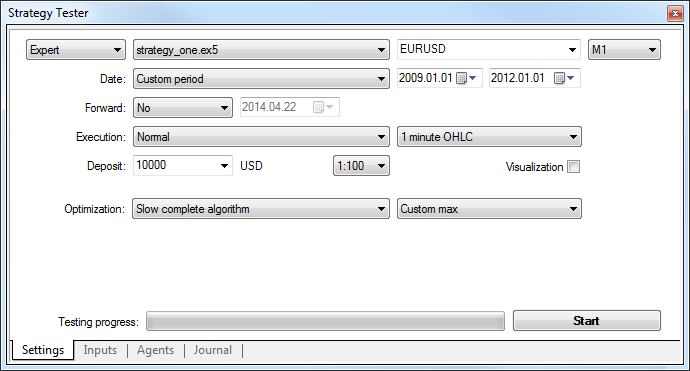

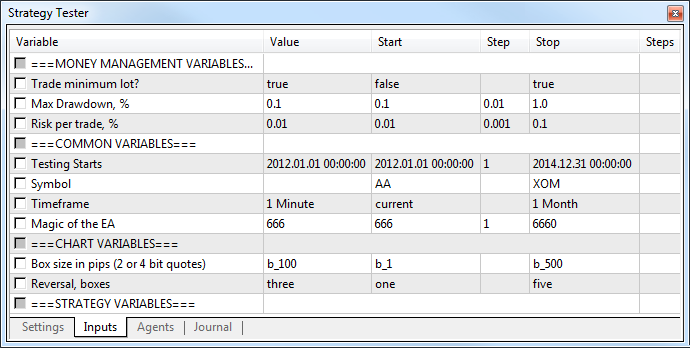

设置窗口:

在第一种情况, 测试员中的设置窗口面貌如下:

注意测试开始线。该自动交易至少需要几列图表进行分析和决策; 当您设置的箱体大小等于 50 点或以上,一年的历史数据往往不足一列。因此,对于具有 50 点或更多的箱体尺寸,用三年左右或以上的间隔开始自动交易操作,在设置窗口中的测试开始参数中设置自动交易操作开始。在我们的例子中, 测试箱体尺寸是 100 点,所以在设置选卡中指定间隔为 01.01.2009; 在参数选卡中设置间隔为 01.01.2012。

参数 "Trade minimum lot?" 为 false 表示手数大小依据余额和 "Risk per Trade, %" 变量 (在此情况是 1% 每笔交易, 但它可以被优化)。"Max Drawdown, %" 是在 OnTester() 函数中的优化准则。在本文中我只使用两个变量来优化: 品种和箱体尺寸点数。

优化周期: 2012-2013。此 EA 在 EURUSD 图表上运行良好, 因为品种提供了最佳的即时价格覆盖。下表包含一个完整的测试报告,基于第一种策略,箱体尺寸10,多种货币对:

| 通过 | 结果 | 获利 | 预期收益 | 获利因子 | 采收率 | 夏普比率 | 定制 | 净值回撤 % | 交易 | 选择品种 | 箱体 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0,00 | 0,00 | -1 002,12 | -18,91 | 0,54 | -0,79 | -0,24 | 0,00 | 12,67 | 53,00 | AUDCAD | 10,00 |

| 1,00 | 886,56 | 886,56 | 14,53 | 1,40 | 1,52 | 0,13 | 886,56 | 5,76 | 61,00 | AUDCHF | 10,00 |

| 2,00 | 0,00 | -1 451,63 | -10,60 | 0,77 | -0,70 | -0,09 | 0,00 | 19,92 | 137,00 | AUDJPY | 10,00 |

| 3,00 | -647,66 | -647,66 | -17,50 | 0,57 | -0,68 | -0,24 | -647,66 | 9,46 | 37,00 | AUDNZD | 10,00 |

| 4,00 | -269,22 | -269,22 | -3,17 | 0,92 | -0,26 | -0,03 | -269,22 | 9,78 | 85,00 | AUDUSD | 10,00 |

| 5,00 | 0,00 | -811,44 | -13,52 | 0,72 | -0,64 | -0,14 | 0,00 | 12,20 | 60,00 | CADCHF | 10,00 |

| 6,00 | 0,00 | 1 686,34 | 16,53 | 1,36 | 1,17 | 0,12 | 0,00 | 11,78 | 102,00 | CHFJPY | 10,00 |

| 7,00 | 356,68 | 356,68 | 5,66 | 1,13 | 0,40 | 0,06 | 356,68 | 8,04 | 63,00 | EURAUD | 10,00 |

| 8,00 | 0,00 | -1 437,91 | -25,68 | 0,53 | -0,92 | -0,25 | 0,00 | 15,47 | 56,00 | EURCAD | 10,00 |

| 9,00 | 0,00 | -886,66 | -46,67 | 0,34 | -0,74 | -0,46 | 0,00 | 11,56 | 19,00 | EURCHF | 10,00 |

| 10,00 | 0,00 | -789,59 | -21,93 | 0,54 | -0,75 | -0,26 | 0,00 | 10,34 | 36,00 | EURGBP | 10,00 |

| 11,00 | 0,00 | 3 074,86 | 28,47 | 1,62 | 1,72 | 0,20 | 0,00 | 12,67 | 108,00 | EURJPY | 10,00 |

| 12,00 | 0,00 | -1 621,85 | -19,78 | 0,55 | -0,97 | -0,25 | 0,00 | 16,75 | 82,00 | EURNZD | 10,00 |

| 13,00 | 152,73 | 152,73 | 2,88 | 1,07 | 0,21 | 0,03 | 152,73 | 6,90 | 53,00 | EURUSD | 10,00 |

| 14,00 | 0,00 | -1 058,85 | -14,50 | 0,65 | -0,66 | -0,16 | 0,00 | 15,87 | 73,00 | GBPAUD | 10,00 |

| 15,00 | 0,00 | -1 343,47 | -25,35 | 0,43 | -0,64 | -0,34 | 0,00 | 20,90 | 53,00 | GBPCAD | 10,00 |

| 16,00 | 0,00 | -2 607,22 | -44,19 | 0,27 | -0,95 | -0,59 | 0,00 | 27,15 | 59,00 | GBPCHF | 10,00 |

| 17,00 | 0,00 | 1 160,54 | 11,72 | 1,27 | 0,81 | 0,10 | 0,00 | 12,30 | 99,00 | GBPJPY | 10,00 |

| 18,00 | 0,00 | -1 249,91 | -14,70 | 0,69 | -0,85 | -0,15 | 0,00 | 14,41 | 85,00 | GBPNZD | 10,00 |

| 19,00 | 208,94 | 208,94 | 5,36 | 1,12 | 0,25 | 0,05 | 208,94 | 7,81 | 39,00 | GBPUSD | 10,00 |

| 20,00 | 0,00 | -2 137,68 | -21,17 | 0,53 | -0,79 | -0,24 | 0,00 | 25,62 | 101,00 | NZDUSD | 10,00 |

| 21,00 | 0,00 | -1 766,80 | -38,41 | 0,30 | -0,97 | -0,53 | 0,00 | 18,10 | 46,00 | USDCAD | 10,00 |

| 22,00 | -824,69 | -824,69 | -11,95 | 0,73 | -0,90 | -0,13 | -824,69 | 9,11 | 69,00 | USDCHF | 10,00 |

| 23,00 | 2 166,53 | 2 166,53 | 26,10 | 1,58 | 2,40 | 0,18 | 2 166,53 | 7,13 | 83,00 | USDJPY | 10,00 |

| 2 029,87 | -10 213,52 | 13,40 | 1 659,00 |

下面是各品种和箱体尺寸值的汇总表:

| 策略 | 品种 | 箱体尺寸 | 交易 | 净值回撤 % | 获利 | 结果 | 预期余额 |

|---|---|---|---|---|---|---|---|

| 1 | Currencies | 10 | 1 659 | September | -10 214 | 2 030 | 2 030 |

| 1 | Currencies | 20 | 400 | 5 | 1 638 | 2 484 | 2 484 |

| 1 | Stocks | 50 | 350 | 60 | 7 599 | 7 599 | 15 199 |

| 1 | Stocks | 100 | 81 | 2 | 4 415 | 4 415 | 17 659 |

| 2 | Currencies | 10 | 338 | 20 | -4 055 | 138 | 138 |

| 2 | Currencies | 20 | 116 | 8 | 4 687 | 3 986 | 3 986 |

| 2 | Stocks | 50 | 65 | 6 | 6 770 | 9 244 | 9 244 |

| 2 | Stocks | 100 | 12 | 1 | -332 | -332 | -5 315 |

我们看到了什么?

有个傻瓜,他总是做错。

并且 有华尔街傻瓜相信您总是一直在交易。

世界上没有人总能拥有买卖股票所需的所有信息并十分合理的运用它。

这个结论您也许看起来很奇怪: 您的存款更像是高于较少的交易。如果在两年前,用我们的 EA 炒股,箱体尺寸 100 并且每笔风险 1%, 则 EA 从那时起将只做 81 笔交易 (平均每年每个品种 1.25 笔交易) 我们的本金将增长 44%, 而平均净值回撤略高于 2%。可接受的回撤是 10%, 我们的风险是每笔交易 4%, 并且本金两年增长 177%, 即年度 90% 美元!

不要在高位买入,也不要在低位卖出。

不要想着赚大钱。它是不切实际的。

上述策略可以修改,可以在不高于10%的回撤下,获得更大的回报。不要尝试频繁交易, 最好找一个交易商,不仅提供 "标准集合" 20 至 40 个交易品种,而是至少三百或四百个交易品种 (股票, 期货)。最好品种不会被关联,您的存款会更安全。还有一个说法 - 股票表现出比货币对更好的结果。

我的 PnF Chartist 脚本已经在市场中上架。它利用 MT4,MT5 或雅虎财经提供的报价在文本文件中绘制点数图。用它进行价格范式的可视化搜索,因为没有比您的大脑更佳的测试/优化者。发现范式之后立即应用本文中的 EA 模板来证明您的想法。

本社区仅针对特定人员开放

查看需注册登录并通过风险意识测评

5秒后跳转登录页面...